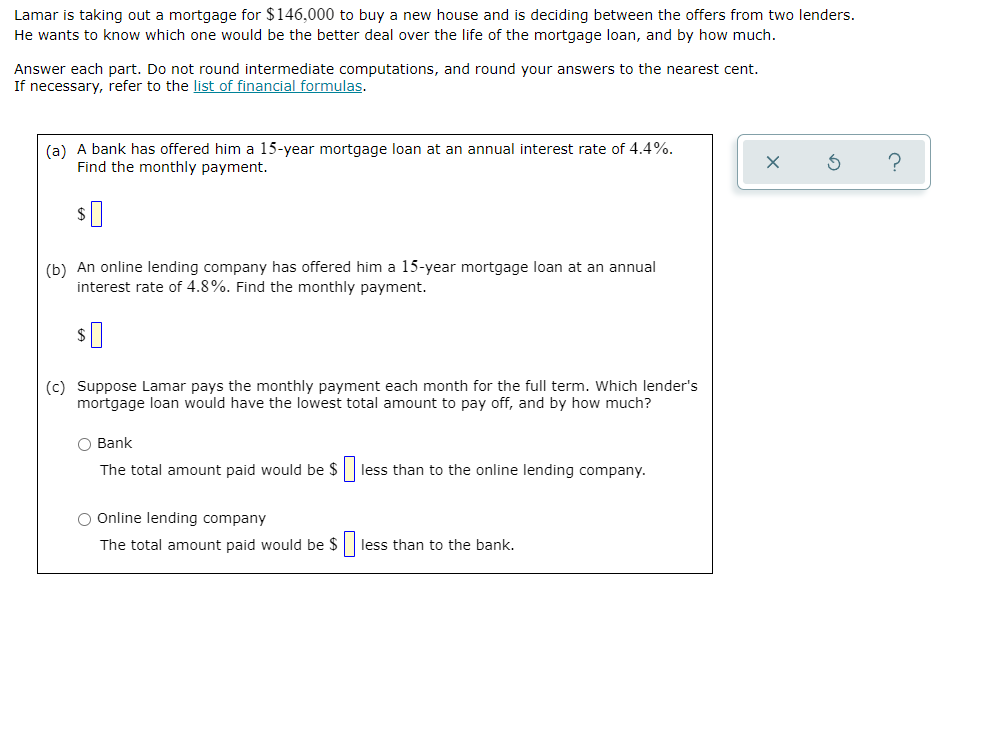

Lamar is taking out a mortgage for $146,000 to buy a new house and is deciding between the offers from two lenders. He wants to know which one would be the better deal over the life of the mortgage loan, and by how much. Answer each part. Do not round intermediate computations, and round your answers to the nearest cent. If necessary, refer to the list of financial formulas. (a) A bank has offered him a 15-year mortgage loan at an annual interest rate of 4.4%. Find the monthly payment. (b) An online lending company has offered him a 15-year mortgage loan at an annual interest rate of 4.8%. Find the monthly payment. (c) Suppose Lamar pays the monthly payment each month for the full term. Which lender's mortgage loan would have the lowest total amount to pay off, and by how much? Bank The total amount paid would be $ less than to the online lending company. Online lending company The total amount paid would be $ less than to the bank.

Lamar is taking out a mortgage for $146,000 to buy a new house and is deciding between the offers from two lenders. He wants to know which one would be the better deal over the life of the mortgage loan, and by how much. Answer each part. Do not round intermediate computations, and round your answers to the nearest cent. If necessary, refer to the list of financial formulas. (a) A bank has offered him a 15-year mortgage loan at an annual interest rate of 4.4%. Find the monthly payment. (b) An online lending company has offered him a 15-year mortgage loan at an annual interest rate of 4.8%. Find the monthly payment. (c) Suppose Lamar pays the monthly payment each month for the full term. Which lender's mortgage loan would have the lowest total amount to pay off, and by how much? Bank The total amount paid would be $ less than to the online lending company. Online lending company The total amount paid would be $ less than to the bank.

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 19DQ

Related questions

Question

Transcribed Image Text:Lamar is taking out a mortgage for $146,000 to buy a new house and is deciding between the offers from two lenders.

He wants to know which one would be the better deal over the life of the mortgage loan, and by how much.

Answer each part. Do not round intermediate computations, and round your answers to the nearest cent.

If necessary, refer to the list of financial formulas.

(a) A bank has offered him a 15-year mortgage loan at an annual interest rate of 4.4%.

Find the monthly payment.

?

(b) An online lending company has offered him a 15-year mortgage loan at an annual

interest rate of 4.8%. Find the monthly payment.

(c) Suppose Lamar pays the monthly payment each month for the full term. Which lender's

mortgage loan would have the lowest total amount to pay off, and by how much?

O Bank

The total amount paid would be $|

less than to the online lending company.

O Online lending company

The total amount paid would be $|

less than to the bank.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT