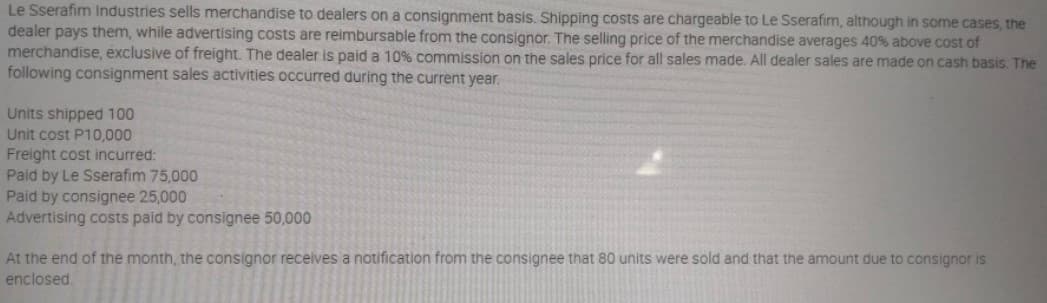

Le Sserafim Industries sells merchandise to dealers on a consignment basis. Shipping costs are chargeable to Le Sserafim, although in some cases, the dealer pays them, while advertising costs are reimbursable from the consignor. The selling price of the merchandise averages 40% above cost of merchandise, exclusive of freight. The dealer is paid a 10% commission on the sales price for all sales made. All dealer sales are made on cash basis. The following consignment sales activities occurred during the current year. Units shipped 100 Unit cost P10,000 Freight cost incurred: Paid by Le Sserafim 75,000 Paid by consignee 25,000 Advertising costs paid by consignee 50,000 At the end of the month, the consignor receives a notification from the consignee that 80 units were sold and that the amount due to consignor is enclosed.

Le Sserafim Industries sells merchandise to dealers on a consignment basis. Shipping costs are chargeable to Le Sserafim, although in some cases, the dealer pays them, while advertising costs are reimbursable from the consignor. The selling price of the merchandise averages 40% above cost of merchandise, exclusive of freight. The dealer is paid a 10% commission on the sales price for all sales made. All dealer sales are made on cash basis. The following consignment sales activities occurred during the current year. Units shipped 100 Unit cost P10,000 Freight cost incurred: Paid by Le Sserafim 75,000 Paid by consignee 25,000 Advertising costs paid by consignee 50,000 At the end of the month, the consignor receives a notification from the consignee that 80 units were sold and that the amount due to consignor is enclosed.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 14E: Many different businesses employ markup on cost to arrive at a price. For each of the following...

Related questions

Topic Video

Question

1. How much is the value of inventory in the hands of consignee?

2. How much is the net Income to be reported by Le Sserafim?

3. How much is the amount remitted by the dealer to Le Sserafim?

Transcribed Image Text:Le Sserafim Industries sells merchandise to dealers on a consignment basis. Shipping costs are chargeable to Le Sserafim, although in some cases, the

dealer pays them, while advertising costs are reimbursable from the consignor. The selling price of the merchandise averages 40% above cost of

merchandise, exclusive of freight. The dealer is paid a 10% commission on the sales price for all sales made. All dealer sales are made on cash basis. The

following consignment sales activities occurred during the current year.

Units shipped 100

Unit cost P10,000

Freight cost incurred:

Paid by Le Sserafim 75,000

Paid by consignee 25,000

Advertising costs paid by consignee 50,000

At the end of the month, the consignor receives a notification from the consignee that 80 units were sold and that the amount due to consignor is

enclosed.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning