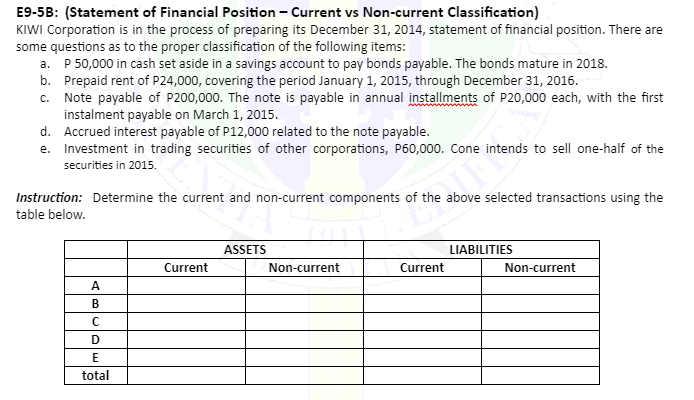

E9-5B: (Statement of Financial Position - Current vs Non-current Classification) KIWI Corporation is in the process of preparing its December 31, 2014, statement of financial position. There are some questions as to the proper classification of the following items: a. P 50,000 in cash set aside in a savings account to pay bonds payable. The bonds mature in 2018. b. Prepaid rent of P24,000, covering the period January 1, 2015, through December 31, 2016. c. Note payable of P200,000. The note is payable in annual installments of P20,000 each, with the first instalment payable on March 1, 2015. d. Accrued interest payable of P12,000 related to the note payable. e. Investment in trading securities of other corporations, P60,000. Cone intends to sell one-half of the securities in 2015. Instruction: Determine the current and non-current components of the above selected transactions using the table below. ASSETS LIABILITIES Current Non-current Current Non-current A В D E total

E9-5B: (Statement of Financial Position - Current vs Non-current Classification) KIWI Corporation is in the process of preparing its December 31, 2014, statement of financial position. There are some questions as to the proper classification of the following items: a. P 50,000 in cash set aside in a savings account to pay bonds payable. The bonds mature in 2018. b. Prepaid rent of P24,000, covering the period January 1, 2015, through December 31, 2016. c. Note payable of P200,000. The note is payable in annual installments of P20,000 each, with the first instalment payable on March 1, 2015. d. Accrued interest payable of P12,000 related to the note payable. e. Investment in trading securities of other corporations, P60,000. Cone intends to sell one-half of the securities in 2015. Instruction: Determine the current and non-current components of the above selected transactions using the table below. ASSETS LIABILITIES Current Non-current Current Non-current A В D E total

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter7: Financial Activities

Section: Chapter Questions

Problem 5QE

Related questions

Question

Transcribed Image Text:E9-5B: (Statement of Financial Position – Current vs Non-current Classification)

KIWI Corporation is in the process of preparing its December 31, 2014, statement of financial position. There are

some questions as to the proper classification of the following items:

P 50,000 in cash set aside in a savings account to pay bonds payable. The bonds mature in 2018.

b. Prepaid rent of P24,000, covering the period January 1, 2015, through December 31, 2016.

c. Note payable of P200,000. The note is payable in annual installments of P20,000 each, with the first

instalment payable on March 1, 2015.

d. Accrued interest payable of P12,000 related to the note payable.

e. Investment in trading securities of other corporations, P60,000. Cone intends to sell one-half of the

a.

securities in 2015.

Instruction: Determine the current and non-current components of the above selected transactions using the

table below.

ASSETS

LIABILITIES

Current

Non-current

Current

Non-current

A

В

total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning