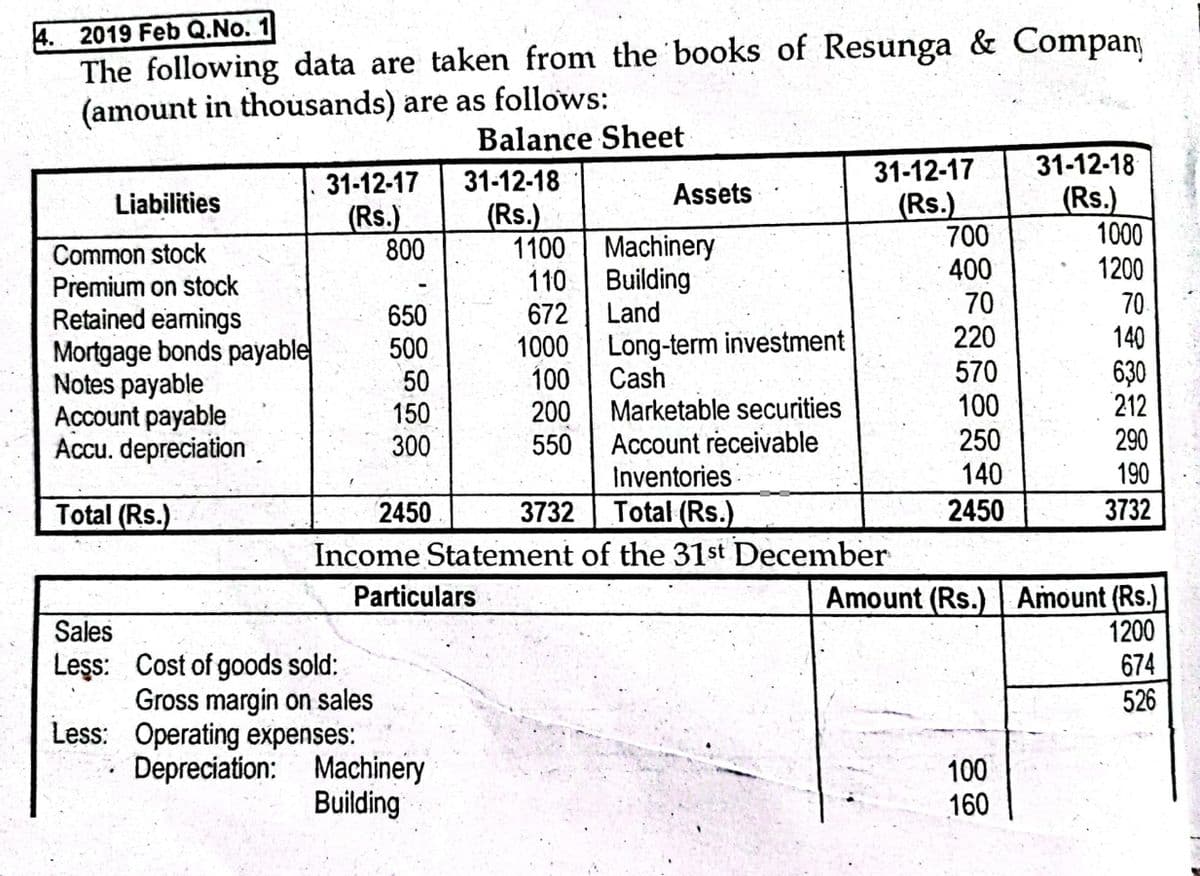

. 2019 Feb Q.No. 1 The following data are taken from the books of Resunga & Company (amount in thousands) are as follows: Liabilities Common stock Premium on stock Retained earnings Mortgage bonds payable Notes payable Account payable Accu. depreciation Total (Rs.) 31-12-17 (Rs.) 800 650 500 50 150 300 Sales Less: Cost of goods sold: Gross margin on sales Less: Operating expenses: Particulars Balance Sheet 31-12-18 (Rs.) Depreciation: Machinery Building 1100 110 672 1000 100 200 550 Assets Machinery Building Land Long-term investment Cash 2450 3732 Total (Rs.) Income Statement of the 31st December Marketable securities Account receivable Inventories 31-12-17 (Rs.) 700 400 70 220 570 100 250 140 2450 31-12-18 (Rs.) 100 160 1000 1200 70 140 630 212 290 190 3732 Amount (Rs.) Amount (Rs.) 1200 674 526

. 2019 Feb Q.No. 1 The following data are taken from the books of Resunga & Company (amount in thousands) are as follows: Liabilities Common stock Premium on stock Retained earnings Mortgage bonds payable Notes payable Account payable Accu. depreciation Total (Rs.) 31-12-17 (Rs.) 800 650 500 50 150 300 Sales Less: Cost of goods sold: Gross margin on sales Less: Operating expenses: Particulars Balance Sheet 31-12-18 (Rs.) Depreciation: Machinery Building 1100 110 672 1000 100 200 550 Assets Machinery Building Land Long-term investment Cash 2450 3732 Total (Rs.) Income Statement of the 31st December Marketable securities Account receivable Inventories 31-12-17 (Rs.) 700 400 70 220 570 100 250 140 2450 31-12-18 (Rs.) 100 160 1000 1200 70 140 630 212 290 190 3732 Amount (Rs.) Amount (Rs.) 1200 674 526

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 5E: Multiple-Step and Single-Step In coin Statements The following items were derived from Gold...

Related questions

Topic Video

Question

Transcribed Image Text:4. 2019 Feb Q.No. 1

The following data are taken from the books of Resunga & Company

(amount in thousands) are as follows:

Balance Sheet

Liabilities

Common stock

Premium on stock

Retained earnings

Mortgage bonds payable

Notes payable

Account payable

Accu. depreciation

Total (Rs.)

31-12-17

(Rs.)

800

Sales

Less: Cost of goods sold:

Less:

650

500

50

150

300

31-12-18

(Rs.)

Particulars

Gross margin on sales

Operating expenses:

Depreciation: Machinery

Building

Assets

Machinery

Building

Land

1100

110

672

1000

100

200

Marketable securities

550 Account receivable

Inventories

2450

3732

Total (Rs.)

Income Statement of the 31st December

Long-term investment

Cash

31-12-17

(Rs.)

700

400

70

220

570

100

250

140

2450

31-12-18

(Rs.)

100

160

1000

1200

70

140

630

212

290

190

3732

Amount (Rs.) Amount (Rs.)

1200

674

526

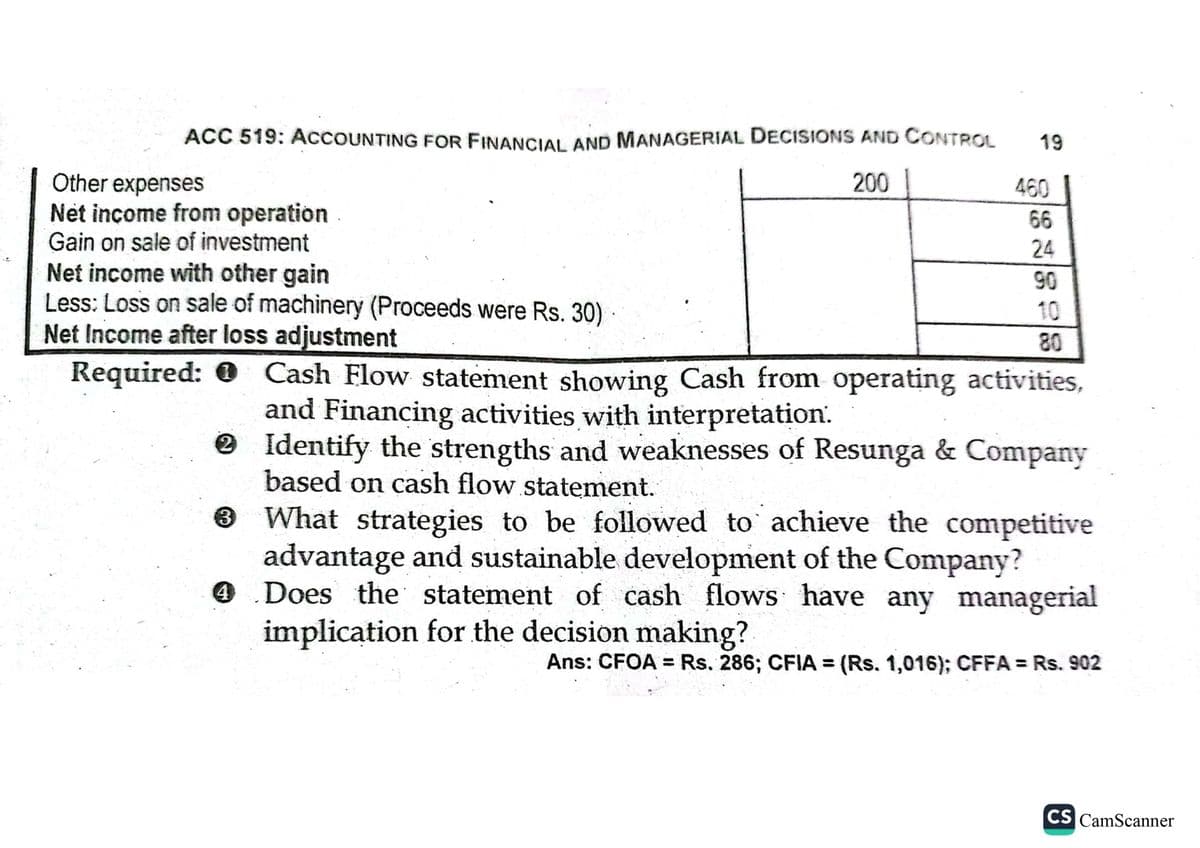

Transcribed Image Text:ACC 519: ACCOUNTING FOR FINANCIAL AND MANAGERIAL DECISIONS AND CONTROL

200

Other expenses

Net income from operation

Gain on sale of investment

Net income with other gain

Less: Loss on sale of machinery (Proceeds were Rs. 30).

Net Income after loss adjustment

Required:

19

3

460

66

24

90

10

80

Cash Flow statement showing Cash from operating activities,

and Financing activities with interpretation.

Identify the strengths and weaknesses of Resunga & Company

based on cash flow statement.

What strategies to be followed to achieve the competitive

advantage and sustainable development of the Company?

4 Does the statement of cash flows have any managerial

implication for the decision making?

Ans: CFOA = Rs. 286; CFIA = (Rs. 1,016); CFFA = Rs. 902

CS CamScanner

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Your solution is wrong see the answers at bottom of the question

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning