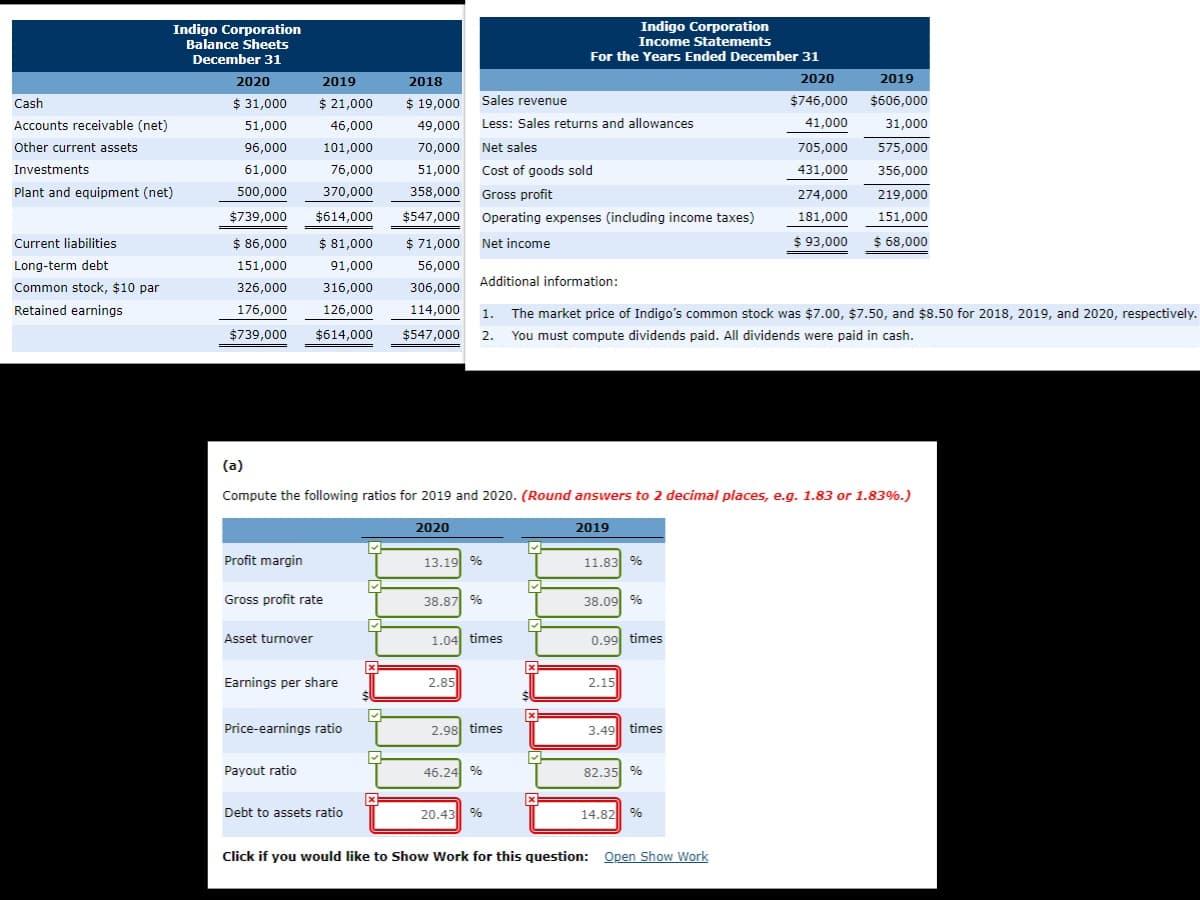

Indigo Corporation Indigo Corporation Balance Sheets December 31 Income Statements For the Years Ended December 31 2020 2019 2020 2019 2018 Sales revenue $ 21,000 $606,000 $ 31,000 $ 19,000 $746,000 Cash Less: Sales returns and allowances 41,000 31,000 Accounts receivable (net) 49,000 51,000 46,000 Other current assets 96,000 Net sales 101,000 70,000 705,000 575,000 76,000 51,000 431,000 Investments 61,000 Cost of goods sold 356,000 500,000 370,000 358,000 Gross profit Plant and equipment (net) 274,000 219,000 $739,000 $614,000 $547,000 Operating expenses (including income taxes) 181,000 151,000 $ 68,000 $ 93,000 $ 86,000 $ 81,000 $ 71,000 Current liabilities Net income Long-term debt 151,000 91,000 56,000 Additional information: Common stock, $10 par 306,000 326,000 316,000 126,000 Retained earnings 176,000 114,000 The market price of Indigo's common stock was $7.00, $7.50, and $8.50 for 2018, 2019, and 2020, respectively. 1. You must compute dividends paid. All dividends were paid in cash. $739,000 $614,000 $547,000 2. (a) Compute the following ratios for 2019 and 2020. (Round answers to 2 decimal places, e.g. 1.83 or 1.83%.) 2020 2019 Profit margin 11.83 % 13.19 % Gross profit rate 38.09 % 38.87 % Asset turnover 1.04 times 0.99 times х Earnings per share 2.15 2.85 Price-earnings ratio 2.98 times 3.49 times Payout ratio 46.24 % 82.35 % Debt to assets ratio 20.43 % 14.82 % Open Show Work Click if you would like to Show Work for this question:

Indigo Corporation Indigo Corporation Balance Sheets December 31 Income Statements For the Years Ended December 31 2020 2019 2020 2019 2018 Sales revenue $ 21,000 $606,000 $ 31,000 $ 19,000 $746,000 Cash Less: Sales returns and allowances 41,000 31,000 Accounts receivable (net) 49,000 51,000 46,000 Other current assets 96,000 Net sales 101,000 70,000 705,000 575,000 76,000 51,000 431,000 Investments 61,000 Cost of goods sold 356,000 500,000 370,000 358,000 Gross profit Plant and equipment (net) 274,000 219,000 $739,000 $614,000 $547,000 Operating expenses (including income taxes) 181,000 151,000 $ 68,000 $ 93,000 $ 86,000 $ 81,000 $ 71,000 Current liabilities Net income Long-term debt 151,000 91,000 56,000 Additional information: Common stock, $10 par 306,000 326,000 316,000 126,000 Retained earnings 176,000 114,000 The market price of Indigo's common stock was $7.00, $7.50, and $8.50 for 2018, 2019, and 2020, respectively. 1. You must compute dividends paid. All dividends were paid in cash. $739,000 $614,000 $547,000 2. (a) Compute the following ratios for 2019 and 2020. (Round answers to 2 decimal places, e.g. 1.83 or 1.83%.) 2020 2019 Profit margin 11.83 % 13.19 % Gross profit rate 38.09 % 38.87 % Asset turnover 1.04 times 0.99 times х Earnings per share 2.15 2.85 Price-earnings ratio 2.98 times 3.49 times Payout ratio 46.24 % 82.35 % Debt to assets ratio 20.43 % 14.82 % Open Show Work Click if you would like to Show Work for this question:

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 15.17EX: Profitability ratios The following selected data were taken from the financial statements of...

Related questions

Question

Transcribed Image Text:Indigo Corporation

Indigo Corporation

Balance Sheets

December 31

Income Statements

For the Years Ended December 31

2020

2019

2020

2019

2018

Sales revenue

$ 21,000

$606,000

$ 31,000

$ 19,000

$746,000

Cash

Less: Sales returns and allowances

41,000

31,000

Accounts receivable (net)

49,000

51,000

46,000

Other current assets

96,000

Net sales

101,000

70,000

705,000

575,000

76,000

51,000

431,000

Investments

61,000

Cost of goods sold

356,000

500,000

370,000

358,000 Gross profit

Plant and equipment (net)

274,000

219,000

$739,000

$614,000

$547,000

Operating expenses (including income taxes)

181,000

151,000

$ 68,000

$ 93,000

$ 86,000

$ 81,000

$ 71,000

Current liabilities

Net income

Long-term debt

151,000

91,000

56,000

Additional information:

Common stock, $10 par

306,000

326,000

316,000

126,000

Retained earnings

176,000

114,000

The market price of Indigo's common stock was $7.00, $7.50, and $8.50 for 2018, 2019, and 2020, respectively.

1.

You must compute dividends paid. All dividends were paid in cash.

$739,000

$614,000

$547,000

2.

(a)

Compute the following ratios for 2019 and 2020. (Round answers to 2 decimal places, e.g. 1.83 or 1.83%.)

2020

2019

Profit margin

11.83 %

13.19 %

Gross profit rate

38.09 %

38.87 %

Asset turnover

1.04 times

0.99 times

х

Earnings per share

2.15

2.85

Price-earnings ratio

2.98 times

3.49 times

Payout ratio

46.24 %

82.35 %

Debt to assets ratio

20.43 %

14.82 %

Open Show Work

Click if you would like to Show Work for this question:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning