Larry's Landscaping Balance Sheets as of the End of February and March 2021 March 31, 2021 February 28, 2021 Assets $ 17,500 17,500 $ 15,000 15,000 Cash Total Current Assets 25,000 100,000 Equipment Building Accumulated Depreciation Equipment.. Accumulated Depreciation Building Land ... 40,000 100,000 (500) (1,000) 20,000 Total Property, Plant & Equipment 158,500 Total Assets $176.000 ..... 20,000 145,000 $160,000 Liabilities Note Payable Long-Term . . $110,000 $100,000 100,000 Total Liabilities 110,000 Owners' Equity 6,000 54,000 6,000 54,000 6,000 66,000 Common Stock Paid-in Capital in Excess of Par Value. Retained Earnings... ...... Total Owners' Equity Total Liabilities and Equity $176.000 60,000 $160,000

Larry's Landscaping Balance Sheets as of the End of February and March 2021 March 31, 2021 February 28, 2021 Assets $ 17,500 17,500 $ 15,000 15,000 Cash Total Current Assets 25,000 100,000 Equipment Building Accumulated Depreciation Equipment.. Accumulated Depreciation Building Land ... 40,000 100,000 (500) (1,000) 20,000 Total Property, Plant & Equipment 158,500 Total Assets $176.000 ..... 20,000 145,000 $160,000 Liabilities Note Payable Long-Term . . $110,000 $100,000 100,000 Total Liabilities 110,000 Owners' Equity 6,000 54,000 6,000 54,000 6,000 66,000 Common Stock Paid-in Capital in Excess of Par Value. Retained Earnings... ...... Total Owners' Equity Total Liabilities and Equity $176.000 60,000 $160,000

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 3DQ

Related questions

Question

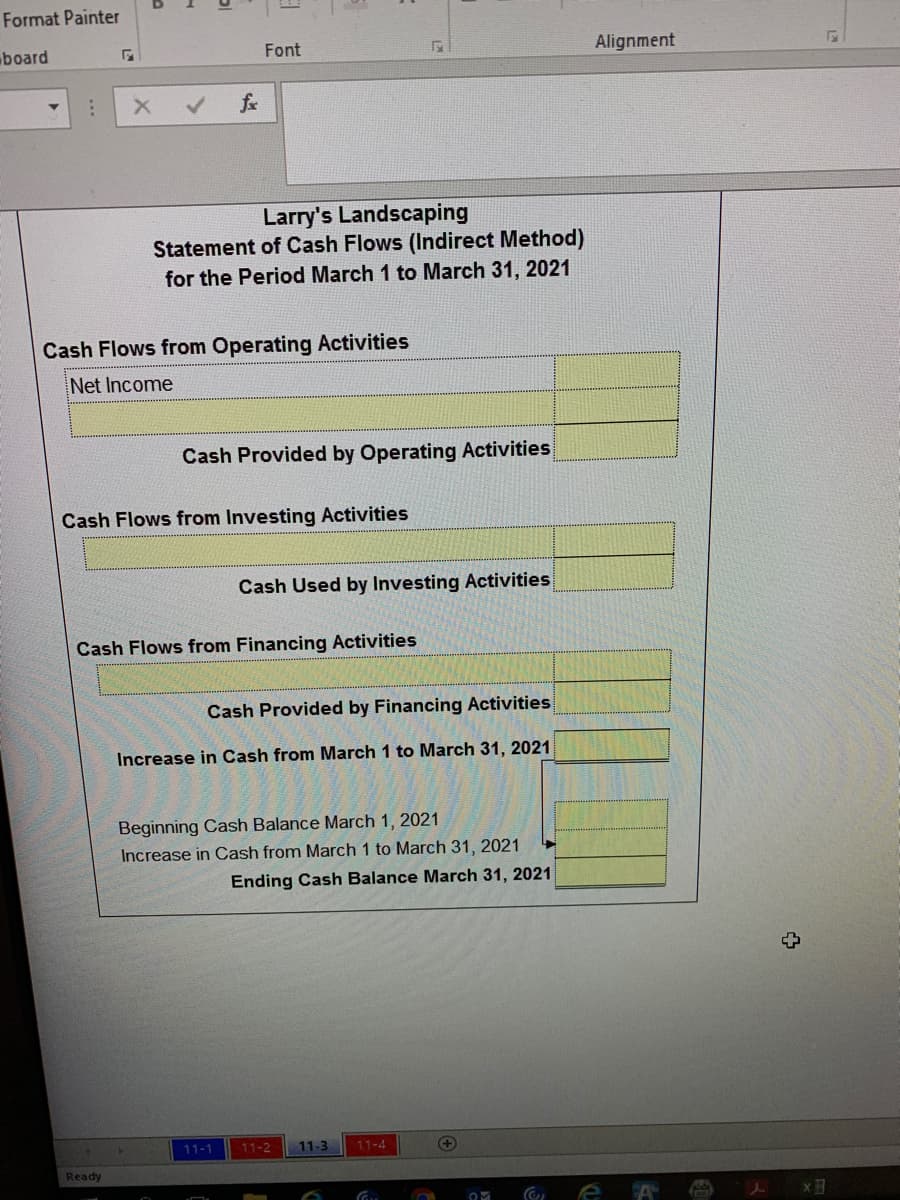

Transcribed Image Text:Format Painter

board

Font

Alignment

fe

Larry's Landscaping

Statement of Cash Flows (Indirect Method)

for the Period March 1 to March 31, 2021

Cash Flows from Operating Activities

Net Income

Cash Provided by Operating Activities

Cash Flows from Investing Activities

Cash Used by Investing Activities

Cash Flows from Financing Activities

Cash Provided by Financing Activities

Increase in Cash from March 1 to March 31, 2021

Beginning Cash Balance March 1, 2021

Increase in Cash from March 1 to March 31, 2021

Ending Cash Balance March 31, 2021

11-1

11-2

11-3

11-4

Ready

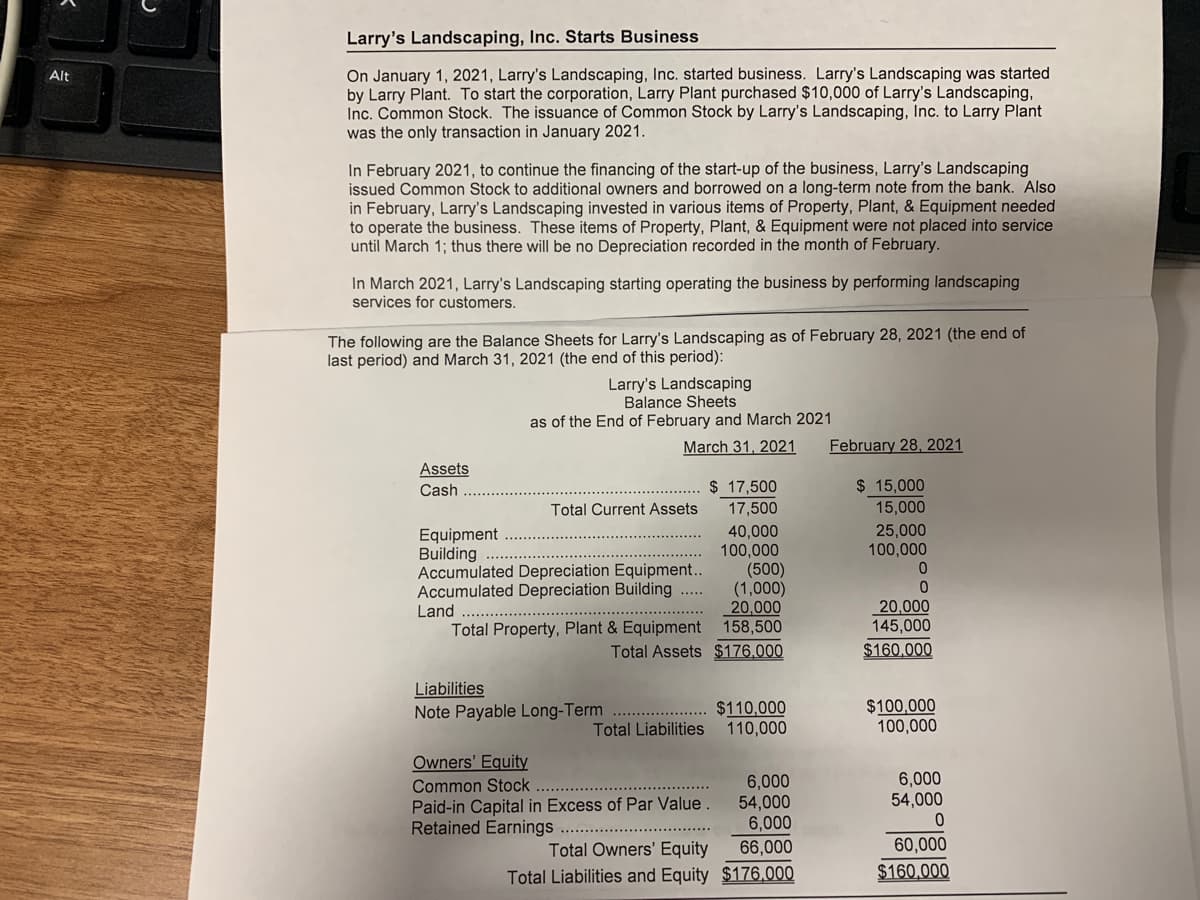

Transcribed Image Text:Larry's Landscaping, Inc. Starts Business

On January 1, 2021, Larry's Landscaping, Inc. started business. Larry's Landscaping was started

by Larry Plant. To start the corporation, Larry Plant purchased $10,000 of Larry's Landscaping,

Inc. Common Stock. The issuance of Common Stock by Larry's Landscaping, Inc. to Larry Plant

was the only transaction in January 2021.

Alt

In February 2021, to continue the financing of the start-up of the business, Larry's Landscaping

issued Common Stock to additional owners and borrowed on a long-term note from the bank. Also

in February, Larry's Landscaping invested in various items of Property, Plant, & Equipment needed

to operate the business. These items of Property, Plant, & Equipment were not placed into service

until March 1; thus there will be no Depreciation recorded in the month of February.

In March 2021, Larry's Landscaping starting operating the business by performing landscaping

services for customers.

The following are the Balance Sheets for Larry's Landscaping as of February 28, 2021 (the end of

last period) and March 31, 2021 (the end of this period):

Larry's Landscaping

Balance Sheets

as of the End of February and March 2021

March 31, 2021

February 28, 2021

Assets

$ 15,000

$ 17,500

17,500

Cash

Total Current Assets

15,000

25,000

100,000

Equipment

Building

Accumulated Depreciation Equipment..

Accumulated Depreciation Building

40,000

100,000

(500)

(1,000)

20,000

Total Property, Plant & Equipment 158,500

Total Assets $176.000

.....

20,000

145,000

Land

$160,000

Liabilities

Note Payable Long-Term

$110,000

110,000

$100,000

100,000

.....................

Total Liabilities

Owners' Equity

6,000

54,000

Common Stock

Paid-in Capital in Excess of Par Value

Retained Earnings

6,000

54,000

6,000

66,000

Total Owners' Equity

60,000

Total Liabilities and Equity $176,000

$160,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning