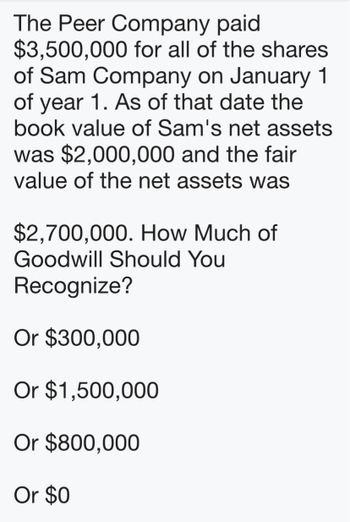

the amount paid, how much is attributable to goodwill?

Jimin, Inc. purchased 40% of Hope Inc.’s outstanding ordinary shares on January 2, 2021, for $270,000,000. Jimin obtained significant influence over Jimin. The book value of Hope's net assets at the purchase date totalled $450,000,000. Book values and fair values were the same for all financial statement items except for inventory and buildings, for which fair values exceeded book values by $12,500,000 and $112,500,000, All inventories on hand at the purchase date was sold during 2021. The buildings have average remaining useful lives of 15 years. Hope, Inc. reported net income of $110,000,000 for the year ended December 31, 2021, and paid cash dividends of $50,000,000. The fair value of Jimin, Inc.’s investment in associate was $300,000,000 at December 31, 2021.

Of the amount paid, how much is attributable to

Step by step

Solved in 2 steps with 1 images