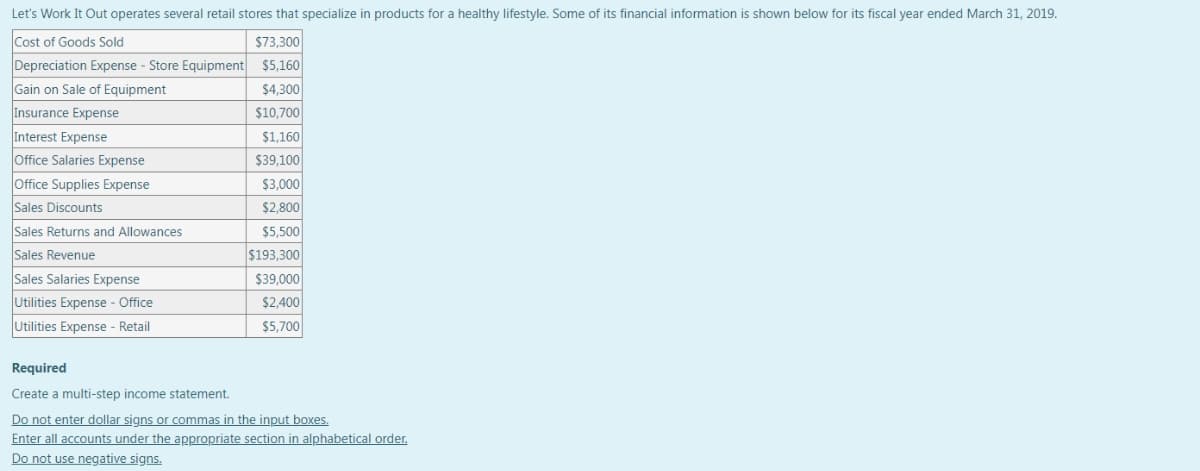

Let's Work It Out operates several retail stores that specialize in products for a healthy lifestyle. Some of its financial information is shown below for its fiscal year ended March 31, 2019. Cost of Goods Sold $73,300 Depreciation Expense - Store Equipment $5,160 Gain on Sale of Equipment Insurance Expense Interest Expense $4,300 $10,700 $1,160 Office Salaries Expense $39,100 Office Supplies Expense $3,000 Sales Discounts $2,800 Sales Returns and Allowances $5,500 Sales Revenue $193,300 Sales Salaries Expense $39,000 Utilities Expense - Office $2,400 $5,700 Utilities Expense - Retail Required Create a multi-step income statement. Do not enter dollar signs or commas in the input boxes. Enter all accounts under the appropriate section in alphabetical order. Do not use negative signs.

Let's Work It Out operates several retail stores that specialize in products for a healthy lifestyle. Some of its financial information is shown below for its fiscal year ended March 31, 2019. Cost of Goods Sold $73,300 Depreciation Expense - Store Equipment $5,160 Gain on Sale of Equipment Insurance Expense Interest Expense $4,300 $10,700 $1,160 Office Salaries Expense $39,100 Office Supplies Expense $3,000 Sales Discounts $2,800 Sales Returns and Allowances $5,500 Sales Revenue $193,300 Sales Salaries Expense $39,000 Utilities Expense - Office $2,400 $5,700 Utilities Expense - Retail Required Create a multi-step income statement. Do not enter dollar signs or commas in the input boxes. Enter all accounts under the appropriate section in alphabetical order. Do not use negative signs.

Chapter2: Building Blocks Of Managerial Accounting

Section: Chapter Questions

Problem 3PB: Puzzles, Pranks ** Games is a retail business selling children’s toys and games as well as a wide...

Related questions

Question

Transcribed Image Text:Let's Work It Out operates several retail stores that specialize in products for a healthy lifestyle. Some of its financial information is shown below for its fiscal year ended March 31, 2019.

Cost of Goods Sold

$73,300

Depreciation Expense - Store Equipment

$5,160

Gain on Sale of Equipment

$4,300

Insurance Expense

$10,700

Interest Expense

$1,160

Office Salaries Expense

Office Supplies Expense

$39,100

$3,000

Sales Discounts

$2,800

Sales Returns and Allowances

$5,500

Sales Revenue

$193.300

Sales Salaries Expense

$39.000

Utilities Expense - Office

$2,400

Utilities Expense - Retail

$5,700

Required

Create a multi-step income statement.

Do not enter dollar signs or commas in the input boxes.

Enter all accounts under the appropriate section in alphabetical order.

Do not use negative signs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,