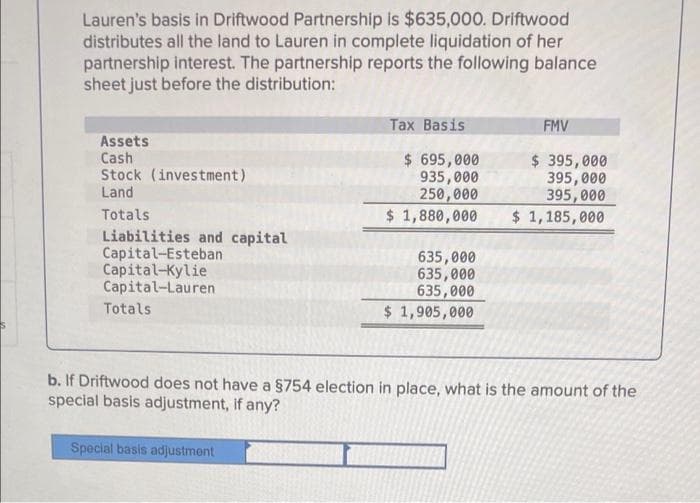

Lauren's basis in Driftwood Partnership is $635,000. Driftwood distributes all the land to Lauren in complete liquidation of her partnership interest. The partnership reports the following balance sheet just before the distribution: Tax Basis FMV Assets Cash Stock (investment) Land $ 695,000 935,000 250,000 $ 1,880,000 $ 395,000 395,000 395,000 $ 1,185,000 Totals Liabilities and capital Capital-Esteban Capital-Kylie Capital-Lauren Totals 635,000 635,000 635,000 $ 1,905,000 b. If Driftwood does not have a $754 election in place, what is the amount of the special basis adjustment, If any? Special basis adjustment

Lauren's basis in Driftwood Partnership is $635,000. Driftwood distributes all the land to Lauren in complete liquidation of her partnership interest. The partnership reports the following balance sheet just before the distribution: Tax Basis FMV Assets Cash Stock (investment) Land $ 695,000 935,000 250,000 $ 1,880,000 $ 395,000 395,000 395,000 $ 1,185,000 Totals Liabilities and capital Capital-Esteban Capital-Kylie Capital-Lauren Totals 635,000 635,000 635,000 $ 1,905,000 b. If Driftwood does not have a $754 election in place, what is the amount of the special basis adjustment, If any? Special basis adjustment

Chapter21: Partnerships

Section: Chapter Questions

Problem 10BCRQ

Related questions

Question

100%

Please Solve In 20mins

Transcribed Image Text:Lauren's basis in Driftwood Partnership is $635,000. Driftwood

distributes all the land to Lauren in complete liquidation of her

partnership interest. The partnership reports the following balance

sheet just before the distribution:

Tax Basis

FMV

Assets

Cash

Stock (investment)

Land

$ 695,000

935,000

250,000

$ 1,880,000

$ 395,000

395, 000

395,000

$ 1,185,000

Totals

Liabilities and capital

Capital-Esteban

Capital-Kylie

Capital-Lauren

635,000

635,000

635,000

$ 1,905,000

Totals

b. If Driftwood does not have a $754 election in place, what is the amount of the

special basis adjustment, if any?

Special basis adjustment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you