Larkspur Landscaping began construction of a new plant on December 1, 2020. On this date, the company purchased a parcel of land for $150,000 in cash. In addition, it paid $2.400 in surveying costs and $3,840 for a title insurance policy. An old dwelling on the premises was demolished at a cost of $3,360, with $1.200 being received from the sale of materials. Architectural plans were also formalized on December 1, 2020, when the architect was paid $36,000. The necessary building permits costing $3,360 were obtained from the city and paid for on December 1 as well. The excavation work began during the first week in December with payments made to the contractor in 2021 as follows. Date of Payment Amount of Payment March 1 $262,800 May 1 333,600 July 1 63.600 The building was completed on July 1, 2021. To finance construction of this plant. Larkspur borrowed $603,600 from the bank on December 1, 2020. Larkspur had no other borrowings. The $603,600 was a 10-year loan bearing interest at 10%. Compute the balance in each of the following accounts at December 31, 2020, and December 31, 2021. (Round answers to 0 decimal places, e.g. 5,275.) (a) (b) (c) Balance in Land Account Balance in Building Balance in Interest Expense December 31, 2020 December 31, 2021

Larkspur Landscaping began construction of a new plant on December 1, 2020. On this date, the company purchased a parcel of land for $150,000 in cash. In addition, it paid $2.400 in surveying costs and $3,840 for a title insurance policy. An old dwelling on the premises was demolished at a cost of $3,360, with $1.200 being received from the sale of materials. Architectural plans were also formalized on December 1, 2020, when the architect was paid $36,000. The necessary building permits costing $3,360 were obtained from the city and paid for on December 1 as well. The excavation work began during the first week in December with payments made to the contractor in 2021 as follows. Date of Payment Amount of Payment March 1 $262,800 May 1 333,600 July 1 63.600 The building was completed on July 1, 2021. To finance construction of this plant. Larkspur borrowed $603,600 from the bank on December 1, 2020. Larkspur had no other borrowings. The $603,600 was a 10-year loan bearing interest at 10%. Compute the balance in each of the following accounts at December 31, 2020, and December 31, 2021. (Round answers to 0 decimal places, e.g. 5,275.) (a) (b) (c) Balance in Land Account Balance in Building Balance in Interest Expense December 31, 2020 December 31, 2021

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter17: Business Tax Credits And The Alternative Minimum Tax

Section: Chapter Questions

Problem 11P

Related questions

Question

dont give answer in image format

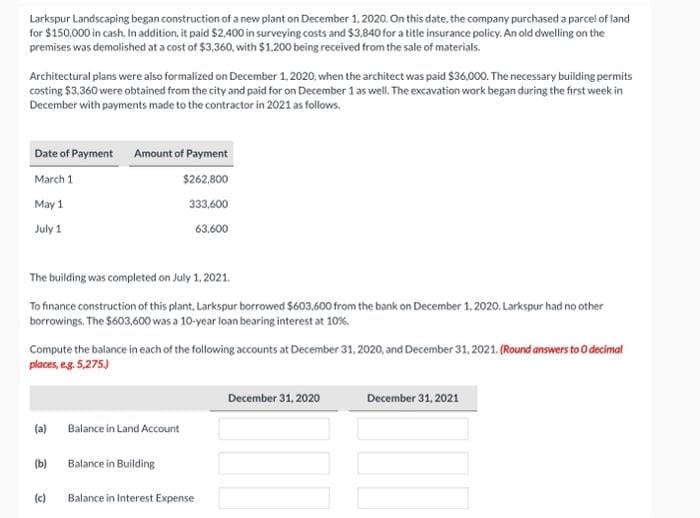

Transcribed Image Text:Larkspur Landscaping began construction of a new plant on December 1, 2020. On this date, the company purchased a parcel of land

for $150,000 in cash. In addition, it paid $2,400 in surveying costs and $3,840 for a title insurance policy. An old dwelling on the

premises was demolished at a cost of $3,360, with $1.200 being received from the sale of materials.

Architectural plans were also formalized on December 1, 2020, when the architect was paid $36,000. The necessary building permits

costing $3,360 were obtained from the city and paid for on December 1 as well. The excavation work began during the first week in

December with payments made to the contractor in 2021 as follows.

Date of Payment Amount of Payment

March 1

$262,800

333,600

63,600

May 1

July 1

The building was completed on July 1, 2021.

To finance construction of this plant. Larkspur borrowed $603.600 from the bank on December 1, 2020. Larkspur had no other

borrowings. The $603,600 was a 10-year loan bearing interest at 10%.

Compute the balance in each of the following accounts at December 31, 2020, and December 31, 2021. (Round answers to O decimal

places, e.g. 5,275.)

(a)

(b)

(c)

Balance in Land Account

Balance in Building

Balance in Interest Expense

December 31, 2020

December 31, 2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College