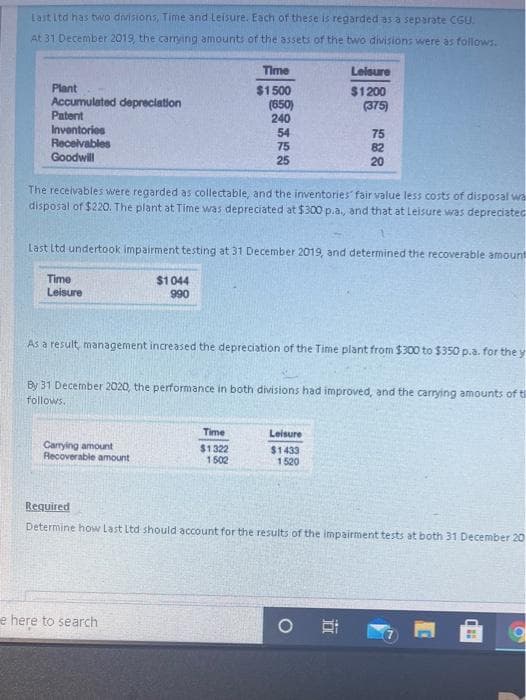

Last Ltd has two divisions, Time and Leisure. Each of these is regarded as a separate CGU. At 31 December 2019, the carrying amounts of the assets of the two divisions were as follows. Time Lelsure Plant Accumulated depreciation Patent Inventories Recelvables Goodwill $1 500 (650) 240 54 75 25 $1200 (375) 75 82 20 The receivables were regarded as collectable, and the inventories fair value less costs of disposal wa disposal of $220. The plant at Time was depreciated at $300 p.a, and that at Leisure was depreciatec Last Ltd undertook impairment testing at 31 December 2019, and determined the recoverable amoun Time Leisure $1044 990 As a result, management increased the depreciation of the Time plant from $300 to $350 p.a. for the y By 31 December 2020, the performance in both divisions had improved, and the carrying amounts of t follows. Time Leisure Carrying amount Recoverable amount $1322 1502 $1433 1520 Required Determine how Last Ltd should account for the results of the impairment tests at both 31 December 20

Last Ltd has two divisions, Time and Leisure. Each of these is regarded as a separate CGU. At 31 December 2019, the carrying amounts of the assets of the two divisions were as follows. Time Lelsure Plant Accumulated depreciation Patent Inventories Recelvables Goodwill $1 500 (650) 240 54 75 25 $1200 (375) 75 82 20 The receivables were regarded as collectable, and the inventories fair value less costs of disposal wa disposal of $220. The plant at Time was depreciated at $300 p.a, and that at Leisure was depreciatec Last Ltd undertook impairment testing at 31 December 2019, and determined the recoverable amoun Time Leisure $1044 990 As a result, management increased the depreciation of the Time plant from $300 to $350 p.a. for the y By 31 December 2020, the performance in both divisions had improved, and the carrying amounts of t follows. Time Leisure Carrying amount Recoverable amount $1322 1502 $1433 1520 Required Determine how Last Ltd should account for the results of the impairment tests at both 31 December 20

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 10RE

Related questions

Question

Transcribed Image Text:Last itd has two divisions, Time and Leisure. Each of these is regarded as a separate CGU.

At 31 December 2019, the carrying amounts of the assets of the two divisions were as follows.

Time

Leisure

$1 500

(650)

240

Plant

$1200

(375)

Accumulated depreciation

Patent

Inventories

54

Receivables

Goodwill

75

82

75

25

20

The receivables were regarded as collectable, and the inventories fair value less costs of disposal wa

disposal of $220. The plant at Time was depreciated at $300 p.a, and that at Leisure was depreciated

Last Itd undertook impairment testing at 31 December 2019, and determined the recoverable amount

Time

$1044

Leisure

990

As a result, management increased the depreciation of the Time plant from $300 to $350 p.a. for the y

By 31 December 2020, the performance in both divisions had improved, and the carrying amounts of ti

follows.

Time

Leisure

Carrying amount

Recoverable amount

$1322

1502

$1433

1520

Required

Determine how Last Ltd should account for the results of the impairment tests at both 31 December 20

e here to search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning