Lantern Company is thinking of discontinuing product line F because it is reporting an operating loss. All fixed costs are unavoidable. Lantern Company discontinues product line F and rents the space formerly used to produce product F for $22,000 per year, what affect will this have on operating income? .... O A. Increase $31,000 O B. Increase $41,000 O C. Decrease $14,000 O D. Increase $14.000

Lantern Company is thinking of discontinuing product line F because it is reporting an operating loss. All fixed costs are unavoidable. Lantern Company discontinues product line F and rents the space formerly used to produce product F for $22,000 per year, what affect will this have on operating income? .... O A. Increase $31,000 O B. Increase $41,000 O C. Decrease $14,000 O D. Increase $14.000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 7RE

Related questions

Question

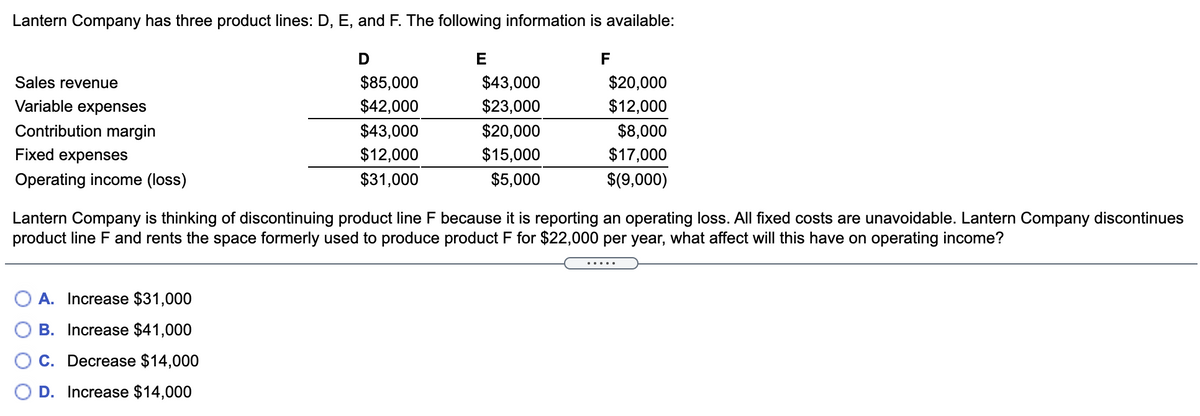

Transcribed Image Text:Lantern Company has three product lines: D, E, and F. The following information is available:

D

E

F

Sales revenue

$85,000

$43,000

$20,000

Variable expenses

$42,000

$23,000

$12,000

Contribution margin

$43,000

$20,000

$8,000

Fixed expenses

$12,000

$15,000

$17,000

Operating income (loss)

$31,000

$5,000

$(9,000)

Lantern Company is thinking of discontinuing product line F because it is reporting an operating loss. All fixed costs are unavoidable. Lantern Company discontinues

product line F and rents the space formerly used to produce product F for $22,000 per year, what affect will this have on operating income?

A. Increase $31,000

B. Increase $41,000

C. Decrease $14,000

D. Increase $14,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning