leen Company acquired patent rights on January 10 of Year 1 for $488.000. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $24,500. f required, round your ansvwer to the nearest dollar. a. Determine the patent amortization expense for the Year 4 ended December 31. 30,500 x Feedback Check My Work For intangible assets with finite lives, a company uses the straight-line method to calculate amortization. If a company successfully defends a patent it becomes part of the cost of the patent. If the company loses a lawsuit regarding a patent infringement, then the patent is written a b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. If an amount box does not require an entry, leave it blank. Accumulated Depletion x 65.900 V Amortization Expense-Patents x 65.900

leen Company acquired patent rights on January 10 of Year 1 for $488.000. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $24,500. f required, round your ansvwer to the nearest dollar. a. Determine the patent amortization expense for the Year 4 ended December 31. 30,500 x Feedback Check My Work For intangible assets with finite lives, a company uses the straight-line method to calculate amortization. If a company successfully defends a patent it becomes part of the cost of the patent. If the company loses a lawsuit regarding a patent infringement, then the patent is written a b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. If an amount box does not require an entry, leave it blank. Accumulated Depletion x 65.900 V Amortization Expense-Patents x 65.900

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.9AMCP

Related questions

Question

I put the choices for part be in the order they appear on the drop down box.

Part B.

1.

- Accumulated Depletion

- Amortization Expense-Patents

- Cash

- Patent

- Repairs and Maintenance Expense

2.

- Amortization Expense-Patents

- Cash

- Depletion Expense

- Patents

- Repairs and Maintenance Expense

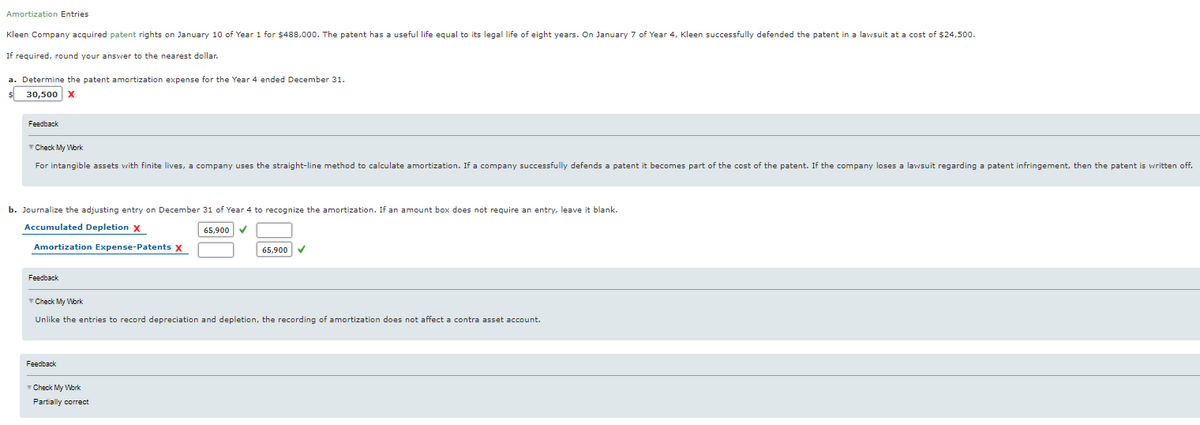

Transcribed Image Text:Amortization Entries

Kleen Company acquired patent rights on January 10 of Year 1 for $488,000. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $24,500.

If required, round your answer to the nearest dollar.

a. Determine the patent amortization expense for the Year 4 ended December 31.

30,500

X

Feedback

V Check My Work

For intangible assets with finite lives, a company uses the straight-line method to calculate amortization. If a company successfully defends a patent it becomes part of the cost of the patent. If the company loses a lawsuit regarding a patent infringement, then the patent is written off.

| b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. If an amount box does not require an entry, leave it blank.

Accumulated Depletion X

65,900

Amortization Expense-Patents X

65,900

Feedback

Check My Work

Unlike the entries to record depreciation and depletion, the recording of amortization does not affect a contra asset account.

Feedback

Check My Work

Partially correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,