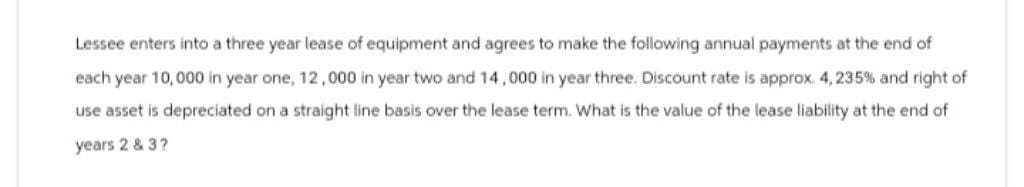

Lessee enters into a three year lease of equipment and agrees to make the following annual payments at the end of each year 10,000 in year one, 12,000 in year two and 14,000 in year three. Discount rate is approx. 4, 235% and right of use asset is depreciated on a straight line basis over the lease term. What is the value of the lease liability at the end of years 2 & 3?

Q: Paola and Isidora are married; file a joint tax return; report modified AGI of $136,025; and have…

A: To claim the American Opportunity credit, the student must be pursuing a degree or other recognized…

Q: Saxe Banners reported the following figures in its financial statements: Cash Cash Equivalents…

A: Cash ratio is calculated by dividing cash and cash equivalents by current liabilities. Cash and…

Q: Compute the additional Medicare tax for the following taxpayers. If required, round your answers to…

A: It is the federal payroll tax that helps the employees and employers to pay for the medical…

Q: Oroblanco Company has prepared consolidated financial statements for the current year and is now…

A: Segment reporting is the process of breaking down the financial data of a company into different…

Q: 3 Antonio's Car Services provides maintenance services for motorized vehicles. In March 2024, Rick…

A: Revenue Recognition means the recording of revenues of an entity in its books. It is an accrual…

Q: bh.8

A: The objective of this question is to calculate the Net Income of ABC Company based on the given…

Q: Sandhill Company makes three models of tasers. Information on the three products is given below.…

A: Variable cost Depends upon the production of goods or services that is increment of sales increases…

Q: The first production department of Stone Incorporated reports the following for April. Direct…

A: EUP's or equivalent production units are those units which are not fully completed at the end of the…

Q: Revenue 11,600,000ExpensesSalaries & Wages 7,600,000Employer NIS Contribution 1,400,000Rent and…

A: Dear student, kindly check the answer in the explanation box below.Explanation:To address the…

Q: e margin g income $750,000 $300,000 $170,000 s the company's margin of safety in dollars? e Choice

A: $425,000Margin of safety= $425,000Margin of safety= current sales- Break-even salesMargin of safety=…

Q: FDC-37968 Incorporated, manufactures and sells two products: Product Z1 and Product Z8. The company…

A: Activity rate is the rate determined by the entity for the purpose of allocating the costs over…

Q: es Harrison Forklift's pension expense includes a service cost of $10 million. Harrison began the…

A: PBO can be used to explain the present value of all pension benefits obtained by employees on the…

Q: Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the…

A: In order to compute financial advantage (Disadvantage) of accepting special order we should compare…

Q: Korsak Corporation is a service company that measures its output by the number of customers served.…

A: Variances is the amount of difference between the actual values and the values estimated by the…

Q: Give me correct answer with explanation.j

A: The objective of the question is to prepare an income statement for Cullumber Company for the year…

Q: Entry to record the exercise of the warrants, assuming that only 80% of the warrants were exercised.

A: Warrants issued at premium.Amount for shares warrants : 750 shares* P10 = 7,500 (at Par)750 shares*…

Q: 1)Which of the following statements is true regarding the taxable income limitation on the qualified…

A: The first question is asking about the taxable income limitation on the qualified business income…

Q: Starware Software was founded last year to develop software for gaming applications. The founder…

A: Total shares after investment of venture capitalist is calculated as shown below:

Q: Question Content Area Department M had 2,800 units 52% completed in process at the beginning of…

A: The objective of the question is to calculate the number of equivalent units of production for…

Q: The Rink offers annual $350 memberships that entitle members to unlimited use of ice-skating…

A: The transaction price represents the sum paid by the customer as consideration for the goods or…

Q: a. 5 Beck Construction Company began work on a new building project on January 1, 2023. The project…

A: The principle of conservatism guides the recognition of revenue in accounting. Anticipated gains are…

Q: 251 A company reported the following for the current year: Retained earnings appropriated for plant…

A: The other comprehensive income forms a part of the income statement of the company. It is the total…

Q: Franco owns a 60% interest in the Dulera LLC. On December 31 of the current tax year, his basis in…

A: Fair value is the actual value of asset or liability on a given date in the market which is listed…

Q: GigaBite Company's computer system recently crashed, erasing much of the company's financial data.…

A: Direct material available for use:To determine the direct material available for use, direct…

Q: Demarco and Janine Jackson have been married for 20 years and have four children (no children under…

A: Answer:- The amount that an individual or business is required to pay the government is generally…

Q: Morganton Company makes one product and it provided the following formation to help prepare master…

A: The current liabilities refer to the amount owed to outsiders and which is held for less than one…

Q: Castle Company provides estimates for its uncollectible accounts. The allowance for uncollectible…

A:

Q: In 2023, Ivanna, who has three children under age 13, worked full-time while her spouse, Sergio, was…

A: The Child and Dependent Care Credit is a tax credit provided by the U.S. government to help offset…

Q: Ingabire Company manufactures recyclable soft-drink cans. A unit of production is a case of 12 dozen…

A: See answer in the explanation.Explanation:To post the journal entries to the appropriate T-accounts,…

Q: FDC-11063 Incorporated, manufactures and sells two products: Product Z1 and Product Z8. The company…

A: Activity rate is the rate determined by the entity for the purpose of allocating the costs over…

Q: Radford Products adds materials at the beginning of the process in Department A. The following…

A: The equivalent units are calculated on the basis of the percentage of the work completed during the…

Q: Pharoah Corporation provides the following information about its defined benefit pension plan for…

A: Continuity schedule is prepared to calculate the defined benefit obligation for the end of the year.…

Q: BloWare's year-end unadjusted trial balance shows accounts receivable of $33,000 and sales of…

A: The bad debts refer to non-performing assets. When the sales are made on account and the amount due…

Q: 9 Beavis Construction Company was the low bidder on a construction project to build an earthen dam…

A: The revenue which has to be recognized as per the percentage of completion method is a method…

Q: swer is partially June transactions: (1) purchase of raw materials, factory labor costs incurred,…

A: The objective of the question is to record the transactions for the month of June in the books of…

Q: The following is the ending balances of accounts at December 31, 2018 for the Valley Pump…

A: Balance sheetBalance Sheet is one of the important financial statement of a company. Balance sheet…

Q: 7 parts to question thanks in advance :) Brett Knight Company operates four bowling alleys. business…

A: Bank Reconciliation Statement:A bank reconciliation statement is a crucial financial document that…

Q: Give me correct answer with explanation.m Don't upload any image

A: The objective of the question is to journalize the issuance of common and preferred shares by…

Q: Cost Flow Methods The following three identical units of Item Alpha are purchased during April: Item…

A: FIFO method is one of the methods of inventory valuation in which it is assumed that old purchases…

Q: Culver Company has an inexperienced accountant. During the first 2 weeks on the job, the accountant…

A: Journal Entry is the primary step in recording the transactions in the books of accounts.The…

Q: Exercise 13-9A (Static) Using the contribution margin approach for a special order decision LO 13-2…

A: Contribution means the difference between the selling price and variable cost. Break even point…

Q: On June 30, 2024, Concord Ltd's general ledger contained the following liability accounts: Accounts…

A: The objective of the question is to understand the impact of the transactions that occurred during…

Q: Assume that Sarasota is a public company using IFRS. Determine the total value of ending inventory…

A: Inventory is used to make final product in a business. The inventory is valued at lower of cost or…

Q: Examine the Statement of Cash flows and the accompanying notes to the financial statements found in…

A: Solution:-The inquiry involves evaluating a company's cash movements by reviewing its Statement of…

Q: [The following information applies to the questions displayed below.] Jenkins has a one-third…

A: Overall, a long-term capital loss is less tax-saving than an ordinary loss. While a capital loss is…

Q: a company had a beginning inventory of 180 units that cost $117,000 in May 1, in May 5 they sold 120…

A: The objective of the question is to calculate the company's Cost of Goods Sold (COGS), Gross Margin,…

Q: Pronghorn Island Corporation began operations on April 1 by issuing 52,200 shares of $5 par value…

A: Journal entries: A journal entry is recorded for every business transaction. This is the first step…

Q: Solomon Manufacturing Company began operations on January 1. During the year, it started and…

A: Product cost indicates the total cost incurred during the period of production of goods. It includes…

Q: Required Information [The following information applies to the questions displayed below.] The…

A: Cost of goods Manufactured:Cost of goods Manufactured is the cost includes the direct material,…

Q: MSI's information related to the ToddleTown Tours collection follows: Sales revenue Variable costs…

A: A company sells multiple products and thus, there might be some products that might bring losses to…

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- Use the information in RE20-3. Prepare the journal entries that Richie Company (the lessor) would make in the first year of the lease assuming the lease is classified as a sales-type lease. Assume that the lessee is required to make payments on December 31 each year. Also assume that Richie had purchased the equipment at a cost of 200,000.Owens Company leased equipment for 4 years at 50,000 a year with an option to renew the lease for 6 years at 2,000 per month or to purchase the equipment for 25,000 (a price considerably less than the expected fair value) after the initial lease term of 4 years. Why would this lease qualify as a finance lease?Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.

- Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.Comprehensive Landlord Company and Tenant Company enter into a noncancelable, direct financing lease on January 1, 2019, for nonspecialized equipment that cost the Landlord 280,000 (useful life is 6 years with no residual value). The fair value of the equipment is 300,000. The interest rate implicit in the lease is 14%. The 6-year lease requires 6 equal annual amounts payable each January 1, beginning with January 1, 2019. Tenant pays all executory costs directly to a third party on December 1 of each year. The equipment reverts to the lessor at the termination of the lease. Assume that there are no initial direct costs. Landlord expects to collect all rental payments. Required: 1. Next Level (a) Show how landlord should compute the annual rental amounts, (b) Discuss how the Tenant Company should compute the present value of the lease payments. What additional information would be required to make this computation? 2. Next Level Prepare a table summarizing the lease and interest receipts that would be suitable for Landlord. Under what conditions would this table be suitable for Tenant? 3. Assuming that the table prepared in Requirement 2 is suitable for both the lessee and the lessor, prepare the journal entries for both firms for the years 2019 and 2020. Use the straight-line depreciation method for the leased equipment. The executory costs paid by the lessee are in 2019: insurance, 700 and property taxes, 800; in 2020: insurance, 600 and property taxes, 750. 4. Next Level Show the items and amounts that would be reported on the comparative 2019 and 2020 income statements and ending balance sheets for both the lessor and the lessee, using the change in present value approach.Use the information in RE20-3. Prepare the journal entries that Garvey Company would make in the first year of the lease assuming the lease is classified as a finance lease. However, assume that Garvey is now required to make the 65,949.37 payments on January 1 each year and that the fair value at the lease inception is now 275,000 (65,949:37 4:169865).

- Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement dated January 1, 2019, that provides for it to lease non-specialized heavy equipment from Scott Rental Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of 20,000 to be paid in advance at the beginning of each year. 2. The cost, and also fair value, of the heavy equipment to Scott at the inception of the lease is 68,036.62. The equipment has an estimated life of 4 years and has a zero estimated residual value at the end of this time. 3. Adden agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. Scotts interest rate implicit in the lease is 12%. Adden is aware of this rate, which is equal to its borrowing rate. 6. Adden uses the straight-line method to record depreciation on similar equipment. 7. Executory costs paid at the end of the year by Adden are: Required: 1. Next Level Determine what type of lease this is for Adden. 2. Prepare a table summarizing the lease payments and interest expense for Adden. 3. Prepare journal entries for Adden for the years 2019 and 2020.In the third year of a 6-year finance lease, the portion of the lease payment applicable to the reduction of the lease liability should be: a. less than in the second year b. more than in the second year c. the same as in the fourth year d. more than in the fourth year

- Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.Lessee and Lessor Accounting Issues Diego Leasing Company agrees to provide La Jolla Company with equipment under a noncancelable lease for 5 years. The equipment has a 5-year life, cost Diego 25,000, and will have no residual value when the lease term ends. The fair value of the equipment is 30,000. La Jolla agrees to pay all executory costs (500 per year) throughout the lease period directly to a third party. On January 1, 2019, the equipment is delivered. Diego expects a 14% return on its net investment. The five equal annual rents are payable in advance starting January 1, 2019. Required: 1. Assuming this is a sales-type lease for the Diego and a finance lease for the La Jolla, prepare a table summarizing the lease and interest payments suitable for use by either party. 2. Next Level On the assumption that both companies adjust and close books each December 31, prepare journal entries relating to the lease for both companies through December 31, 2020, based on data derived in the table. Assume that La Jolla depreciates similar equipment by the straight line method