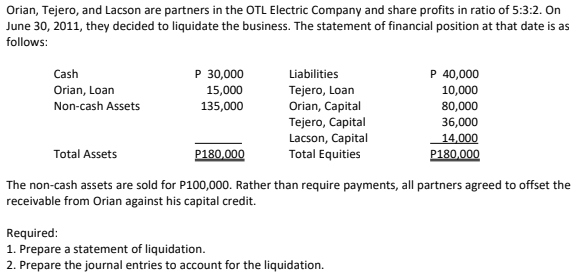

Orian, Tejero, and Lacson are partners in the OTL Electric Company and share profits in ratio of 5:3:2. On June 30, 2011, they decided to liquidate the business. The statement of financial position at that date is as follows:

Orian, Tejero, and Lacson are partners in the OTL Electric Company and share profits in ratio of 5:3:2. On June 30, 2011, they decided to liquidate the business. The statement of financial position at that date is as follows:

Chapter22: S Corporations

Section: Chapter Questions

Problem 19CE

Related questions

Question

Transcribed Image Text:Orian, Tejero, and Lacson are partners in the OTL Electric Company and share profits in ratio of 5:3:2. On

June 30, 2011, they decided to liquidate the business. The statement of financial position at that date is as

follows:

Cash

P 30,000

Liabilities

P 40,000

Tejero, Loan

Orian, Capital

Orian, Loan

15,000

10,000

Non-cash Assets

135,000

80,000

Tejero, Capital

Lacson, Capital

Total Equities

36,000

14,000

Total Assets

P180,000

P180,000

The non-cash assets are sold for P100,000. Rather than require payments, all partners agreed to offset the

receivable from Orian against his capital credit.

Required:

1. Prepare a statement of liquidation.

2. Prepare the journal entries to account for the liquidation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you