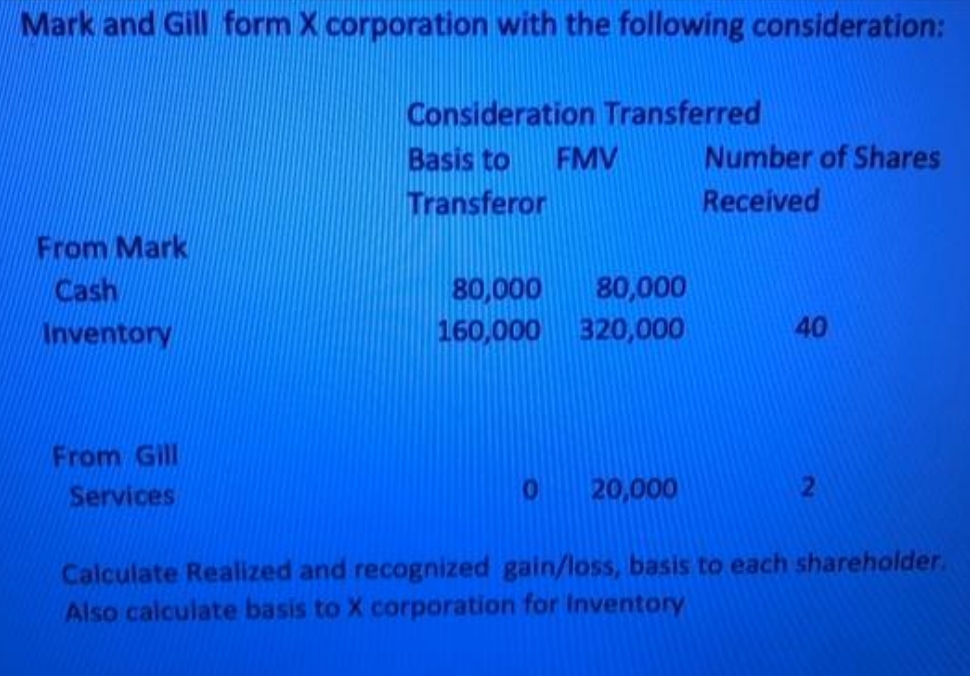

late basis to X corporation for Inventory

Q: Richardson Company cans a variety of vegetable-type soups. Recently, the company decided to value…

A: Dollar value LIFO pools method is a type of inventory valuation method which is mainly used by the…

Q: Sunland Company owns a trade name that was purchased in an acquisition of Blossom Company. The trade…

A: The trade name is an intangible asset for the business, It's reported in the assets section of the…

Q: Solve 29-day billing cycle 4/17 Billing date Previous Balance $1,100 4/27…

A: The average daily balance is a common accounting method that calculates interest charges by…

Q: In the manufacture of 9,400 units of a product, direct materials cost incurred was $177,400, direct…

A: Lets understand the basics. Conversion cost is a cost to convert raw material into finished product.…

Q: The cost of direct materials transferred into the Bottling Department of the Mountain Springs Water…

A: Formula: Cost per equivalent unit of Materials = Total cost of direct materials / Total equivalent…

Q: Which of the following statements is true? Select one: Profit sharing plans may not offer…

A: Pension plans are introduced by the government or the employer for the welfare of employees after…

Q: ich the following onscreen Vendors and Expenses transaction forms typically should be prepared.…

A: The payments are done to the vendors in the order bills and invoices are received and they are paid…

Q: please show all work and preferably on paper Question 2. The marketing manager for Tim Hortons is…

A: The selling price is a combination of cost and markup value. So we can calculate the selling price…

Q: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 Chapter 7: Applying Excel Data…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: Prepare the current assets section of Bramble's statement of financial position as at December 31,…

A: Balance sheet shows the financial position of the company that involves the assets, liabilities, and…

Q: down credit card 3. For Which credit card did you pay?, select 2100 VISA Credit Card 4. For How much…

A: Credit card is the facility given by bank to pay the expenses without having money in the bank…

Q: Sandhill Corp. uses a perpetual inventory system. The company had the following inventory…

A: Journal entry: It refers to the recording of company's financial transactions in it's primary book…

Q: Enter the opening balances in the ledger accounts as at October 1. Write "Balance" in the expla-…

A: Journal entry: It refers to the recording of company's financial transactions in it's primary book…

Q: QRC Company is trying to decide which one of two alternatives it will accept. The costs and revenues…

A: Differential revenue = Alternative B revenue - Alternative A revenue

Q: Weighted Average Cost Method with Perpetual Inventory The beginning inventory for Midnight Supplies…

A: Weighted Average Cost Method The COGS and inventory amounts are determined using a weighted average…

Q: A small air conditioning repair and parts supply company employ 25 workmen who perform services…

A: These risks can be mitigated by implementation of following internal controls: 1. Segregation of…

Q: Mercury Company’s unadjusted book balance at September 30 is $722. If the company's accountant…

A: The rule of correcting the cash balnace state that if you add more then you should deduct the excess…

Q: On jan 1 2022, rodney inc provided services to smith's company in exchange for smith's $300000, 2…

A: Financial Management: Financial management can be explained as a technique used by business…

Q: Using the calendar below, list the due dates of each deposit in the first quarter. Paydays…

A: Please find the attachment below for the first a) answer Schedule B (Form 941): Report of Tax…

Q: Mary Henderson invested $45,000 cash in the company in exchange for its common stock.

A: Common Stock - Common Stock is the shares issued to the public in exchange of Cash. This denotes…

Q: 05) Which of the following stateme consolidation is true: (1) Subsidiaries are consolidated in full…

A: According to the given question, we are required to select the correct answer from the options given…

Q: Vermont Resources, which uses the FIFO inventory costing method, has the following account balances…

A: The question is based on the concept of Financial Accounting.

Q: Presented below is information related to Anderson Company for 2022. Sales revenue…

A: According to the given question, we are required to prepare the income statement for the year ending…

Q: not-for-profit organization

A: Non profit organizations are the organization that work for the society causes and not for the…

Q: What is the purpose of constructive recite doctrine? Explain Why is it important to use for…

A: Introduction: The doctrine of constructive receipt assesses whether a cash-basis taxpayer receives…

Q: 8. Old West City had the following transactions in fiscal 2014. Assume that all expenditures were…

A: Solution A journal is a company's official book in which all business transaction which are…

Q: On May 10, Hudson Computing sold 90 Millennium laptop computers to Apex Publishers. At the date of…

A: The question is based on the concept of Cost Accounting.

Q: which of the following is correct about the appropriateness of evidence? A. Audit evidence from…

A: Audit is the process of checking the financial statement and identifying the errors and…

Q: Income Statements under Absorption Costing and Variable Costing Gallatin County Motors Inc.…

A: As per the absorption costing method, the product cost includes fixed and variable manufacturing…

Q: Empty Fields Company pays its salaried employees monthly on the last day of each month. The annual…

A: Social Security Tax Benefits are provided by the Social Security programme to retirees and others…

Q: Scampini Technologies is expected to generate $100 million in free cash flow next year, and FCF is…

A: Answer : Stock value per share = Current total value / Share of stock outstanding Current total…

Q: Calculate the variable overhead spending and efficiency variances. (Round answers to O decimal…

A: Variable Overhead Spending Variance = (Actual Hours x Standard Rate) - Actual Overhead Costs…

Q: 14) On October 1, 2012, Peacock Inc. acquired 80% of the outstanding common stock of Shade Co. for…

A: Non-controlling interest in a corporation is a stake in the company that is not substantial enough…

Q: Mr. Juan Lopez launched Lopez Fiesta Mart on December 1, 2022 with a cash investment of ₱220,000.…

A: Journal entry is the process of recording monetary transactions of the business related to a…

Q: Update the balance sheet above to reflect the transactions below, which occur on January 6, 2022 1.…

A: The question is based on the concept of financial accounting.

Q: $35,770. What liability should Fins report on its balance sheet as of December 31, 2021?

A: Liability that Fins should report on its balance sheet as on December 31,2021

Q: Use the expanded accounting equation to compute the missing financial statement amounts. Common…

A: The accounting equation is a mathematical representation of financial transactions. The accounting…

Q: n 20--, the annual salaries paid each of the officers of Abrew, Inc., follow. The officers are paid…

A: FICA Social Security Tax Withheld A payroll tax is required to be deducted from employees' paychecks…

Q: P 3-5 Prepare a consolidated balance sheet one year after acquisition Adjusted trial balances for…

A: Solution Balance sheet is the statement of company's assets , liabilities and shareholder's equity…

Q: a. Determine the value of the inventory at the lower of cost or market applied to each item in the…

A: a. Inventory at the Lower of Cost or Market Product Inventory Quality Cost Per unit in…

Q: ast quarter of 2021 and the first month of 2022. The only securities held by Amalgamated at October…

A: Held for trading securities are types of financial assets, a debt or security purchased with the…

Q: Mia bought a hifg-definition television for $7,500. Based on her income she could afford to pay back…

A: INTRODUCTION: Accounts payable is the sum that clients owe the business for the products they have…

Q: A/R turnover.

A: Accounts Receivable Turnover is the ratio that defines the relationship between the average accounts…

Q: 1. Pedro made 24 payments of P200,000.00 each, and all payments are made at the beginning of each…

A: Time value of money :— According to this concept, value of money in present day is greater than the…

Q: uncollectable accounts recognized

A: The term Receivables refers to the amount of debts owed to a firm by its customers for goods or…

Q: Lemon Ltd has a December 31 year end. On January 1, 2018 Lemon acquires 4000 shares of Nike Inc at…

A: A journal entry is the act of keeping or producing records of any economic or non-economic…

Q: Operating Leverage Beck Inc. and Bryant Inc. have the following operating data: Beck Inc. Bryant…

A: Contribution Margin :— It is the difference between sale and variable cost. Operating Income :— It…

Q: Moyas Corporation sells a single product for $20 per unit. Last year, the company's sales revenue…

A: The break even no of units, as the name suggests , is the no of units of goods that company needs to…

Q: Determine the direct materials price variance, direct materials quantity variance, and total direct…

A: Variance is difference between the budgeted and actual cost. It is calculated by management for…

Q: interest of Her basis in the her partnership 76,000 prior to the distribution what is Katie spaces…

A:

P13.

Step by step

Solved in 2 steps with 2 images

- T holds two business assets, X (with a basis of 30 and a value of 120) and Y (with a basis of 70 and value of 50). T also has outstanding debt of $40 (held by C). T is wholly owned by A whose basis for his T stock is 50 (with a value of $130). Acquiring corporation P will acquire T’s assets in what is assumed to be a qualified section 368 reorganization. If T merges into P for $65 of P stock and $65 in cash, which cash and stock are distributed to A upon the surrender of A’s T shares; and P assumes T’s debt to C. Describe the consequences of the reorganization transaction to T, T’s shareholder A & P. a) Transferor corporation (T) b) Transferor Corporation’s shareholder (A) c) Acquiring Corporation (P)Peter Corp acquired the net identifiable assets of Simon Corp by issuing its own 5,000 ordinary shares with par and fair value of P100 and P125 per share, respectively and payment of cash of P2,000,000. The assets and liabilities of Simon have fair values of P3,500,000 and P1,200,000, respectively. Peter Corp incurred the following other realted cost of acquiring Simon Corp. such as cost of registering shares P120,000 including listing fees of P20,000; due diligence cost of P5,000; legal fees P10,000; broker's fee P3,000; Audit fee for SEC registration of share issue P25,000; printing cost of share certificates P2,000; pre acquisition audit fee P8,000; and general and administrative cost of maintaining an internal acquisition P30,000. The total expenditures that should be debited to share premium?Jacobson Company is considering an investment in the common stock of Biltrite Company. What are the accounting issues surrounding the recording of income in future periods if Jacobson purchases: a. 15% of Biltrite’s outstanding shares. b. 40% of Biltrite’s outstanding shares. c. 100% of Biltrite’s outstanding shares. d. 80% of Biltrite’s outstanding shares.

- Company Aero is about to acquire 100% of company Berry. Company Berry has identifiable net assets with book value of $300,000 and $500,000 respectively. As payment Company Aero will issue common stock with a fair value of $75,000. How should the transaction be recorded if the acquisition is:a) An acquisition of net assets?b) An acquisition of Company B’s common stock and Company B remains a separate legal entity?Peter Corp acquired the net identifiable assets of Simon Corp by issuing its own 5,000 ordinary shares with par and fair value of P100 and P125 per share, respectively and payment of cash of P2,000,000. The assets and liabilities of Simon have fair values of P3,500,000 and P1,200,000, respectively. Peter Corp incurred the following other related cost of acquiring Simon Corp. such as cost of registering shares P120,000 including listing fees of P20,000; due diligence cost of P5,000; legal fees P10,000; broker’s fee P3,000; Audit fee for SEC registration of share issue P25,000; printing cost of share certificates P2,000; pre acquisition audit fee P8,000; and general and administrative cost of maintaining an internal acquisition P30,000. The total goodwill to be recorded by Peter Corp?Peter Corp acquired the net identifiable assets of Simon Corp by issuing its own 5,000 ordinary shares with par and fair value of P100 and P125 per share, respectively and payment of cash of P2,000,000. The assets and liabilities of Simon have fair values of P3,500,000 and P1,200,000, respectively. Peter Corp incurred the following other related cost of acquiring Simon Corp. such as cost of registering shares P120,000 including listing fees of P20,000; due diligence cost of P5,000; legal fees P10,000; broker’s fee P3,000; Audit fee for SEC registration of share issue P25,000; printing cost of share certificates P2,000; pre acquisition audit fee P8,000; and general and administrative cost of maintaining an internal acquisition P30,000. Total expenditures that should be charged to profit or loss?

- Hippo Co. is a holding company. It holds all the shares of Opco. Shareholder H holds all the shares of Hippo Co. What should Opco be directed to do prior to its sale in order to minimize taxable capital gains? a. Transfer all assets to Hippo Co. before sale. b. Transfer all shares in Opco to Shareholder H prior to the sale c. Transfer all the shares of Hippo Co. to shareholder H prior to the sale. d. Pay a tax-free dividend to Hippo Co. from Opco prior to the saleOn June 1, 2020, SME A acquired 35% of the equity of entities X, Y, Z for P64,000 and P58,000 and P37,000, respectively, SME A has joint control over the strategic financial and operating decisions of entities X, Y and Z. Transaction costs of 5% of the purchase price of the shares were incurred by SME A. On December 31, 2020, Entity X declared dividends of P9,000 and Entity Y, P15,000 for the year 2020. These dividends are to be paid by X and Y in 2021. Entity Z declared and paid a dividend of P24,000 for the year ended 2020. For the year ended December, 31, 2020, entities X and Y recognized loss of P30,000 and P42,000. respectively. However, entity Z recognized a profit of P18,000 for that year. Published price quotations do not exist for the shares of X, Y and Z. Using appropriate valuation techniques, SME A determined the fair values of their investments in entities X, Y and Z at December 31, 2020 as P60,000, P65,000, and P49,000, respectively. Costs to sell are estimated at 9% of…The shareholders of ABC Corporation would like to know the valuation of their ownership in the entity. Relative valuation based on its two closest competitors will be made. The price-book value ratio will be used. X Inc. Y Co. Market value of ordinary shares 5,980,000 7,020,000 Book Value of ordinary shares 5,200,000 6,000,000 ABC has a book value of ordinary shares at P5,800,000. This includes aninvestment property that provides additional income. It has a book value ofP420,000 but a market value of P650,000. Also, a material error in theaccounts payable was identified and it resulted to a P300,000understatement. After considering these, the remaining and corrected bookvalue can be valued using relative valuation. What is the total relative valueof ABC ordinary shares?

- If Alakdan Co., a new company would acquire the net assets of Cardo and Allana Company by issuing 50,000 shares of P25 par value ordinary shares with fair value of P130 per share and paying professional finders fee and stock registration costs of P125,000 and P65,000, respectively, determine:i. The total amount of Goodwill to be reported by Alakdan Co.ii. The total assets of Alakdan Co. after the business combination.iii. The total stockholders equity of Aklan Co after the business combination.iv. The journal entries to be made by Alakdan Co. for the business combination.On January 1, 2021, PARKSOOYOUNG acquired all the outstanding shares ofSUNGJAE for P600,000. The shareholders’ equity of SUNGJAE on this dateamounted to P600,000. The net assets of SUNGJAE on this day were fairly valuedexcept for inventories which were overstated by P50,000, equipment which wasunderstated by P75,000, and building which was overstated by P125,000. Only half ofthe inventories were sold during 2021. The useful lives of the equipment and thebuilding at the beginning of 2021 were 3 years and 5 years remaining, respectively.On December 31, 2021, the statements of financial position of PARKSOOYOUNGand SUNGJAE are as follows:PARKSOOYOUNG SUNGJAECash 300,000 300,000Inventory 400,000 250,000Equipment 1,000,000 900,000Building 600,000 500,000Liabilities 1,100,000 500,000Share capital 600,000 600,000Retained earnings 600,000 850,000How much is the consolidated total assets as of December 31, 2021? A. 4,125,000B. 4,250,000C. 4,150,0004, D. 275,000ardner Corp. owns 80% of the voting common stock of Lockhart Co. Lockhart owns 70% of Canning Co. Gardner and Lockhart both use the initial value method to account for their investments. The following information is available from the financial statements and records of the three companies: GardnerCorp. LockhartCo. CanningCo. Separate company net income before investment income $900,000 $650,000 $150,000 Dividend income from investment in subsidiary 250,000 120,000 Deferral of intra-entity gains 110,000 80,000 20,000 Amortization expense related to excess fair value over book value of investment 40,000 25,000 Separate company net income includes intra-entity gains before the consolidating deferral but does not include dividend income from investment in subsidiary. The accrual-based net income of Gardner Corp. is calculated to be