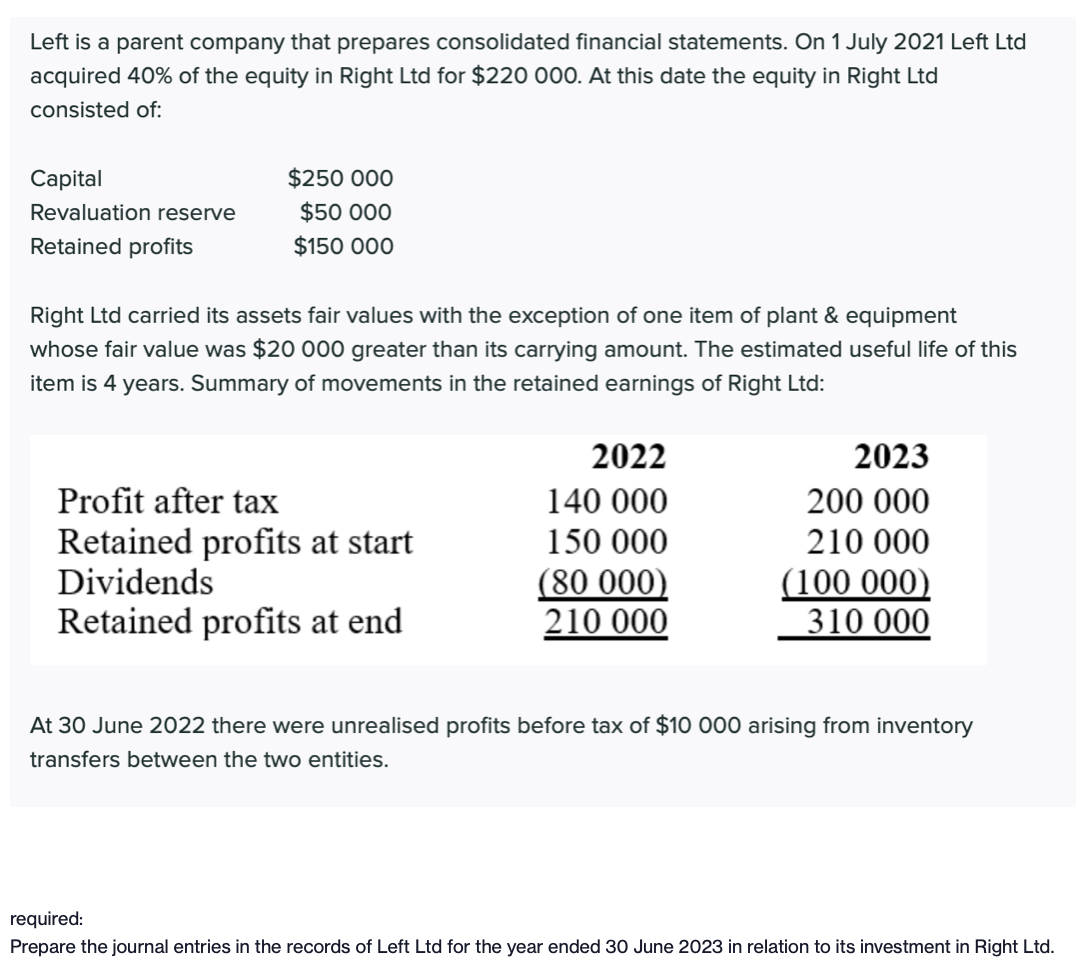

Left is a parent company that prepares consolidated financial statements. On 1 July 2021 Left Ltd acquired 40% of the equity in Right Ltd for $22o 000. At this date the equity in Right Ltd consisted of: Capital $250 000 Revaluation reserve $50 000 Retained profits $150 000 Right Ltd carried its assets fair values with the exception of one item of plant & equipment whose fair value was $20 000 greater than its carrying amount. The estimated useful life of this item is 4 years. Summary of movements in the retained earnings of Right Ltd: 2022 2023 Profit after tax 140 000 200 000 Retained profits at start Dividends 150 000 210 000 (80 000) 210 000 (100 000) 310 000 Retained profits at end At 30 June 2022 there were unrealised profits before tax of $10 000 arising from inventory transfers between the two entities. equired: Prepare the journal entries in the records of Left Ltd for the year ended 30 June 2023 in relation to its investment in Right Ltd.

Left is a parent company that prepares consolidated financial statements. On 1 July 2021 Left Ltd acquired 40% of the equity in Right Ltd for $22o 000. At this date the equity in Right Ltd consisted of: Capital $250 000 Revaluation reserve $50 000 Retained profits $150 000 Right Ltd carried its assets fair values with the exception of one item of plant & equipment whose fair value was $20 000 greater than its carrying amount. The estimated useful life of this item is 4 years. Summary of movements in the retained earnings of Right Ltd: 2022 2023 Profit after tax 140 000 200 000 Retained profits at start Dividends 150 000 210 000 (80 000) 210 000 (100 000) 310 000 Retained profits at end At 30 June 2022 there were unrealised profits before tax of $10 000 arising from inventory transfers between the two entities. equired: Prepare the journal entries in the records of Left Ltd for the year ended 30 June 2023 in relation to its investment in Right Ltd.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Transcribed Image Text:Left is a parent company that prepares consolidated financial statements. On 1 July 2021 Left Ltd

acquired 40% of the equity in Right Ltd for $220 000. At this date the equity in Right Ltd

consisted of:

Capital

$250 000

Revaluation reserve

$50 000

Retained profits

$150 000

Right Ltd carried its assets fair values with the exception of one item of plant & equipment

whose fair value was $20 000 greater than its carrying amount. The estimated useful life of this

item is 4 years. Summary of movements in the retained earnings of Right Ltd:

2022

2023

Profit after tax

140 000

200 000

Retained profits at start

Dividends

150 000

210 000

(80 000)

210 000

(100 000)

310 000

Retained profits at end

At 30 June 2022 there were unrealised profits before tax of $10 000 arising from inventory

transfers between the two entities.

required:

Prepare the journal entries in the records of Left Ltd for the year ended 30 June 2023 in relation to its investment in Right Ltd.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning