Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 2STP

Related questions

Question

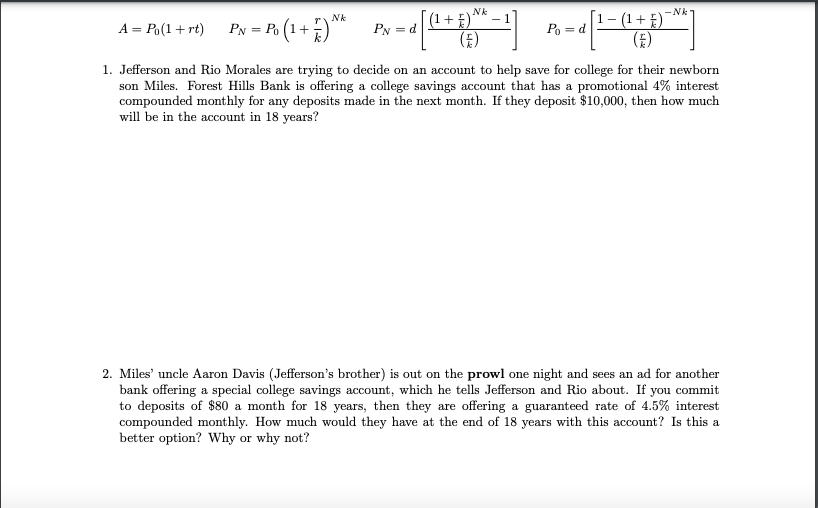

Transcribed Image Text:Nk

-Nk

(1+ E)'

[1- (1+E)

(E)

Nk

A = P,(1+ rt) PN = P. (1+)*

PN =d

Po = d

1. Jefferson and Rio Morales are trying to decide on an account to help save for college for their newborn

son Miles. Forest Hills Bank is offering a college savings account that has a promotional 4% interest

compounded monthly for any deposits made in the next month. If they deposit $10,000, then how much

will be in the account in 18 years?

2. Miles' uncle Aaron Davis (Jefferson's brother) is out on the prowl one night and sees an ad for another

bank offering a special college savings account, which he tells Jefferson and Rio about. If you commit

to deposits of $80 a month for 18 years, then they are offering a guaranteed rate of 4.5% interest

compounded monthly. How much would they have at the end of 18 years with this account? Is this a

better option? Why or why not?

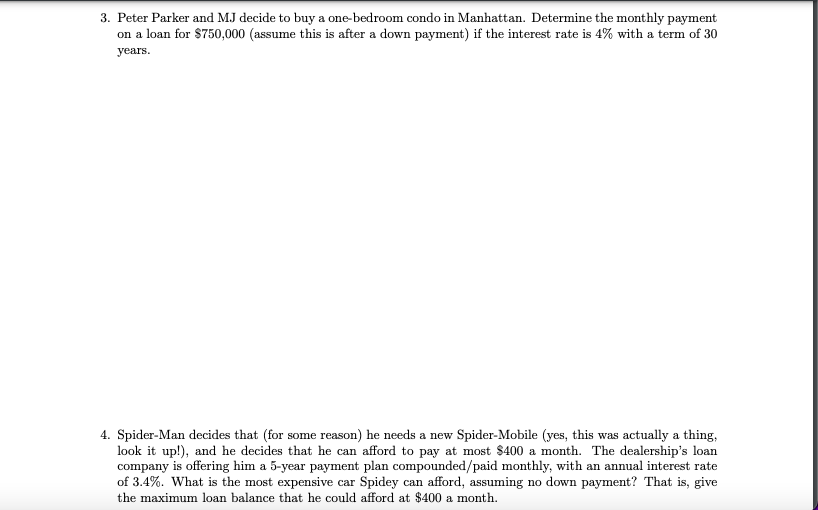

Transcribed Image Text:3. Peter Parker and MJ decide to buy a one-bedroom condo in Manhattan. Determine the monthly payment

on a loan for $750,000 (assume this is after a down payment) if the interest rate is 4% with a term of 30

years.

4. Spider-Man decides that (for some reason) he needs a new Spider-Mobile (yes, this was actually a thing,

look it up!), and he decides that he can afford to pay at most $400 a month. The dealership's loan

company is offering him a 5-year payment plan compounded/paid monthly, with an annual interest rate

of 3.4%. What is the most expensive car Spidey can afford, assuming no down payment? That is, give

the maximum loan balance that he could afford at $400 a month.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning