LIBERTY CORPORATION Comparative Balance Sheet December 31, 2019 and 2018 2019 2018 Assets Current Assets: Cash and Cash Equivalents $ 2,450 $ 2,094 Accounts Receivable 1,813 1,611 Merchandise Inventory 1,324 1,060 1,709 2,120 Prepaid Expenses 7,296 6,885 Total Current Assets 18,500 15,737 Other Assets $ 25,796 $ 22,622 Total Assets Liabilities $ 7,230 $ 8,467 Current Liabilities 4,798 3,792 Long-term Liabilities Total Liabilities 12,028 12,259 Stockholders' Equity Common Stock, no par 6,568 4,363 Retained Earnings 7,200 6,000 Total Stockholders' Equity 13,768 10,363 Total Liabilities and Stockholders' Equity $ 25,796 $ 22,622 LIBERTY CORPORATION Income Statement Year Ended December 31, 2019 $ 20,941 Net Sales Revenue Cost of Goods Sold 7,055 13,886 Gross Profit 7,065 Operating Expenses 6,821 Operating Income 210 Interest Expense Income Before Income Taxes 6,611 2,563 Income Tax Expense $ 4,048 Net Income

LIBERTY CORPORATION Comparative Balance Sheet December 31, 2019 and 2018 2019 2018 Assets Current Assets: Cash and Cash Equivalents $ 2,450 $ 2,094 Accounts Receivable 1,813 1,611 Merchandise Inventory 1,324 1,060 1,709 2,120 Prepaid Expenses 7,296 6,885 Total Current Assets 18,500 15,737 Other Assets $ 25,796 $ 22,622 Total Assets Liabilities $ 7,230 $ 8,467 Current Liabilities 4,798 3,792 Long-term Liabilities Total Liabilities 12,028 12,259 Stockholders' Equity Common Stock, no par 6,568 4,363 Retained Earnings 7,200 6,000 Total Stockholders' Equity 13,768 10,363 Total Liabilities and Stockholders' Equity $ 25,796 $ 22,622 LIBERTY CORPORATION Income Statement Year Ended December 31, 2019 $ 20,941 Net Sales Revenue Cost of Goods Sold 7,055 13,886 Gross Profit 7,065 Operating Expenses 6,821 Operating Income 210 Interest Expense Income Before Income Taxes 6,611 2,563 Income Tax Expense $ 4,048 Net Income

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.1C: Leverage Cook Corporation issued financial statements at December 31, 2019, that include the...

Related questions

Question

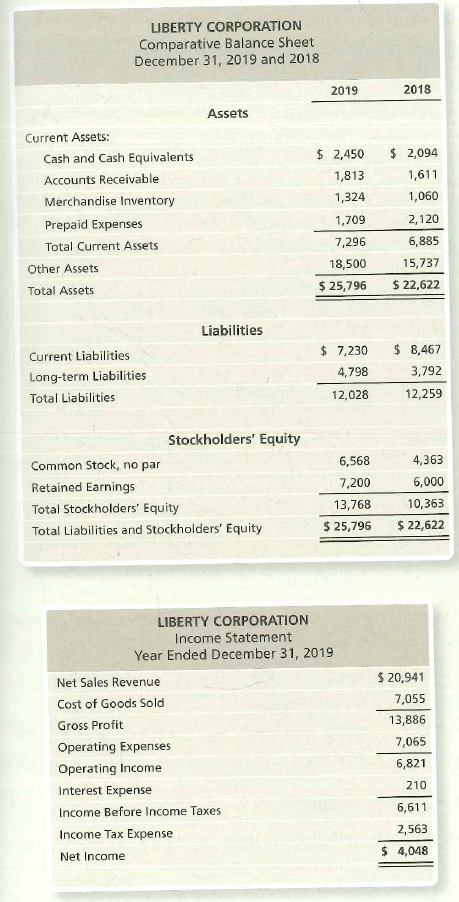

Liberty Corporation reported the following financial statements:

What part of the Liberty’s annual report is written by the company and could a biased view of financial conditions and results?

a. Balance Sheet

b. Management’s Discussion and Analysis of Financial Condition and Results Operations (MD&A)

c. Auditors Report

d. Income Statement

Transcribed Image Text:LIBERTY CORPORATION

Comparative Balance Sheet

December 31, 2019 and 2018

2019

2018

Assets

Current Assets:

Cash and Cash Equivalents

$ 2,450

$ 2,094

Accounts Receivable

1,813

1,611

Merchandise Inventory

1,324

1,060

1,709

2,120

Prepaid Expenses

7,296

6,885

Total Current Assets

18,500

15,737

Other Assets

$ 25,796

$ 22,622

Total Assets

Liabilities

$ 7,230

$ 8,467

Current Liabilities

4,798

3,792

Long-term Liabilities

Total Liabilities

12,028

12,259

Stockholders' Equity

Common Stock, no par

6,568

4,363

Retained Earnings

7,200

6,000

Total Stockholders' Equity

13,768

10,363

Total Liabilities and Stockholders' Equity

$ 25,796

$ 22,622

LIBERTY CORPORATION

Income Statement

Year Ended December 31, 2019

$ 20,941

Net Sales Revenue

Cost of Goods Sold

7,055

13,886

Gross Profit

7,065

Operating Expenses

6,821

Operating Income

210

Interest Expense

Income Before Income Taxes

6,611

2,563

Income Tax Expense

$ 4,048

Net Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning