Determine the employee benefit expense for the current year, remeasurement related to the defined benefit plan and prepare journal entry to record the employee benefit expense.

Q: Instructions (a) Determine the pension expense to be reported on the income statement for 2021. (b)…

A:

Q: A company currently offers it’s employees a defined benefit pension plan, but is looking into…

A: Defined Benefit pension plan A defined-benefit plan is an employer-sponsored retirement plan where…

Q: increases the Employee Benefit Expense?

A: Employee benefit expense means Benefits/Compensation provided to the employee other than by way of…

Q: Which of the following factors is least likely to affect the amount of retirement benefits under a…

A: Defined benefit pension plans are the retirement designs that include providing a fixed and…

Q: If employee's are paying into a SIMPLE retirement plan, each payperiod how is the SIMPLE plan's…

A: Simple Retirement Plan- A Savings Incentive Match Plan for Employees of Small Employers (simple) is…

Q: Determine the employee's total income tax deduction for this pay period. Your answer:

A: Income tax is defined as the portion of the income paid to the government or the taxation authority…

Q: What is included in the journal entry to record the employer amount of the payroll? Assume gross…

A: Solution- Payroll journal entries are used to record the compensation paid to employees. These…

Q: a) Calculate the total accumulated long-service leave benefit as at 30 June 2020. b) What amount…

A:

Q: Taxpayers who make after-tax contributions to a qualified employer plan recover their investment…

A: Taxpayer who makes after tax contribution to a qualified employer plan recover their investment…

Q: A. Find the employer's FICA deductions for each of the following employ B. Find the amounts of the…

A: This question is based on the real time interest rate for social security, Medicare and FUTA. Total…

Q: Independently considering each of the following statements regarding Form W-2 (Wage and Tax…

A: The employer makes deductions from the employee’s salary and therefore there is some legal…

Q: Find the employer’s FICA deduction for each of the following employees. Find the amounts of the FUTA…

A: Federal Unemployment Taxes (FUTA) The threshold limit for the Federal Unemployment taxes (FUTA) is $…

Q: Differentiate between “accounting for the employer” and “accounting for the pension fund.”

A: Pension: A fixed sum of money, receivable in future or after the age of retirement, which the…

Q: How much is the defined benefit obligation on December 31, 2019? What is the amount of overfunding…

A: Defined Benefit Plan:-This is the benefit enjoyed by the employees how much benefit they will…

Q: Define Employee Retirement Income Security Act (ERISA)

A: The 1974 Employee Retirement Income Security Act secures American pension resources by enforcing…

Q: A pension plan paid out benefits amounting to $343,200 during the year to retired plan members.…

A: Whenever any benefit is to be paid to member in future out of pension plan,we create 2 things in…

Q: n recording the payroll, the debit to an expense represents: Group of answer choices deductions…

A: The payroll journal entry is the initial recognition of payroll.

Q: If pension expense recognized in a period exceeds the current amount funded by the employer, what…

A: Pension: A fixed sum of money, receivable in future or after the age of retirement, which the…

Q: hange in the benefit plan assets? a.contributions from the employer. b.actual/expected return on…

A: Employees with defined benefit plans receive a fixed, predetermined benefit when they retire. The…

Q: According to PAS 19, contributions to a defined contribution plan are recognized a. at each…

A: An organization pays the employee past employee benefits. There are some post employee benefits. ·…

Q: and discuss the key accounting issues in determining the method of accounting for defined benefit…

A: Pension Accounting Many organizations provide additional benefits to their employees in addition to…

Q: Under IAS 19 on Employee Benefits, which of the following terms best describes other long-term…

A: Explanation : The Long-term employee benefits, which are the employee benefits (other than the post…

Q: Compute the FICA taxes for each employee and the employer's FICA taxes. Round all computations to…

A: Under federal law, employers are required to deduct 6.2% of employees wages as his or her OASDI/EE…

Q: Determine the total employee withholdings

A:

Q: The computation of pension expense includes all the following except Select one: 13 а. interest on…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Which of the following forms is typically given to employees at the end of the calendar year so that…

A: Given: The form provided for the employees to file the form for income tax.

Q: In a defined contribution plan, a formula is used that: O Requires an employer to contribute a…

A: Defined contribution plans are funded by the employees and the amount if collected for their…

Q: Prepare journal entry to recognize the transitional effect of adopting revised PAS 19, determine the…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: While examining the books and records in the general and administrative expense account of X Ltd.,…

A: A pension plan is any plan,fund or scheme which provides retirement income

Q: A defined-contribution plan specifies the benefits the employee will receive at the normal…

A: Defined Contribution Employer Contributes specific periodic amounts of contribution to the plan…

Q: To calculate the debit to payroll tax expense in recording the employer's payroll taxes the…

A: Employer payroll taxes means those tax expenses that are incurred by employer on behalf of employees…

Q: The W-4 form lists all of all of the following EXCEPT one: a.Lists the employee's Social Security…

A: W-4 Form List: On the updated version of Form W-4, workers are not prompted to specify personal…

Q: Indicate by letter whether each of the events listed below increases (I), decreases (D), or has no…

A: Answer: Events 1. N 2. N 3. D 4. I 5. I 6. D 7. I 8. I 9. N 10. I 11. D…

Q: 1. How to find out the acturial gains and losses on the defined benefit obligation and the defined…

A: The US GAAP and IFRS principles have a similar method of measuring pension benefit obligations but…

Q: All of the following income items are includible in an employee's gross income except: a, Severance…

A: Gross income Individuals' entire earnings before taxes or other deductions are referred to as their…

Q: Required: Determine Scholz's pension expense for 2019 and prepare the appropriate journal…

A: Hello! Since there are multiple sub-parts posted, we will answer first three sub-parts. If you want…

Q: CHOOSE THE LETTER OF THE CORRECT ANSWER What is the employee benefit expense for the current year?…

A: Acuturial gan or loss refers to an increase or decrease in the projections used to value a…

Q: b. Assume that the employees of Purnell, Inc., must also pay state contributions (disability…

A: Wages: Wages are the earnings of the employees for their work to the company they serve. These are…

Q: Instruetions: (a) Determine the amounts of the components of pension expense that should be…

A: Pension expense is defined as the equivalent sum recorded by the entity for expenses associated with…

Q: Under PAS 19, employee benefits are alloforms of consideration given by an entity in exchange for…

A: The question is based on the concept of Accounting Standard on Employee Benefits.

Q: An employer's obligation for post-retirement benefits that are expected to be provided to an…

A: Post-retirement healthcare benefits often are provided in terms of percentage oftotal coverage. For…

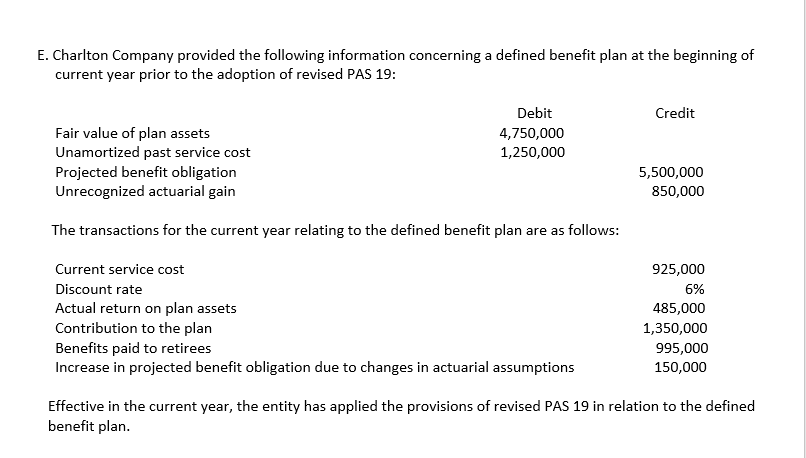

Determine the employee benefit expense for the current year, remeasurement related to the defined benefit plan and prepare

Step by step

Solved in 4 steps with 1 images

- E. Charlton Company provided the following information concerning a defined benefit plan at the beginning ofcurrent year prior to the adoption of revised PAS 19:Debit CreditFair value of plan assets 4,750,000Unamortized past service cost 1,250,000Projected benefit obligation 5,500,000Unrecognized actuarial gain 850,000The transactions for the current year relating to the defined benefit plan are as follows:Current service cost 925,000Discount rate 6%Actual return on plan assets 485,000Contribution to the plan 1,350,000Benefits paid to retirees 995,000Increase in projected benefit obligation due to changes in actuarial assumptions 150,000Effective in the current year, the entity has applied the provisions of revised PAS 19 in relation to the definedbenefit plan.REQUIRED: 17. Compute the remeasurement related to the defined benefit plan.E. Charlton Company provided the following information concerning a defined benefit plan at the beginning ofcurrent year prior to the adoption of revised PAS 19:Debit CreditFair value of plan assets 4,750,000Unamortized past service cost 1,250,000Projected benefit obligation 5,500,000Unrecognized actuarial gain 850,000The transactions for the current year relating to the defined benefit plan are as follows:Current service cost 925,000Discount rate 6%Actual return on plan assets 485,000Contribution to the plan 1,350,000Benefits paid to retirees 995,000Increase in projected benefit obligation due to changes in actuarial assumptions 150,000Effective in the current year, the entity has applied the provisions of revised PAS 19 in relation to the definedbenefit plan.REQUIRED: 19. Compute for the Fair Value Plan Asset (FVPA) as of December 31.E. Charlton Company provided the following information concerning a defined benefit plan at the beginning ofcurrent year prior to the adoption of revised PAS 19:Debit CreditFair value of plan assets 4,750,000Unamortized past service cost 1,250,000Projected benefit obligation 5,500,000Unrecognized actuarial gain 850,000The transactions for the current year relating to the defined benefit plan are as follows:Current service cost 925,000Discount rate 6%Actual return on plan assets 485,000Contribution to the plan 1,350,000Benefits paid to retirees 995,000Increase in projected benefit obligation due to changes in actuarial assumptions 150,000Effective in the current year, the entity has applied the provisions of revised PAS 19 in relation to the definedbenefit plan. Compute the remeasurement related to the defined benefit plan.

- E. Charlton Company provided the following information concerning a defined benefit plan at the beginning ofcurrent year prior to the adoption of revised PAS 19:Debit CreditFair value of plan assets 4,750,000Unamortized past service cost 1,250,000Projected benefit obligation 5,500,000Unrecognized actuarial gain 850,000The transactions for the current year relating to the defined benefit plan are as follows:Current service cost 925,000Discount rate 6%Actual return on plan assets 485,000Contribution to the plan 1,350,000Benefits paid to retirees 995,000Increase in projected benefit obligation due to changes in actuarial assumptions 150,000Effective in the current year, the entity has applied the provisions of revised PAS 19 in relation to the definedbenefit plan.REQUIRED: 16. Determine the employee benefit expense for the current year.Charlton Company provided the following information concerning a defined benefit plan at the beginning ofcurrent year prior to the adoption of revised PAS 19:Debit CreditFair value of plan assets 4,750,000Unamortized past service cost 1,250,000Projected benefit obligation 5,500,000Unrecognized actuarial gain 850,000The transactions for the current year relating to the defined benefit plan are as follows:Current service cost 925,000Discount rate 6%Actual return on plan assets 485,000Contribution to the plan 1,350,000Benefits paid to retirees 995,000Increase in projected benefit obligation due to changes in actuarial assumptions 150,000Effective in the current year, the entity has applied the provisions of revised PAS 19 in relation to the definedbenefit plan. 18. Prepare journal entry to record the employee benefit expense.19. Compute for the Fair Value Plan Asset (FVPA) as of December 31.20. Compute for the projected benefit obligation on December 31.Charlton Company provided the following information concerning a defined benefit plan at the beginning ofcurrent year prior to the adoption of revised PAS 19:Debit CreditFair value of plan assets 4,750,000Unamortized past service cost 1,250,000Projected benefit obligation 5,500,000Unrecognized actuarial gain 850,000The transactions for the current year relating to the defined benefit plan are as follows:Current service cost 925,000Discount rate 6%Actual return on plan assets 485,000Contribution to the plan 1,350,000Benefits paid to retirees 995,000Increase in projected benefit obligation due to changes in actuarial assumptions 150,000Effective in the current year, the entity has applied the provisions of revised PAS 19 in relation to the definedbenefit plan.REQUIRED: Prepare journal entry to recognize the transitional effect of adopting revised PAS 19.

- Charlton Company provided the following information concerning a defined benefit plan at the beginning ofcurrent year prior to the adoption of revised PAS 19:Debit CreditFair value of plan assets 4,750,000Unamortized past service cost 1,250,000Projected benefit obligation 5,500,000Unrecognized actuarial gain 850,000The transactions for the current year relating to the defined benefit plan are as follows:Current service cost 925,000Discount rate 6%Actual return on plan assets 485,000Contribution to the plan 1,350,000Benefits paid to retirees 995,000Increase in projected benefit obligation due to changes in actuarial assumptions 150,000Effective in the current year, the entity has applied the provisions of revised PAS 19 in relation to the definedbenefit plan.REQUIRED: Prepare journal entry to record the employee benefit expense.Charlton Company provided the following information concerning a defined benefit plan at the beginning of current year prior to the adoption of revised PAS 19: Debit Credit Fair value of plan assets 4,750,000 Unamortized past service cost 1,250,000 Projected benefit obligation Unrecognized actuarial gain 5,500,000 850,000 The transactions for the current year relating to the defined benefit plan are as follows: Current service cost 925,000 Discount rate 6% Actual return on plan assets 485,000 1,350,000 995,000 Contribution to the plan Benefits paid to retirees Increase in projected benefit obligation due to changes in actuarial assumptions 150,000 Effective in the current year, the entity has applied the provisions of revised PAS 19 in relation to the defined benefit plan. REQUIRED: 15. Prepare journal entry to recognize the transitional effect of adopting revised PAS 19. 17. Compute the remeasurement related to the defined benefit plan. 18. Prepare journal entry to record the…Information about the defined benefit plan of the company is shown belowFair value on plan asset, January 1, 2021 3,000,000Contribution to the fund 1,500,000Return on plan assets 160,000Defined benefit liability. December 31, 2021 410,000Defined benefit obligation, December 31, 2021 4,550,000What is the balance of the fair value on plan asset as of December 31, 2021?

- At the beginning of current year, an entity provided the following information in connection with adefined benefit plan:Fair value of plan assets 10,000,000Projected benefit obligation (13,000,000)Prepaid /accrued benefit cost (3,000,000)The entity revealed the following transactions affecting the plan for the current year:Current service cost 2,500,000Past service cost - remaining vesting period of covered employees is 5 years 1,200,000Contribution to the plan 3,500,000Benefits paid to retirees 3,000,000Actual return on plan assets 1,500,000Decrease in projected benefit obligation due to change in actuarial assumptions 400,000Discount rate 10%Expected return on plan assets 12%REQUIRED:1. Compute the employee benefit expense for the current year2. Compute the net remeasurement gain for the current year3. Compute the fair value of plan assets at year-endAt the beginning of current year, an entity provided the following information in connection with adefined benefit plan:Fair value of plan assets 10,000,000Projected benefit obligation (13,000,000)Prepaid /accrued benefit cost (3,000,000)The entity revealed the following transactions affecting the plan for the current year:Current service cost 2,500,000Past service cost - remaining vesting period of covered employees is 5 years 1,200,000Contribution to the plan 3,500,000Benefits paid to retirees 3,000,000Actual return on plan assets 1,500,000Decrease in projected benefit obligation due to change in actuarial assumptions 400,000Discount rate 10%Expected return on plan assets 12%REQUIRED: 4. Compute the projected benefit obligation at year-end 5. What amount should be reported as accrued or prepaid benefit cost at year-endA. At the beginning of current year, an entity provided the following information in connection with adefined benefit plan: Fair value of plan assets 10,000,000Projected benefit obligation (13,000,000)Prepaid /accrued benefit cost (3,000,000) The entity revealed the following transactions affecting the plan for the current year: Current service cost 2,500,000Past service cost - remaining vesting period of covered employees is 5 years 1,200,000Contribution to the plan 3,500,000Benefits paid to retirees 3,000,000Actual return on plan assets 1,500,000 Decrease in projected benefit obligation due to change in actuarial assumptions 400,000Discount rate 10%Expected return on plan assets 12% Compute the projected benefit obligation at year-end What amount should be reported as accrued or prepaid benefit cost at year-end