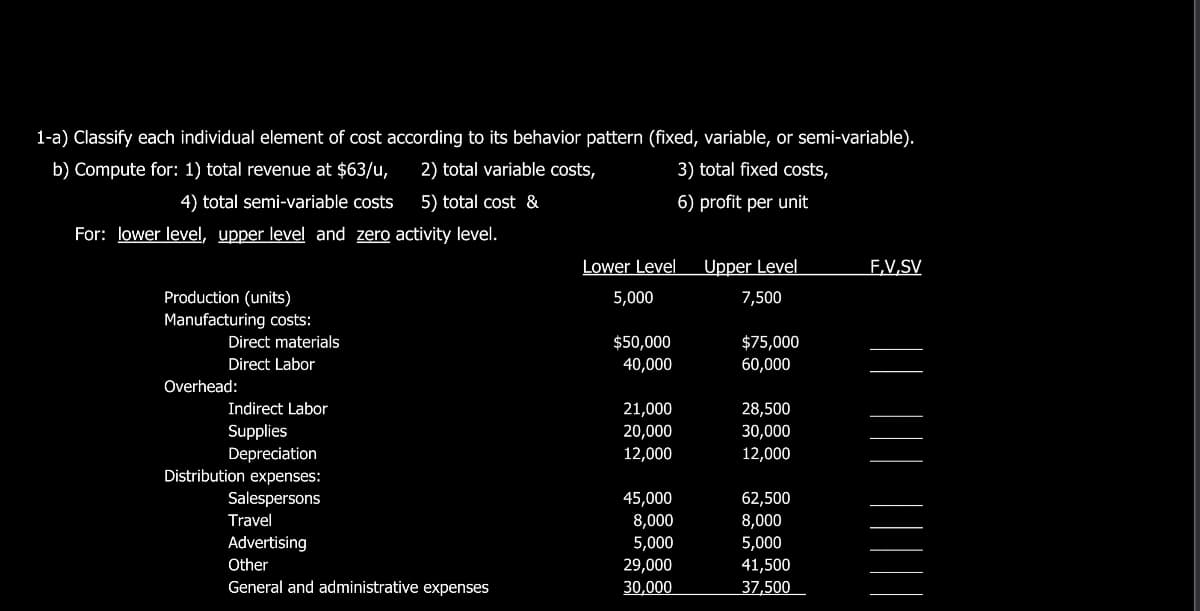

lassify each individual element of cost according to its behavior pattern (fixed, variable, or semi-variable). b) Compute for: 1) total revenue at $63/u, 2) total variable costs, 3) total fixed costs, 4) total semi-variable costs 5) total cost & 6) profit per unit For: lower level, upper level and zero activity level. Lower Level Upper Level F,V,SV Production (units) 5,000 7,500 Manufacturing costs: Direct materials $50,000 $75,000 ______ Direct Labor 40,000 60,000 ______ Overhead: Indirect Labor 21,000 28,500 ______ Supplies 20,000 30,000 ______ Depreciation 12,000 12,000 ______ Distribution expenses: Salespersons 45,000 62,500 ______ Travel 8,000 8,000 ______ Advertising 5,000 5,000 ______ Other 29,000 41,500 ______ General and administrative expenses 30,000 37,500 ______

lassify each individual element of cost according to its behavior pattern (fixed, variable, or semi-variable). b) Compute for: 1) total revenue at $63/u, 2) total variable costs, 3) total fixed costs, 4) total semi-variable costs 5) total cost & 6) profit per unit For: lower level, upper level and zero activity level. Lower Level Upper Level F,V,SV Production (units) 5,000 7,500 Manufacturing costs: Direct materials $50,000 $75,000 ______ Direct Labor 40,000 60,000 ______ Overhead: Indirect Labor 21,000 28,500 ______ Supplies 20,000 30,000 ______ Depreciation 12,000 12,000 ______ Distribution expenses: Salespersons 45,000 62,500 ______ Travel 8,000 8,000 ______ Advertising 5,000 5,000 ______ Other 29,000 41,500 ______ General and administrative expenses 30,000 37,500 ______

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter11: Price And Output Determination: Monopoly And Dominant Firms

Section: Chapter Questions

Problem 6E

Related questions

Question

Classify each individual element of cost according to its behavior pattern (fixed, variable, or semi-variable).

b) Compute for: 1) total revenue at $63/u, 2) total variable costs, 3) total fixed costs,

4) total semi-variable costs 5) total cost & 6) profit per unit

For: lower level, upper level and zero activity level.

Lower Level Upper Level F,V,SV

Production (units) 5,000 7,500

Manufacturing costs:

Direct materials $50,000 $75,000 ______

Direct Labor 40,000 60,000 ______

Overhead:

Indirect Labor 21,000 28,500 ______

Supplies 20,000 30,000 ______

Depreciation 12,000 12,000 ______

Distribution expenses:

Salespersons 45,000 62,500 ______

Travel 8,000 8,000 ______

Advertising 5,000 5,000 ______

Other 29,000 41,500 ______

General and administrative expenses 30,000 37,500 ______

Transcribed Image Text:1-a) Classify each individual element of cost according to its behavior pattern (fixed, variable, or semi-variable).

b) Compute for: 1) total revenue at $63/u,

2) total variable costs,

3) total fixed costs,

4) total semi-variable costs

5) total cost &

6) profit per unit

For: lower level, upper level and zero activity level.

Lower Level

Upper Level

F.V,SV

Production (units)

5,000

7,500

Manufacturing costs:

Direct materials

$50,000

$75,000

Direct Labor

40,000

60,000

Overhead:

Indirect Labor

21,000

28,500

30,000

Supplies

Depreciation

Distribution expenses:

20,000

12,000

12,000

Salespersons

45,000

8,000

5,000

62,500

8,000

5,000

Travel

Advertising

Other

29,000

41,500

General and administrative expenses

30,000

37,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning