Lasik Vision Inc. recently analyzed the project whose cash flows are shown below. However, before Lasik decided to accept or reject the project, the Federal Reserve took actions that changed interest rates and therefore the firm's WACC. The Fed's action did not affect the forecasted cash flows. By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's projected NPV can be negative, in which case it should be rejected. Old WACC: 8.00% New WACC: 9.75% Year 3 Cash flows -$1,000 $410 $410 $410 O a. -$32.50 O b. -$30.55 O c. -$28.60 O d. -$29.25 O e. -$34.12

Lasik Vision Inc. recently analyzed the project whose cash flows are shown below. However, before Lasik decided to accept or reject the project, the Federal Reserve took actions that changed interest rates and therefore the firm's WACC. The Fed's action did not affect the forecasted cash flows. By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's projected NPV can be negative, in which case it should be rejected. Old WACC: 8.00% New WACC: 9.75% Year 3 Cash flows -$1,000 $410 $410 $410 O a. -$32.50 O b. -$30.55 O c. -$28.60 O d. -$29.25 O e. -$34.12

Chapter9: Forecasting Exchange Rates

Section: Chapter Questions

Problem 6ST

Related questions

Question

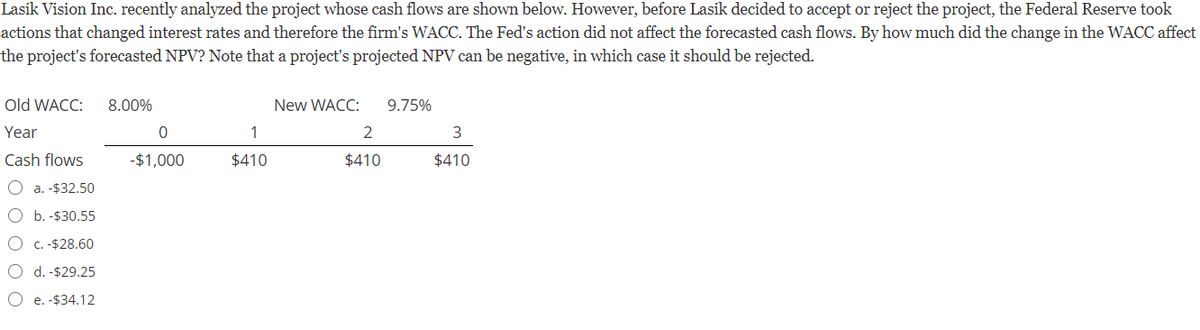

Transcribed Image Text:Lasik Vision Inc. recently analyzed the project whose cash flows are shown below. However, before Lasik decided to accept or reject the project, the Federal Reserve took

actions that changed interest rates and therefore the firm's WACC. The Fed's action did not affect the forecasted cash flows. By how much did the change in the WACC affect

the project's forecasted NPV? Note that a project's projected NPV can be negative, in which case it should be rejected.

Old WACC:

8.00%

New WACC:

9.75%

Year

1

2

3

Cash flows

-$1,000

$410

$410

$410

a. -$32.50

O b. -$30.55

O c. -$28.60

O d. -$29.25

O e. -$34.12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you