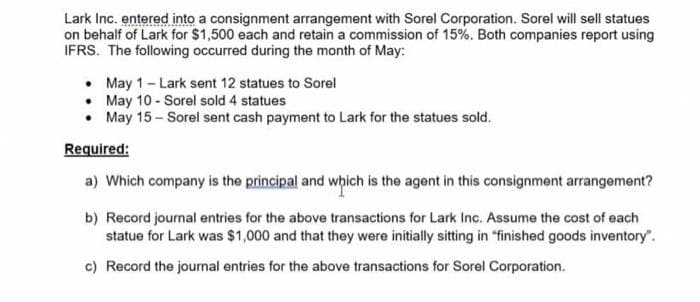

Lark Inc. entered into a consignment arrangement with Sorel Corporation. Sorel will sell statues on behalf of Lark for $1,500 each and retain a commission of 15%. Both companies report using IFRS. The following occurred during the month of May: • . May 1-Lark sent 12 statues to Sorel May 10 - Sorel sold 4 statues May 15 - Sorel sent cash payment to Lark for the statues sold. Required: a) Which company is the principal and which is the agent in this consignment arrangement? b) Record journal entries for the above transactions for Lark Inc. Assume the cost of each statue for Lark was $1,000 and that they were initially sitting in "finished goods inventory". c) Record the journal entries for the above transactions for Sorel Corporation.

Lark Inc. entered into a consignment arrangement with Sorel Corporation. Sorel will sell statues on behalf of Lark for $1,500 each and retain a commission of 15%. Both companies report using IFRS. The following occurred during the month of May: • . May 1-Lark sent 12 statues to Sorel May 10 - Sorel sold 4 statues May 15 - Sorel sent cash payment to Lark for the statues sold. Required: a) Which company is the principal and which is the agent in this consignment arrangement? b) Record journal entries for the above transactions for Lark Inc. Assume the cost of each statue for Lark was $1,000 and that they were initially sitting in "finished goods inventory". c) Record the journal entries for the above transactions for Sorel Corporation.

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 63P

Related questions

Question

please help me

Transcribed Image Text:Lark Inc. entered into a consignment arrangement with Sorel Corporation. Sorel will sell statues

on behalf of Lark for $1,500 each and retain a commission of 15%. Both companies report using

IFRS. The following occurred during the month of May:

•

May 1 - Lark sent 12 statues to Sorel

• May 10 - Sorel sold 4 statues

•

May 15 - Sorel sent cash payment to Lark for the statues sold.

Required:

a) which company is the principal and which is the agent in this consignment arrangement?

b) Record journal entries for the above transactions for Lark Inc. Assume the cost of each

statue for Lark was $1,000 and that they were initially sitting in "finished goods inventory".

c) Record the journal entries for the above transactions for Sorel Corporation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning