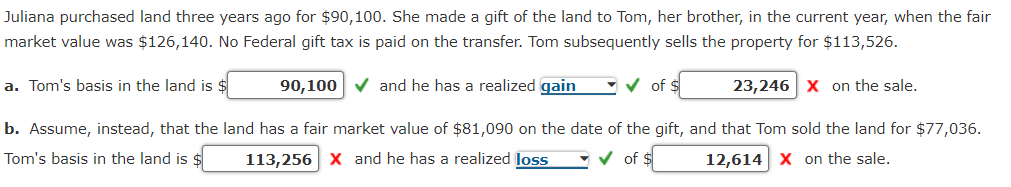

liana purchased land three years ago for $90,100. She made a gift of the land to Tom, her brother, in the current year, when the fain arket value was $126,140. No Federal gift tax is paid on the transfer. Tom subsequently sells the property for $113,526. Tom's basis in the land is $ 90,100 V and he has a realized gain -v of $ 23,246 x on the sale. Assume, instead, that the land has a fair market value of $81,090 on the date of the gift, and that Tom sold the land for $77,036. m's basis in the land is $ 113,256 X and he has a realized Joss v of $ 12,614 x on the sale.

liana purchased land three years ago for $90,100. She made a gift of the land to Tom, her brother, in the current year, when the fain arket value was $126,140. No Federal gift tax is paid on the transfer. Tom subsequently sells the property for $113,526. Tom's basis in the land is $ 90,100 V and he has a realized gain -v of $ 23,246 x on the sale. Assume, instead, that the land has a fair market value of $81,090 on the date of the gift, and that Tom sold the land for $77,036. m's basis in the land is $ 113,256 X and he has a realized Joss v of $ 12,614 x on the sale.

Chapter15: Property Transactions: Nontaxable Exchanges

Section: Chapter Questions

Problem 52P

Related questions

Question

Transcribed Image Text:Juliana purchased land three years ago for $90,100. She made a gift of the land to Tom, her brother, in the current year, when the fair

market value was $126,140. No Federal gift tax is paid on the transfer. Tom subsequently sells the property for $113,526.

a. Tom's basis in the land is $

90,100 V and he has a realized gain

-v of $

23,246 x on the sale.

b. Assume, instead, that the land has a fair market value of $81,090 on the date of the gift, and that Tom sold the land for $77,036.

Tom's basis in the land is $

113,256 x and he has a realized loss

V of

12,614 X on the sale.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT