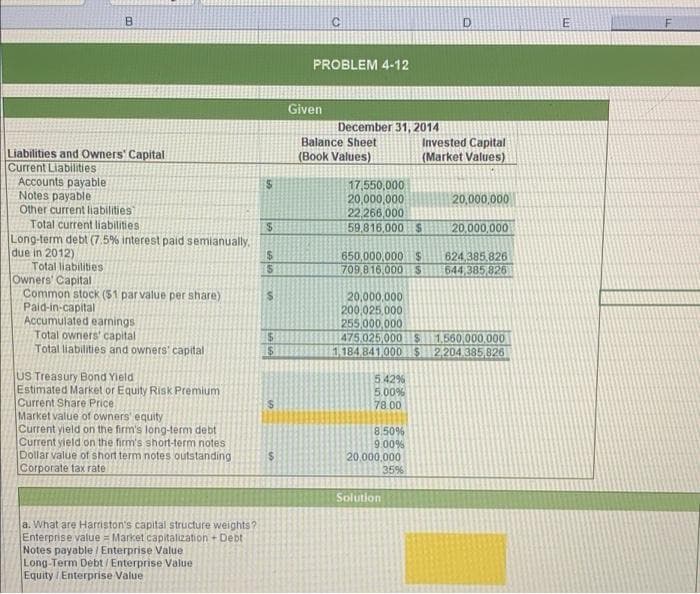

Liabilities and Owners' Capital Current Liabilities Accounts payable Notes payable Other current liabilities Total current liabilities Long-term debt (7.5% interest paid semianually. due in 2012) Total liabilities Owners' Capital Common stock ($1 par value per share) Paid-in-capital Accumulated earnings Total owners' capital Total liabilities and owners' capital US Treasury Bond Yield Estimated Market or Equity Risk Premium Current Share Price Market value of owners' equity Current yield on the firm's long-term debt Current yield on the firm's short-term notes Dollar value of short term notes outstanding Corporate tax rate a. What are Harriston's capital structure weights? Enterprise value = Market capitalization + Debt- Notes payable / Enterprise Value Long-Term Debt/ Enterprise Value Equity / Enterprise Value $ $ $ $ $ PROBLEM 4-12 Given December 31, 2014 Balance Sheet (Book Values) 17,550,000 20,000,000 22,266,000 59.816,000 $ Invested Capital (Market Values) 5.42% 5.00% 78.00 650,000,000 $ 624,385,826 709,816,000 $ 644,385,8261 8.50% 9.00% 20.000.000 35% 20,000,000 20,000,000 200,025,000 255,000,000 475.025,000 $ 1,560,000,000 1,184 841,000 $2,204.385,826 Solution 20,000,000

Liabilities and Owners' Capital Current Liabilities Accounts payable Notes payable Other current liabilities Total current liabilities Long-term debt (7.5% interest paid semianually. due in 2012) Total liabilities Owners' Capital Common stock ($1 par value per share) Paid-in-capital Accumulated earnings Total owners' capital Total liabilities and owners' capital US Treasury Bond Yield Estimated Market or Equity Risk Premium Current Share Price Market value of owners' equity Current yield on the firm's long-term debt Current yield on the firm's short-term notes Dollar value of short term notes outstanding Corporate tax rate a. What are Harriston's capital structure weights? Enterprise value = Market capitalization + Debt- Notes payable / Enterprise Value Long-Term Debt/ Enterprise Value Equity / Enterprise Value $ $ $ $ $ PROBLEM 4-12 Given December 31, 2014 Balance Sheet (Book Values) 17,550,000 20,000,000 22,266,000 59.816,000 $ Invested Capital (Market Values) 5.42% 5.00% 78.00 650,000,000 $ 624,385,826 709,816,000 $ 644,385,8261 8.50% 9.00% 20.000.000 35% 20,000,000 20,000,000 200,025,000 255,000,000 475.025,000 $ 1,560,000,000 1,184 841,000 $2,204.385,826 Solution 20,000,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 51CE: Debt Management and Short-Term Liquidity Ratios The following items appear on the balance sheet of...

Related questions

Question

Transcribed Image Text:B

Liabilities and Owners' Capital

Current Liabilities

Accounts payable

Notes payable

Other current liabilities)

Total current liabilities

Long-term debt (7.5% interest paid semianually.

due in 2012)

Total liabilities

Owners' Capital

Common stock ($1 par value per share)

Paid-in-capital

Accumulated earnings

Total owners' capital

Total liabilities and owners' capital

US Treasury Bond Yield

Estimated Market or Equity Risk Premium

Current Share Price

Market value of owners' equity

Current yield on the firm's long-term debt

Current yield on the firm's short-term notes

Dollar value of short term notes outstanding

Corporate tax rate

a. What are Harriston's capital structure weights?

Enterprise value = Market capitalization + Debt

Notes payable / Enterprise Value

Long-Term Debt/ Enterprise Value

Equity / Enterprise Value

$

$

$

55

$

$

$

C

PROBLEM 4-12

Given

December 31, 2014

Balance Sheet

(Book Values)

17,550,000

20,000,000

22,266,000

59,816,000 S

5.42%

5.00%

78.00

D

Invested Capital

(Market Values)

8.50%

9.00%

20,000,000

35%

650,000,000 $

624,385,826

709,816,000 $ 644,385,826

Solution

20,000,000

20,000,000

200,025,000

255,000,000

475.025,000 $ 1.560,000,000

1,184.841,000 $2,204.385,826

20,000,000

E

F

Transcribed Image Text:5

A

41

083286658 6

421

43

44

45

45

47

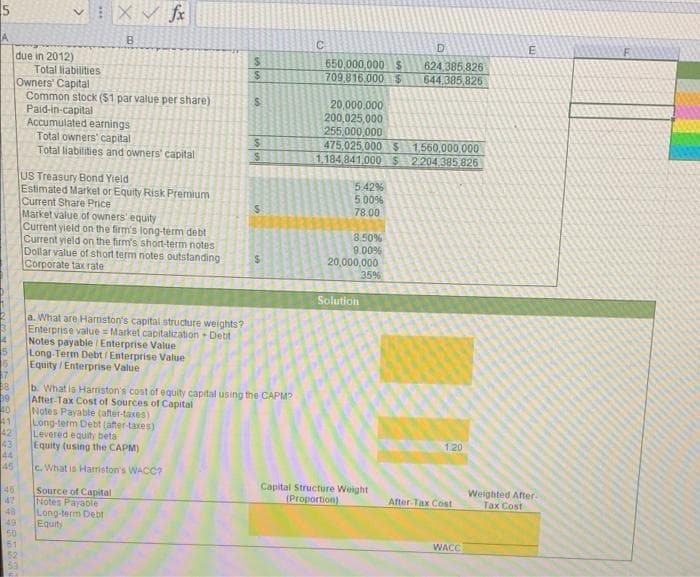

due in 2012)

49

Total liabilities

61

Owners' Capital

Common stock ($1 par value per share)

Paid-in-capital

Accumulated earnings

X XV fx

B

Total owners' capital

Total liabilities and owners' capital

US Treasury Bond Yield

Estimated Market or Equity Risk Premium

Current Share Price

Market value of owners' equity

Current yield on the firm's long-term debt

Current yield on the firm's short-term notes

Dollar value of short term notes outstanding

Corporate tax rate

a. What are Harriston's capital structure weights?

Enterprise value = Market capitalization - Debt

Notes payable / Enterprise Value

Long-Term Debt/ Enterprise Value

Equity/Enterprise Value

Source of Capital

Notes Payable

Long-term Debt

Equity

Notes Payable (after-taxes)

Long-term Debt (after-taxes)

Levered equity beta

Equity (using the CAPM)

c. What is Harriston's WACC?

SS

$

$

ری

SS

$

b. What is Harriston's cost of equity capital using the CAPM?

After-Tax Cost of Sources of Capital

$

C

650,000,000 $

709.816.000 $

20.000.000

200,025,000

255,000,000

475,025,000 $1,560,000,000

1,184,841,000 $2,204.385 826

5.42%

5.00%

78.00

8.50%

9.00%

20,000,000

35%

Solution

D

624,385,826

644,385,825

Capital Structure Weight

(Proportion)

1.20

After-Tax Cost

WACC

E

Weighted After-

Tax Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning