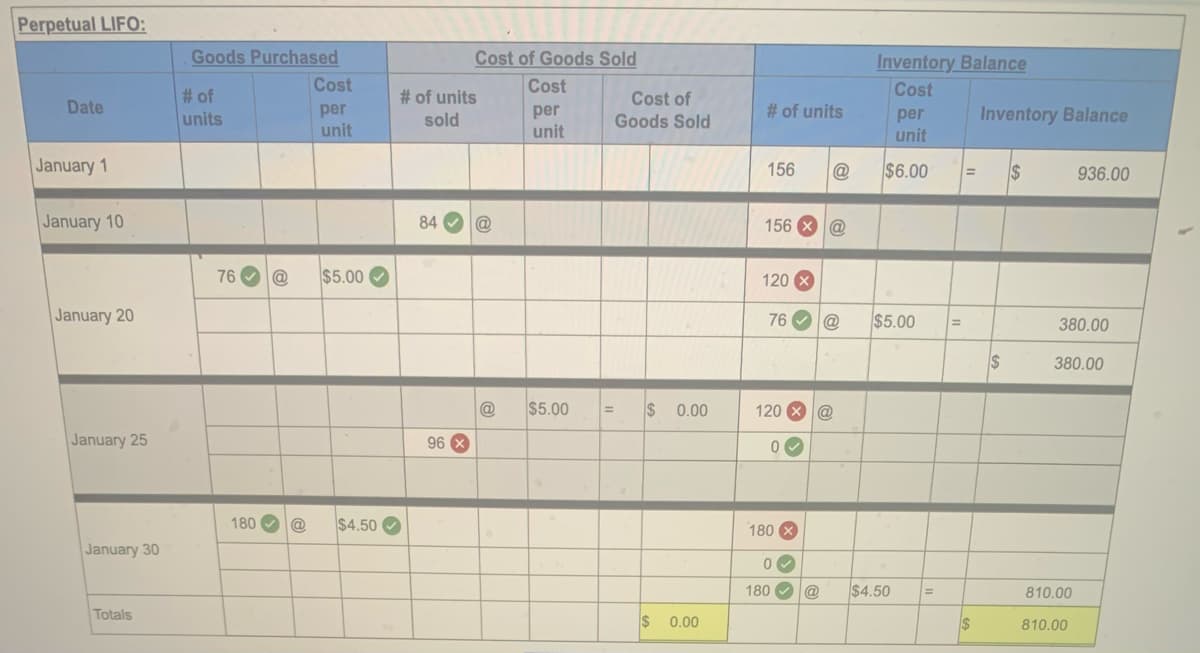

Laker Company reported the following January purchases and sales data for its only product. The Company uses a periodic inventory system. For specific identification, ending inventory consists of 232 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 47 are from beginning inventory. Date Activities January 1 Beginning inventory January 10 Sales January 20 Purchase January 25 Sales January 30 Purchase Totals Units Acquired at Cost @ $ 6.00 156 units 76 units e $5.00 180 units @ $ 4.50 412 units = = $ 936 380 810 $ 2,126 Units sold at Retail 84 units @ 96 units @ 180 units $15.00 $ 15.00

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

![Use the following information for the Exercises 3-7 below. (Algo)

[The following information applies to the questions displayed below.]

Laker Company reported the following January purchases and sales data for its only product. The Company uses a

periodic inventory system. For specific identification, ending inventory consists of 232 units, where 180 are from the

January 30 purchase, 5 are from the January 20 purchase, and 47 are from beginning inventory.

Date

Activities

January 1 Beginning inventory

January 10 Sales

January 20

Purchase

January 25

Sales

January 30

Purchase

Totals

Units Acquired at Cost

$6.00 =

156 units @

76 units e

180 units @

412 units

$ 5.00

$ 4.50

$ 936

380

810

$ 2,126

Units sold at Retail

84 units @

96 units

180 units

@

$ 15.00

$15.00](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F603fb863-551d-4e2c-baf1-38f56fb13d9e%2F6058a6b7-5a3a-48b5-9bda-307839ab5169%2Ffeh7wn7_processed.jpeg&w=3840&q=75)

Step by step

Solved in 2 steps with 2 images