Lester, Torres, and Hearst are members of Arcadia Sales, LLC, sharing income and losses in the ratio of 2:2:1, respectively. The members decide to liquidate the limited liability company. The members’ equity prior to liquidation and asset realization on August 1 are as follows: Lester $48,550 Torres 57,430 Hearst 29,680 Total $135,660 In winding up operations during the month of August, noncash assets with a book value of $154,940 are sold for $166,430, and liabilities of $47,780 are satisfied. Prior to realization, Arcadia Sales has a cash balance of $28,500. Required: a. Prepare a statement of LLC liquidation. For those boxes in which you must enter negative numbers (balance deficiencies, payments, cash distributions, divisions of loss), use a minus sign. If there is no amount to be reported for sale of assets, payment of liabilities, receipt of deficiency, or cash distribution rows, the cell can be left blank. However, in the balance rows, a balance of zero MUST be indicated by entering "0". b. Provide the journal entry for the final cash distribution to members on August 31. c. What is the role of the income- and loss-sharing ratio in liquidating an LLC? Part a - attached Part b - attached Part c - 1c) What is the role of the income- and loss-sharing ratio in liquidating an LLC? Select the best answer to complete the two sentences below. The income- and loss-sharing ratio is... - never used in a Limited Liability Company liquidation. - only used to distribute the gain or loss on the realization of asset sales. - often used for the final distribution. 2c) After all gains and losses on realization have been divided and any member deficiencies have been paid or allocated, the final distribution is based upon - the partners’ wishes. - the credit balances in the member equity accounts. - the income- and loss-sharing ratio.

Lester, Torres, and Hearst are members of Arcadia Sales, LLC, sharing income and losses in the ratio of 2:2:1, respectively. The members decide to liquidate the limited liability company. The members’ equity prior to liquidation and asset realization on August 1 are as follows: Lester $48,550 Torres 57,430 Hearst 29,680 Total $135,660 In winding up operations during the month of August, noncash assets with a book value of $154,940 are sold for $166,430, and liabilities of $47,780 are satisfied. Prior to realization, Arcadia Sales has a cash balance of $28,500. Required: a. Prepare a statement of LLC liquidation. For those boxes in which you must enter negative numbers (balance deficiencies, payments, cash distributions, divisions of loss), use a minus sign. If there is no amount to be reported for sale of assets, payment of liabilities, receipt of deficiency, or cash distribution rows, the cell can be left blank. However, in the balance rows, a balance of zero MUST be indicated by entering "0". b. Provide the journal entry for the final cash distribution to members on August 31. c. What is the role of the income- and loss-sharing ratio in liquidating an LLC? Part a - attached Part b - attached Part c - 1c) What is the role of the income- and loss-sharing ratio in liquidating an LLC? Select the best answer to complete the two sentences below. The income- and loss-sharing ratio is... - never used in a Limited Liability Company liquidation. - only used to distribute the gain or loss on the realization of asset sales. - often used for the final distribution. 2c) After all gains and losses on realization have been divided and any member deficiencies have been paid or allocated, the final distribution is based upon - the partners’ wishes. - the credit balances in the member equity accounts. - the income- and loss-sharing ratio.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter2: The Basics Of Record Keeping And Financial Statement Preparation: Balance Sheet

Section: Chapter Questions

Problem 9E

Related questions

Question

Lester, Torres, and Hearst are members of Arcadia Sales, LLC, sharing income and losses in the ratio of 2:2:1, respectively. The members decide to liquidate the limited liability company. The members’ equity prior to liquidation and asset realization on August 1 are as follows:

| Lester | $48,550 |

| Torres | 57,430 |

| Hearst | 29,680 |

| Total | $135,660 |

In winding up operations during the month of August, noncash assets with a book value of $154,940 are sold for $166,430, and liabilities of $47,780 are satisfied. Prior to realization, Arcadia Sales has a cash balance of $28,500.

Required:

| a. | Prepare a statement of LLC liquidation. For those boxes in which you must enter negative numbers (balance deficiencies, payments, cash distributions, divisions of loss), use a minus sign. If there is no amount to be reported for sale of assets, payment of liabilities, receipt of deficiency, or cash distribution rows, the cell can be left blank. However, in the balance rows, a balance of zero MUST be indicated by entering "0". |

| b. | Provide the |

| c. | What is the role of the income- and loss-sharing ratio in liquidating an LLC? |

Part a - attached

Part b - attached

Part c -

1c) What is the role of the income- and loss-sharing ratio in liquidating an LLC? Select the best answer to complete the two sentences below.

The income- and loss-sharing ratio is...

- never used in a Limited Liability Company liquidation.

- only used to distribute the gain or loss on the realization of asset sales.

- often used for the final distribution.

2c) After all gains and losses on realization have been divided and any member deficiencies have been paid or allocated, the final distribution is based upon

- the partners’ wishes.

- the credit balances in the member equity accounts.

- the income- and loss-sharing ratio.

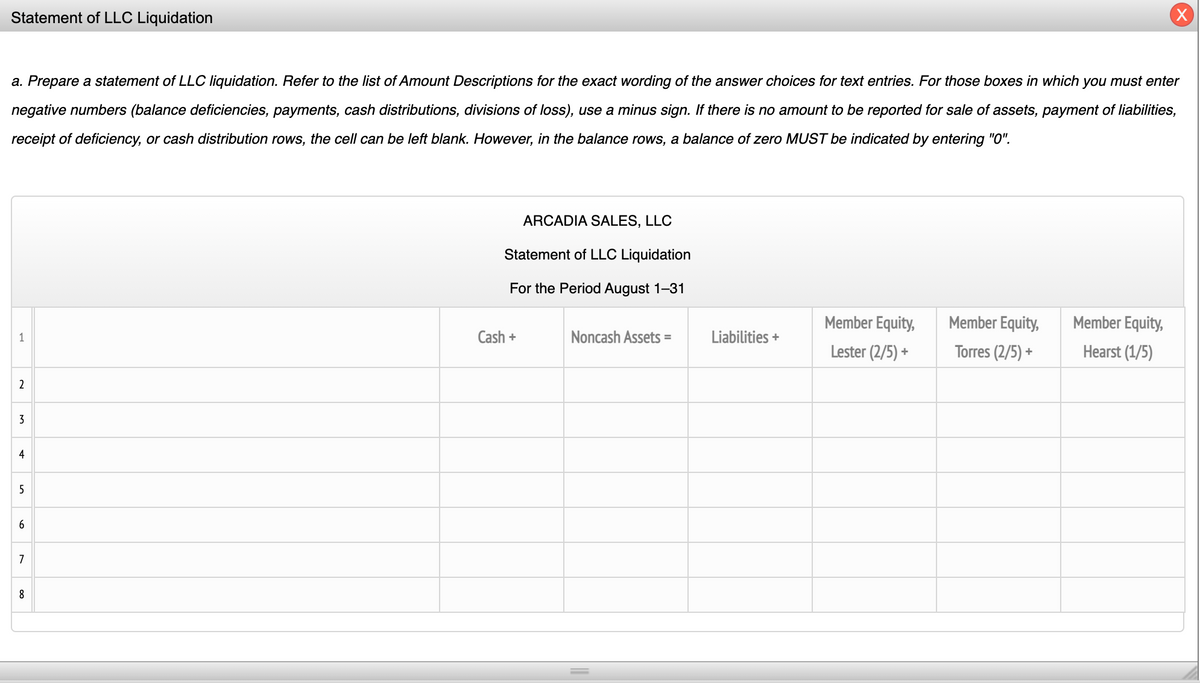

Transcribed Image Text:Statement of LLC Liquidation

a. Prepare a statement of LLC liquidation. Refer to the list of Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter

negative numbers (balance deficiencies, payments, cash distributions, divisions of loss), use a minus sign. If there is no amount to be reported for sale of assets, payment of liabilities,

receipt of deficiency, or cash distribution rows, the cell can be left blank. However, in the balance rows, a balance of zero MUST be indicated by entering "O".

ARCADIA SALES, LLC

Statement of LLC Liquidation

For the Period August 1-31

Member Equity,

Member Equity,

Member Equity,

1

Cash +

Noncash Assets =

Liabilities +

Lester (2/5) +

Torres (2/5) +

Hearst (1/5)

2

3

4

5

8

6.

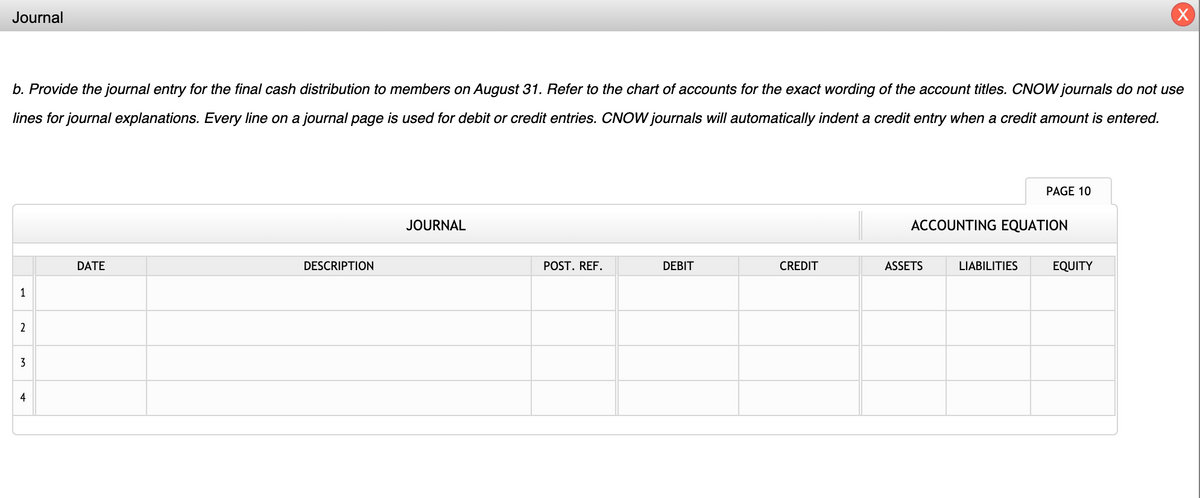

Transcribed Image Text:Journal

(X)

b. Provide the journal entry for the final cash distribution to members on August 31. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use

lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.

PAGE 10

JOURNAL

ACCOUNTING EQUATION

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

1

2

3

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you