Lewis Corporation is considering switching from FIFO to LIFO to reduce its income tax expense. Assuming a corporate income tax rate of 40%, calculate the tax savings this would have made for 2009 to 2011. Would you recommend that Lewis make this change?

Lewis Corporation is considering switching from FIFO to LIFO to reduce its income tax expense. Assuming a corporate income tax rate of 40%, calculate the tax savings this would have made for 2009 to 2011. Would you recommend that Lewis make this change?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 11P: Olson Company adopted the dollar-value LIFO method for inventory valuation at the beginning of 2015....

Related questions

Question

Lewis Corporation is considering switching from FIFO to LIFO to reduce its income tax expense. Assuming a corporate income tax rate of 40%, calculate the tax savings this would have made for 2009 to 2011. Would you recommend that Lewis make this change?

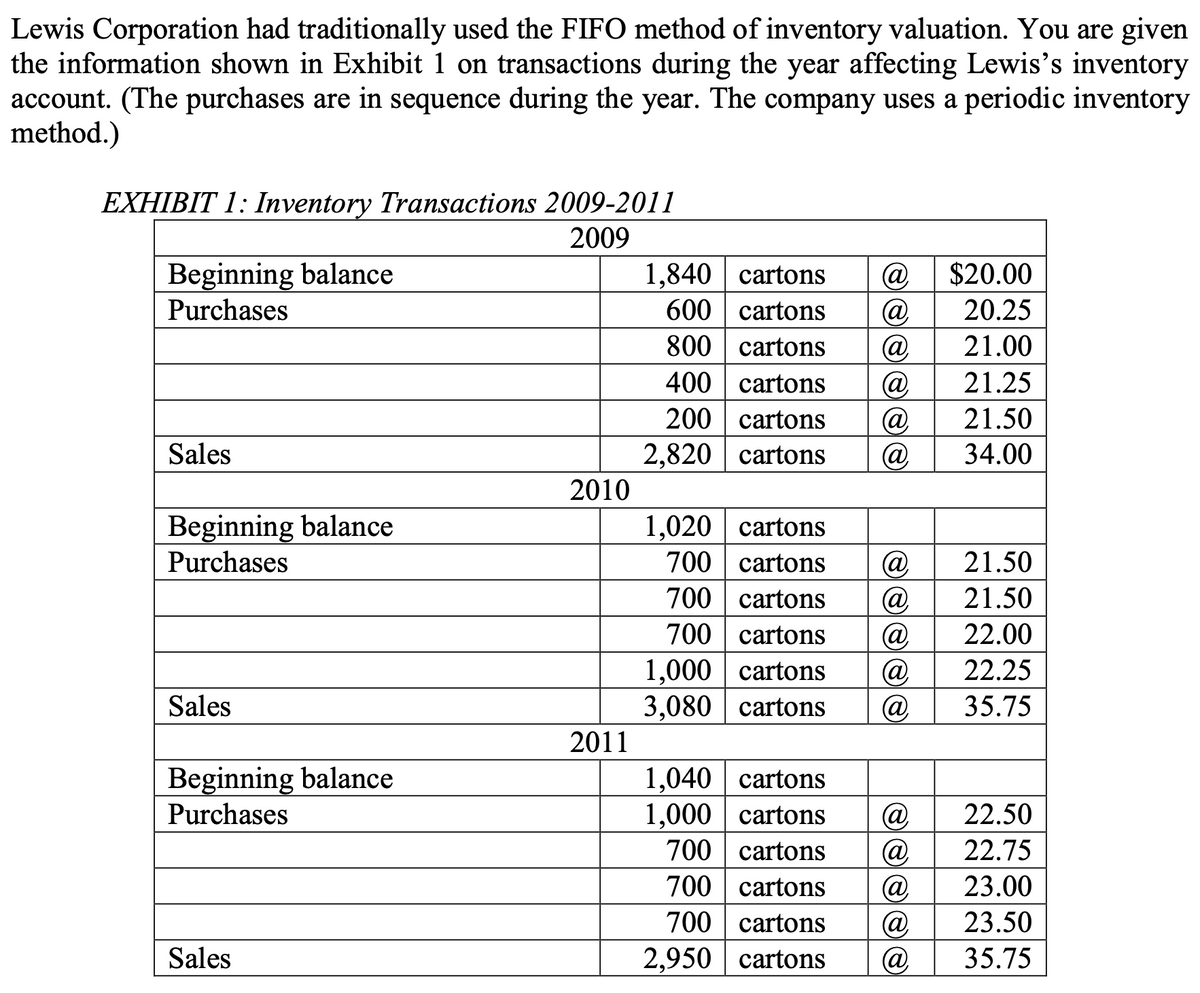

Transcribed Image Text:Lewis Corporation had traditionally used the FIFO method of inventory valuation. You are given

the information shown in Exhibit 1 on transactions during the year affecting Lewis's inventory

account. (The purchases are in sequence during the year. The company uses a periodic inventory

method.)

EXHIBIT 1: Inventory Transactions 2009-2011

2009

Beginning balance

1,840

cartons @

$20.00

Purchases

600 cartons @

20.25

cartons

@

21.00

800

400 cartons @

21.25

cartons @

21.50

200

2,820 cartons @

Sales

34.00

Beginning balance

1,020

cartons

Purchases

700 cartons @ 21.50

700 cartons @ 21.50

cartons @ 22.00

700

1,000 cartons @

22.25

Sales

3,080 cartons @

35.75

1,040 cartons

Beginning balance

Purchases

1,000 cartons @

22.50

700 cartons (a)

22.75

700 cartons a

23.00

700 cartons

(a)

23.50

Sales

2,950 cartons

(a)

35.75

2010

2011

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning