Lenders tighten or loosen their standards for issuing credit as economic conditions change. One of the criteria lenders use to evaluate the creditworthiness of a potential borrower is her credit risk score, usually a FICO score. FICO scores range from 300 to 850. A consumer with a high FICO score is perceived to be a low credit risk to the lender and is more likely to be extended credit than a consumer with a low score. A credit card represents a line of credit, because the credit card holder obtains a loan whenever the card is used to pay for a purchase. A study of credit card accounts opened in 2002 found a mean FICO score for the credit card holder (at the time the card was issued) of 731 and a standard deviation of 76. [Source: Sumit Agarwal, John C. Driscoll, Xavier Gabaix, and David Laibson, "Learning in the Credit Card Market," Working Paper 13822, National Bureau of Economic Research (NBER), February 2008.] You conduct a hypothesis test to determine whether banks have tightened their standards for issuing credit cards since 2002. You collect a random sample of 100 credit cards issued during the past 6 months. The sample mean FICO score of the credit card holders (at the time their cards were issued) is X = 747. Assume that the standard deviation of the population of FICO scores for credit cards issued during the past 6 months is known to be o = 76, the standard deviation from the NBER study.

Lenders tighten or loosen their standards for issuing credit as economic conditions change. One of the criteria lenders use to evaluate the creditworthiness of a potential borrower is her credit risk score, usually a FICO score. FICO scores range from 300 to 850. A consumer with a high FICO score is perceived to be a low credit risk to the lender and is more likely to be extended credit than a consumer with a low score. A credit card represents a line of credit, because the credit card holder obtains a loan whenever the card is used to pay for a purchase. A study of credit card accounts opened in 2002 found a mean FICO score for the credit card holder (at the time the card was issued) of 731 and a standard deviation of 76. [Source: Sumit Agarwal, John C. Driscoll, Xavier Gabaix, and David Laibson, "Learning in the Credit Card Market," Working Paper 13822, National Bureau of Economic Research (NBER), February 2008.] You conduct a hypothesis test to determine whether banks have tightened their standards for issuing credit cards since 2002. You collect a random sample of 100 credit cards issued during the past 6 months. The sample mean FICO score of the credit card holders (at the time their cards were issued) is X = 747. Assume that the standard deviation of the population of FICO scores for credit cards issued during the past 6 months is known to be o = 76, the standard deviation from the NBER study.

Chapter6: Systems Of Equations And Inequalities

Section: Chapter Questions

Problem 17PS: Cholesterol Cholesterol in human blood is necessary, but too much can lead to health problems. There...

Related questions

Topic Video

Question

![Lenders tighten or loosen their standards for issuing credit as economic conditions change. One of the criteria lenders use to evaluate the

creditworthiness of a potential borrower is her credit risk score, usually a FICO score. FICO scores range from 300 to 850. A consumer with a high

FICO score is perceived to be a low credit risk to the lender and is more likely to be extended credit than a consumer with a low score.

A credit card represents a line of credit, because the credit card holder obtains a loan whenever the card is used to pay for a purchase. A study of

credit card accounts opened in 2002 found a mean FICO score for the credit card holder (at the time the card was issued) of 731 and a standard

deviation of 76. [Source: Sumit Agarwal, John C. Driscoll, Xavier Gabaix, and David Laibson, "Learning in the Credit Card Market," Working Paper

13822, National Bureau of Economic Research (NBER), February 2008.]

You conduct a hypothesis test to determine whether banks have tightened their standards for issuing credit cards since 2002. You collect a random

sample of 100 credit cards issued during the past 6 months. The sample mean FICO score of the credit card holders (at the time their cards were

issued) is X = 747. Assume that the standard deviation of the population of FICO scores for credit cards issued during the past 6 months is known to

be o = 76, the standard deviation from the NBER study.

Let u equal the true population mean FICO score for consumers issued credit cards in the past 6 months. You should formulate the null and alternative

hypotheses as:

O Ho: µ > 731, Hạ: µ < 731

O Ho: X< 731, Ha: X > 731

O Ho: µ 2 731, Ha: µ < 731

Ho: µ s 731, Ha: µ > 731

If the null hypothesis is true as an equality, the sampling distribution of x is approximated by

distribution with

and a standard deviation of

The value of the standardized test statistic is](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fe5322f76-08be-4cea-9041-3fbbc034811a%2Fc6e6dfd1-d24d-4438-98d5-74f634fa49fd%2F7vlqrpi_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Lenders tighten or loosen their standards for issuing credit as economic conditions change. One of the criteria lenders use to evaluate the

creditworthiness of a potential borrower is her credit risk score, usually a FICO score. FICO scores range from 300 to 850. A consumer with a high

FICO score is perceived to be a low credit risk to the lender and is more likely to be extended credit than a consumer with a low score.

A credit card represents a line of credit, because the credit card holder obtains a loan whenever the card is used to pay for a purchase. A study of

credit card accounts opened in 2002 found a mean FICO score for the credit card holder (at the time the card was issued) of 731 and a standard

deviation of 76. [Source: Sumit Agarwal, John C. Driscoll, Xavier Gabaix, and David Laibson, "Learning in the Credit Card Market," Working Paper

13822, National Bureau of Economic Research (NBER), February 2008.]

You conduct a hypothesis test to determine whether banks have tightened their standards for issuing credit cards since 2002. You collect a random

sample of 100 credit cards issued during the past 6 months. The sample mean FICO score of the credit card holders (at the time their cards were

issued) is X = 747. Assume that the standard deviation of the population of FICO scores for credit cards issued during the past 6 months is known to

be o = 76, the standard deviation from the NBER study.

Let u equal the true population mean FICO score for consumers issued credit cards in the past 6 months. You should formulate the null and alternative

hypotheses as:

O Ho: µ > 731, Hạ: µ < 731

O Ho: X< 731, Ha: X > 731

O Ho: µ 2 731, Ha: µ < 731

Ho: µ s 731, Ha: µ > 731

If the null hypothesis is true as an equality, the sampling distribution of x is approximated by

distribution with

and a standard deviation of

The value of the standardized test statistic is

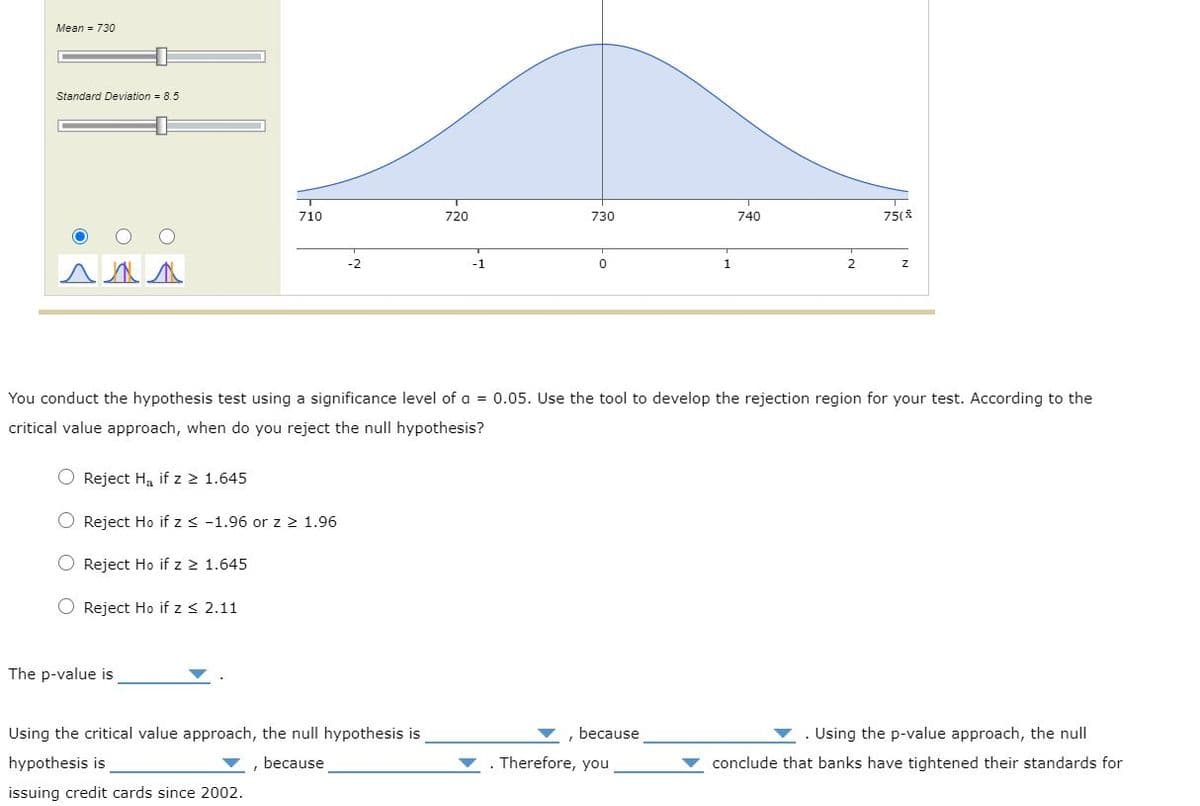

Transcribed Image Text:Mean = 730

Standard Deviation = 8.5

710

720

730

740

75(8

1

2

You conduct the hypothesis test using a significance level of a = 0.05. Use the tool to develop the rejection region for your test. According to the

critical value approach, when do you reject the null hypothesis?

O Reject Ha if z 2 1.645

O Reject Ho if z s -1.96 or z > 1.96

O Reject Ho if z 2 1.645

O Reject Ho if z < 2.11

The p-value is

Using the critical value approach, the null hypothesis is

, because

. Using the p-value approach, the null

hypothesis is

, because

Therefore, you

conclude that banks have tightened their standards for

issuing credit cards since 2002.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL