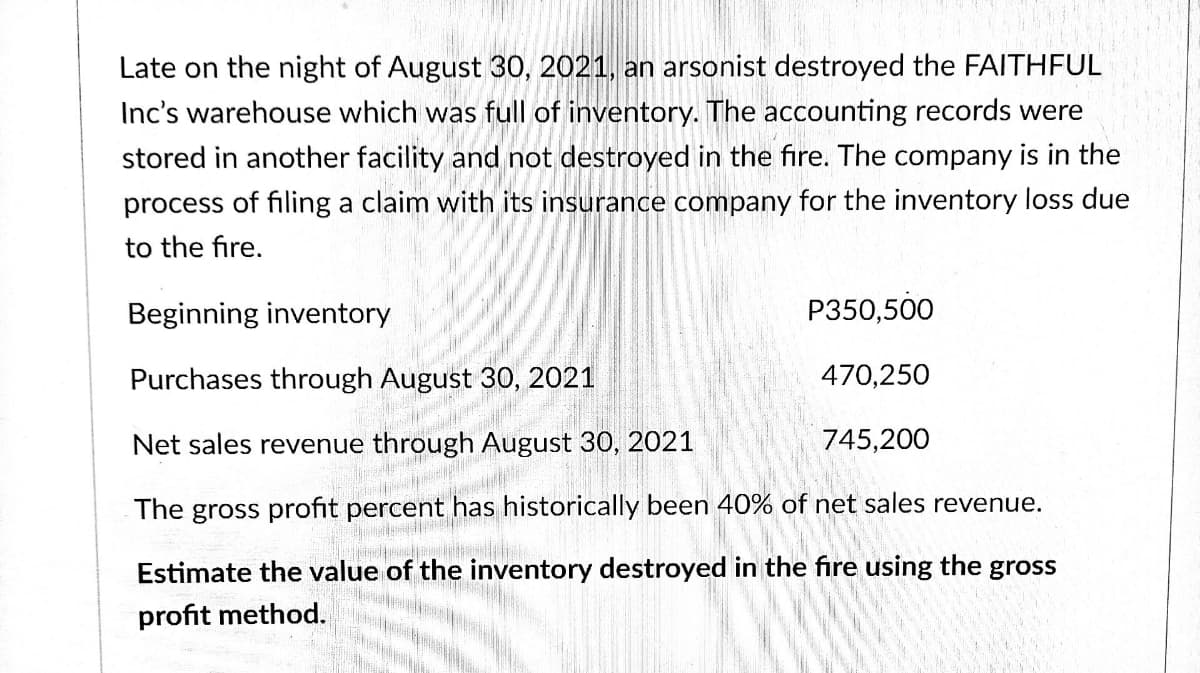

Late on the night of August 30, 2021, an arsonist destroyed the FAITHFUL Inc's warehouse which was full of inventory. The accounting records were stored in another facility and not destroyed in the fire. The company is in the process of filing a claim with its insurance company for the inventory loss due to the fire. Beginning inventory P350,500 Purchases through August 30, 2021 470,250 Net sales revenue through August 30, 2021 745,200 The gross profit percent has historically been 40% of net sales revenue. Estimate the value of the inventory destroyed in the fire using the gross profit method.

Late on the night of August 30, 2021, an arsonist destroyed the FAITHFUL Inc's warehouse which was full of inventory. The accounting records were stored in another facility and not destroyed in the fire. The company is in the process of filing a claim with its insurance company for the inventory loss due to the fire. Beginning inventory P350,500 Purchases through August 30, 2021 470,250 Net sales revenue through August 30, 2021 745,200 The gross profit percent has historically been 40% of net sales revenue. Estimate the value of the inventory destroyed in the fire using the gross profit method.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 7E

Related questions

Question

100%

Transcribed Image Text:Late on the night of August 30, 2021, an arsonist destroyed the FAITHFUL

Inc's warehouse which was full of inventory. The accounting records were

stored in another facility and not destroyed in the fire. The company is in the

process of filing a claim with its insurance company for the inventory loss due

to the fire.

Beginning inventory

P350,500

Purchases through August 30, 2021

470,250

Net sales revenue through August 30, 2021

745,200

The gross profit percent has historically been 40% of net sales revenue.

Estimate the value of the inventory destroyed in the fire using the gross

profit method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT