liability for employees' compensation for future

Chapter9: Payroll, Estimated Payments, And Retirement Plans

Section: Chapter Questions

Problem 5MCQ

Related questions

Question

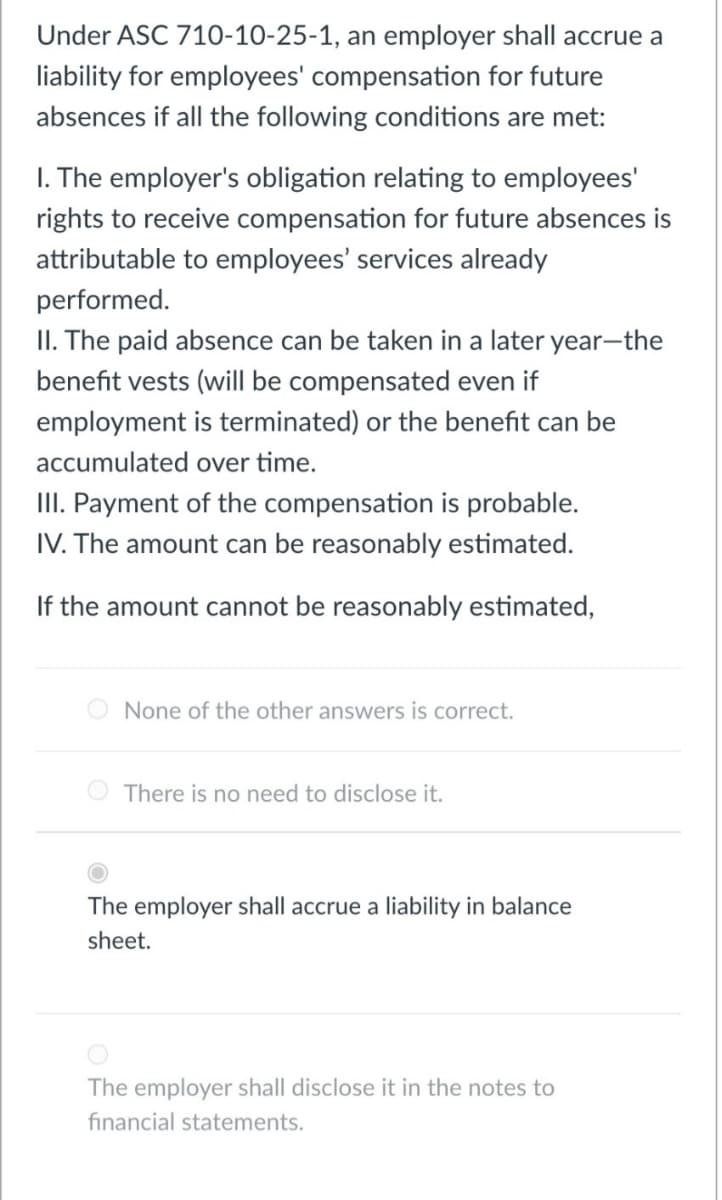

Transcribed Image Text:Under ASC 710-10-25-1, an employer shall accrue a

liability for employees' compensation for future

absences if all the following conditions are met:

I. The employer's obligation relating to employees'

rights to receive compensation for future absences is

attributable to employees' services already

performed.

II. The paid absence can be taken in a later year-the

benefit vests (will be compensated even if

employment is terminated) or the benefit can be

accumulated over time.

III. Payment of the compensation is probable.

IV. The amount can be reasonably estimated.

If the amount cannot be reasonably estimated,

None of the other answers is correct.

O There is no need to disclose it.

The employer shall accrue a liability in balance

sheet.

The employer shall disclose it in the notes to

financial statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT