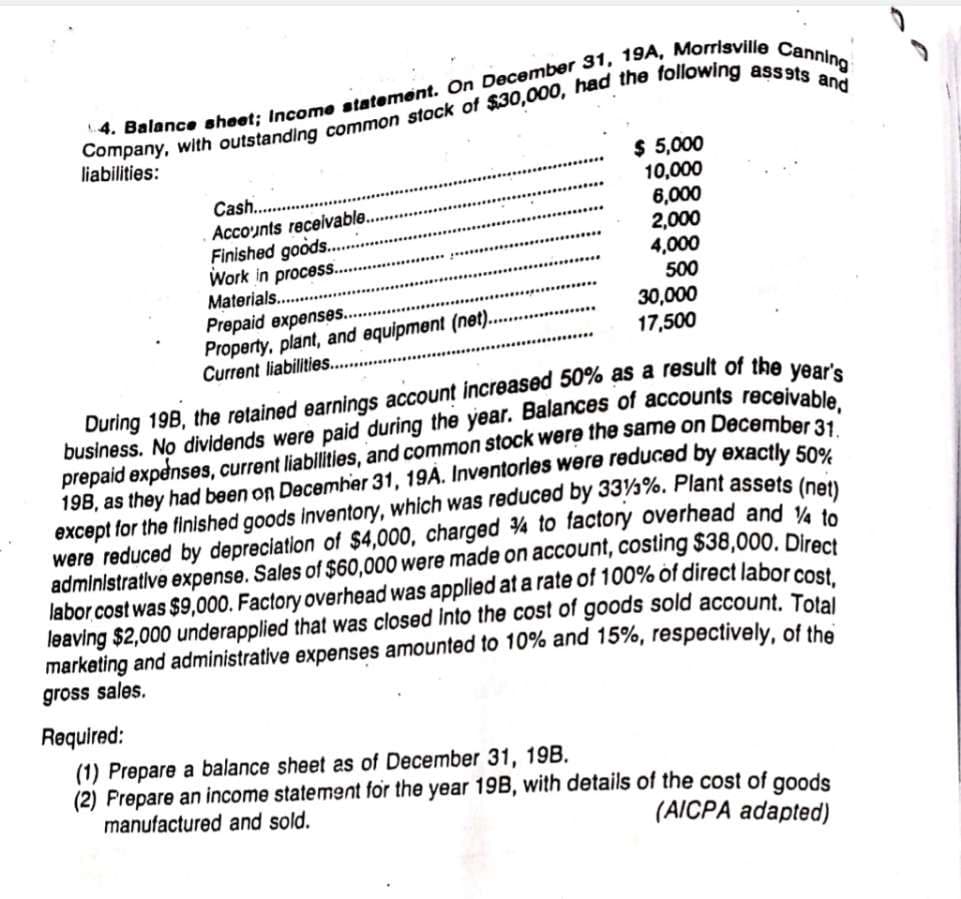

liabilities: Cash. Accounts receivable.. Finished goods.. Work in process.. Materials. $ 5,000 10,000 6,000 2,000 4,000 500 ..........*.** ........ ...... ........ .......... .... Prepaid expenses. .. Property, plant, and equipment (net).. Current liabilities.. 30,000 17,500 .... prepaid expenses, current liabilities, and common stock were the same on December 3 198, as they had been on Decemher 31, 19A. Inventorles were reduced by exactly 50 except for the finished goods inventory, which was reduced by 33V%. Plant assets (non were reduced by depreciation of $4,000, charged 4 to factory overhead and v administrative expense. Sales of $60,000 were made on account, costing $38,000. Direct labor cost was $9,000. Factory overhead was applied at a rate of 100% of direct labor cost leaving $2,000 underapplied that was closed into the cost of goods sold account. Tolel marketing and administrative expenses amounted to 10% and 15%, respectively, of the gross sales. Required: (1) Prepare a balance sheet as of December 31, 19B. (2) Prepare an income statement for the year 19B, with details of the cost of goods manufactured and sold. (AICPA adapted)

liabilities: Cash. Accounts receivable.. Finished goods.. Work in process.. Materials. $ 5,000 10,000 6,000 2,000 4,000 500 ..........*.** ........ ...... ........ .......... .... Prepaid expenses. .. Property, plant, and equipment (net).. Current liabilities.. 30,000 17,500 .... prepaid expenses, current liabilities, and common stock were the same on December 3 198, as they had been on Decemher 31, 19A. Inventorles were reduced by exactly 50 except for the finished goods inventory, which was reduced by 33V%. Plant assets (non were reduced by depreciation of $4,000, charged 4 to factory overhead and v administrative expense. Sales of $60,000 were made on account, costing $38,000. Direct labor cost was $9,000. Factory overhead was applied at a rate of 100% of direct labor cost leaving $2,000 underapplied that was closed into the cost of goods sold account. Tolel marketing and administrative expenses amounted to 10% and 15%, respectively, of the gross sales. Required: (1) Prepare a balance sheet as of December 31, 19B. (2) Prepare an income statement for the year 19B, with details of the cost of goods manufactured and sold. (AICPA adapted)

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.10P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Transcribed Image Text:liabilities:

$ 5,000

10,000

6,000

2,000

4,000

500

Cash..

Acco'unts receivable.

Finished goods...

Work in process..

Materials.

Prepaid expenses..

Property, plant, and equipment (net)...

Current liabilities...

...

30,000

17,500

prepaid expenses, current liablities, and common stock were the same on December 3

198, as they had been on Decemher 31, 19A. Inventorles were reduced by exactly 50

except for the finished goods inventory, which was reduced by 335%. Plant assets (nel

were reduced by depreciation of $4,000, charged 4 to factory overhead and v.

administrative expense. Sales of $60,000 were made on account, costing $38,000. Direct

labor cost was $9,000. Factory overhead was applied at a rate of 100% óf direct labor cost

leaving $2,000 underapplied that was closed into the cost of goods sold account. Total

marketing and administrative expenses amounted to 10% and 15%, respectively, of the

gross sales.

Required:

(1) Prepare a balance sheet as of December 31, 19B.

(2) Prepare an income statement for the year 19B, with details of the cost of goods

manufactured and sold.

(AICPA adapted)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning