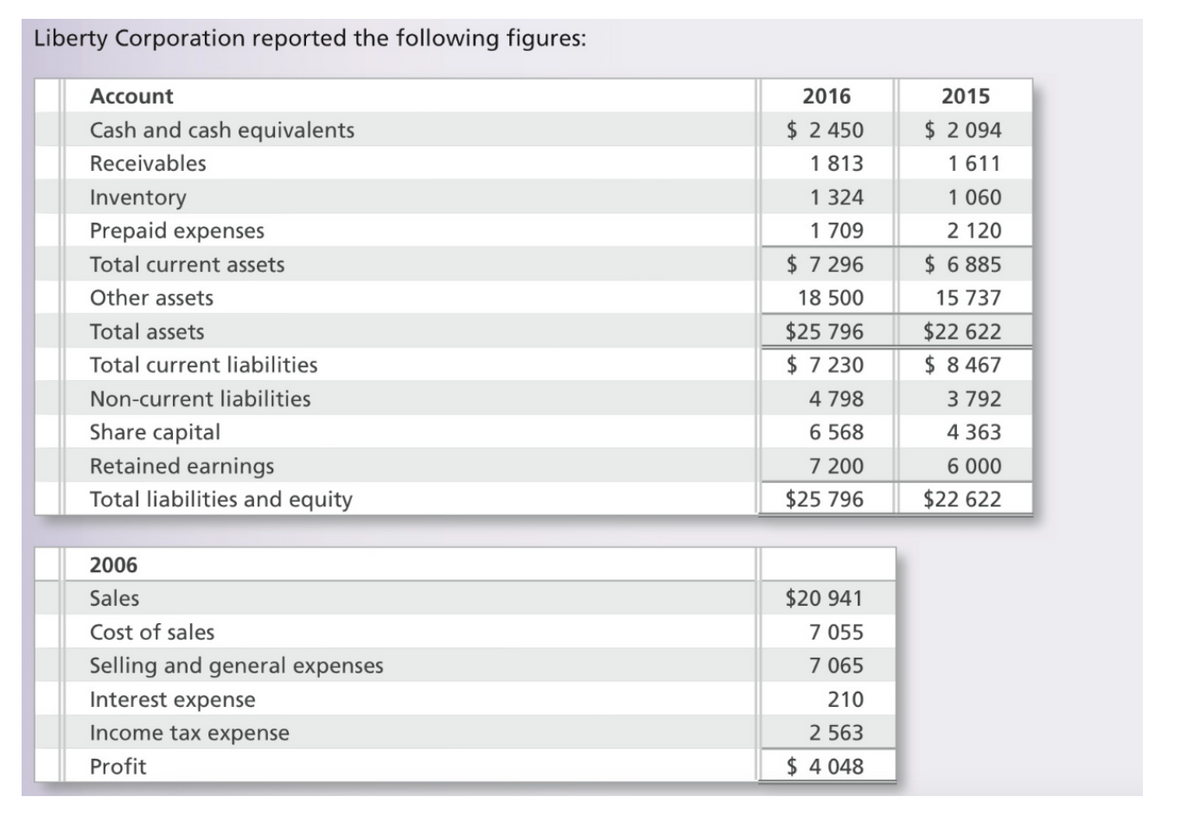

Liberty Corporation reported the following figures: Account 2016 2015 Cash and cash equivalents $ 2 450 $ 2 094 Receivables 1 813 1 611 Inventory 1 324 1 060 Prepaid expenses 1 709 2 120 Total current assets $ 7 296 $ 6 885 Other assets 18 500 15 737 Total assets $25 796 $22 622 Total current liabilities $ 7 230 $ 8 467 Non-current liabilities 4 798 3 792 Share capital 6 568 4 363 Retained earnings 7 200 6 000 Total liabilities and equity $25 796 $22 622 2006 Sales $20 941 Cost of sales 7 055 Selling and general expenses 7 065 Interest expense 210 Income tax expense 2 563 Profit $ 4 048

Q: Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has...

A: A cash budget is prepared to estimate the total cash received and total cash disbursement on the bas...

Q: noncurrent asset

A: The balance sheet represents the financial position of the company that includes the assets, liabili...

Q: Carol Gaston opens her own law office on July 1, 2019. During the first month of operations, the fol...

A: The balance sheet represents the financial position that involves the assets, liabilities, and stock...

Q: The following data were taken from the records of Winner Company for the month of October: Work in ...

A: Solution Given Beginning WIP is 70% complete Ending WIP is 40% complete The unit started is 40000 un...

Q: Michael Corporation is on a calendar year basis. The following data were found during your audit: ...

A:

Q: Required: 1. Prepare the journal entries for the following: a. To close the books of Amos' proprieto...

A: Partnership means a group of persons who come together with a purpose to control and manage the oper...

Q: Macrosoft Company reports net income of $73,000. The accounting records reveal depreciation expense ...

A: Introduction: Statement of cash flows: All cash in and out flows are shown in cash flows statements....

Q: On January 1, 2019, Pigero Company took 3-year, P4,000,000 loan from a bank. The loan agreement requ...

A: Computation of the current liability to the loan in Pigero's 2019 year end financial statement is a...

Q: PARE Company produces and sells a special powder named "CC". Actual and Proj and contribution margin...

A: Market share (MS) refers to the aggregate sales % (percentage) within the industry generated through...

Q: Cane Company manufactures two products called Alpha and Beta that sell for $185 and $120, respective...

A: (A.) Financial advantage (disadvantage) = $360,000 Alphas Per Unit $ Sales 112 Less: Va...

Q: A. Assume that Cane expects to produce and sell 88,000 Alphas during the current year. A supplier ha...

A: Make and buy decision refers to a decision taken the manager whether to product the required materia...

Q: 2. The Company place a fixed deposit of $1,000,000 with the bank on 28.12.10 for a period of 7 days ...

A: Journal entries are the basic method for recording financial transactions in the books of accounts. ...

Q: 2- Amina borrowed 60,000 SR on January 1, 2020, from the local bank to expand its bui The funds were...

A: When bond trades or the market price of the bond is below $1000 or par value it is called a discount...

Q: Engr. Roque owner of the HarRoqe’s Ice Plant is monitoring the cashflow of the plant. Based on the f...

A: Break-even point = Fixed costs / Contribution per unit Contribution per unit = Selling price per uni...

Q: need answers thank you.

A: The question is based on the concept of Financial Accounting.

Q: REQUIRED: a.) At what amount should Prince of Wales record the building on July 1,2020? b.) What is ...

A: Lease Term 10 year Annual lease Payment 750000 Fair Value of Building 4478000 Estimated ...

Q: # of Units Unit Cost Total Cost Jan 1 Beginning Inventory 09 009$ 066$ $1,300 Jan 12 Purchase $11 06...

A: Inventory valuation is based on the flow of exemption used by the company. There are many methods fo...

Q: xercise 12. Account Debited and Account Credited nstruction: For each transaction, identify the acco...

A: Increase in asset is Debited. Increase in liabilities is Credited. Increase in Revenue is Credited. ...

Q: January 1,2020, Shirley Corporation leased a machinery from Joel Company on a five-year lease term a...

A: 1)leasing is the process by which a firm can obtain the use of fixed assets for which it makes a ser...

Q: Dove Company uses FIFO method of process costing. The company’s cost accountant has provided you wi...

A: Solution: Dove Company Finishing Department Computation of Equivalent unit (FIFO) Particula...

Q: If someone gives you $5,000 to do a job what is the journal entry to recognize this $5,000 transacti...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: IFRS 9, the cumulative balance of equity as a result of measuring the investment at fair value throu...

A: Under IFRS 9, an investment can be measured at fair value or amortized cost. If the investment is me...

Q: The retained earnings account only reflects the profits retained in the business and gains and losse...

A: RE stands for Retained Earnings which refers to the net earnings or the company profits in cumulativ...

Q: Dividend revenue is recognized for trading securities and available for sale securities even if held...

A: Solution Concept Dividend is recognized in income statement for trading securities if they are held ...

Q: choose the correct answer: Equity security acquired for trading should be measured at reporting dat...

A: Equity Securities Held for Trading Equity securities which are held for trading purpose which can be...

Q: 1. T.J. Chan, an engineering consultant, decided to begin a business of his own. Chan has set up the...

A: 1) No entry will pass in income statement with regard to inveatemnt in the business . 2)No entry wil...

Q: Nico Manufacturing Company applies process costing in the manufacture of its best-seller Manufacturi...

A: Total cost of units transferred to department 2 comprises of beginning inventory cost and cost of fr...

Q: Magic Oaks Realty's net revenue and profit for a five-year period, using 2012 as the base year, foll...

A: Trend Analysis It is the practice of collecting information and then with the help of that data spot...

Q: Relax Spa Company is engaged in providing facial and body treatment in a spa centre. Customers are r...

A: Spa coupons earlier issued were recorded in Unearned revenue. When these coupons are redeemed , they...

Q: process, beg (3/5 additional work to be done) 10,125 un...

A: Solution: Of the units started in process, ½ represents work in process at the end, That means remai...

Q: 1. _____ are controls that do not rely on the client's information technology (IT) environment for t...

A: Solution Note : Dear student as per the Q&A guideline we are required to answer the first questi...

Q: Which of the following is a financial liability? a. Deferred revenue b. A warranty obligation c. A c...

A: Solution Concept As per the relevant accounting standard Financial liability is -con...

Q: Use the following information for question 6 and 7: Marksman acquired 100 percent of Tribal Transit ...

A: 6) Value of Investment at acquisition date Investment is recorded at the Market value at the acquisi...

Q: What amount should be reported as Cash on December 31, 2017?

A: Cash equivalents refers to those short-term investment of the company which are easily converted int...

Q: The Wilson Motel has two major operated departments: rooms and food. The following information is su...

A: Summary Income statement is a statement used to provide a detailed summary report of all the incomes...

Q: QUESTION 4 Indicate whether each of the following costs incurred by a manufacturer would be consider...

A: The costs incurred in the production of a product are referred to as its product cost. These costs i...

Q: Company were presented for you to prepare a single statement of comprehensive income for the year en...

A: Importance of Statement of Comprehensive income to the users of financial statements: Comprehensive ...

Q: An entity reported taxable income of P 8,000,000 during 2019. Its first year of operations. The foll...

A: Deferred Tax The purpose of creating deferred tax which is any kind of excess amount which are repor...

Q: Haze Company had 6,400 units of work-in-process inventory in department A on October 1, 2022. These ...

A: Under average costing method it is assumed that whole of opening inventory is completed during the p...

Q: Gain or Loss on Sale of FVPL 13) On January 1, 2020, Erika Company purchased equity investments held...

A: Introduction: An income statement is a financial statement that shows the company's income and expen...

Q: Required: (a) Prepare the Bank Reconciliation Statement of Success Company for the month of July 20...

A: 1. Difference of $13544 between Deposits in Cash account of $33000 and Deposits in Bank Statement of...

Q: how do you find the WACC for 2006 given the following information: Operating results 2004 2005 2006...

A: WACC = (1-t) rD (D/V) + rE (E/V) T= Tax rate rD = Debt percentage rE = Equity percentage V = value o...

Q: Would an increase in variable costs per unit cause a company’s break-even point to increase or decre...

A: Variable cost is an amount that changes in total in proportion to the volume produced and sold howev...

Q: Wedding R Us sells wedding dresses. The cost of each dress is comprised of the following: Selling pr...

A: Since you have posted question with multiple sub-parts , we will do the first three sub-parts for yo...

Q: A man deposited Php 20,000 in a savings bank that pays 4 ½% compounded semi-annually for 2 years and...

A: Deposited amount (P) = Php 20,000 Interest rate = 4 1/2% = 4.50% Semi annual interest rate (r) = 4.5...

Q: What is the amount of the deferred tax liability at the end of 2021

A: Deferred tax liability refers to those tax liabilities of a company which is recorded in the balance...

Q: Banana Company purchases 80 percent of Mango. At the date of acquisition, Mango has revenue of P250...

A: Pre-acquisition Earning: The money generated by the firm before the purchase date is referred to as ...

Q: 1. Working paper documentation includes the auditors’ conclusion about ______ and the basis for thei...

A: Answer: As per Q/A guideline, first question has been answered. Please repost remaining questions. W...

Q: P1,500 of supplies on hand at the end of 2009. During 2010, P,2750 of supplies were purchased. A cou...

A: The purchase goods are done by supplier. so there will be stock which will be opening and supplie...

Q: hoose the correct answer: 1. Trading securities are held with the intention of being sold in a shor...

A: Solution Concept Debt securities held to maturity is accounted using amortized cost Debt securities ...

Step by step

Solved in 2 steps

- JEY-4322 Inc. reported the following data for last year: JEY-4322 Inc.Balance Sheet Beginning BalanceEnding BalanceAssets Cash$ 128,000$ 139,000Accounts receivable331,000481,000Inventory567,000471,000Plant and equipment, net894,000869,000Investment in Tesla Inc.400,000428,000Land (undeveloped)246,000249,000Total assets$ 2,566,000$ 2,637,000Liabilities and Stockholders' Equity Accounts payable$ 382,000$ 341,000Long-term debt981,000981,000Stockholders' equity1,203,0001,315,000Total liabilities and stockholders' equity$ 2,566,000$ 2,637,000 JEY-4322 Inc.Income StatementSales $ 3,880,000Operating expenses 3,336,800Net operating income 543,200Interest and taxes: Interest expense$ 111,000 Tax expense197,000308,000Net income $ 235,200 JEY-4322 Inc. paid dividends of $123,200 last year. The “Investment in Tesla Inc.” item on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return is 15%. What was the company’s residual income…Blossom Company reports the following information: Net income $ 539000 Depreciation expense 153000 Increase in accounts receivable 61000 Blossom should report cash provided by operating activities of $ 753000. $ 447000. $ 631000. $ 325000.suppose that a company's cash flow statement showed the following: net income: 22,523.99 deprecitation 4580.77 accounts receivable -543.32 inventory 592.81 accounts payable 880.05 what is this companys net cash from operating activities? A. 23,453.53 B. 27,154.25 C. 27,697.57 D. 28,034.30 E. 27,441.48

- Sheffield Company has the following information available: Net income, $22000; Cash provided by operations, $33000; Cash Sales, $82500; Capital expenditures, $13200; and Cash dividends, $6600. What is Sheffield’s free cash flow? a. $52800. b. $13200. c. $2200. d. $29700.Orbit Limited : Statement of Financial Position as at 31 December 2022 2021 Non-current Assets R11 810 000 R7 560 000 Property, Plant, Equipment R10 025 000 R6 250 000 Investments R1 785 000 R1 310 000 Current Assets R4 190 000 R4 690 000 Inventories R 1 875 000 R2 350 000 Account Receivable R1 925 000 R2 200 000 Cash R390 000 R140 000 Toatal Assets R16 000 000 R12 250 000 Equities & Liabilities Equity ? ? Oridanary share capital R5 480 000 R3 680 000 Retained earnings ? ? Non-current Liabilities R4 500 000 R3 800 000 Loan (20% p.a) R4 500 000 R3 800 000 Current Liabilities R2 300 000 R1 500 000 Accounts payable? R2 300 000 R1 500 000 Calculate the increase in the retained earnings over the two-year period.Revenue R100 000, Debtors (opening R50 000, closing R110 000), Calculate Cash Receipts from Customers. Select one: a. R60 000 b. R40 000 c. R110 000 d. R100 000

- Celloscope Ltd. Balance Sheet 31-Dec-19 Current Assets Cash 18000 Accounts Receivable 20000 Inventory 12000 Prepaid Insurance 600 Sub total 50600 Non-current Assets Land 80000 Building 60000 Less: Accumulated Depreciation 10,000 50000 Sub total 130000 Total Assets 180600 Current Liabilities Accounts payable 50000 Taxes Payable 8000 Sub total 58000 Non-Current Liabilities Bonds Payable (10%) 40000 40000 Owners’ Equity Share Capital 60000 Retained Earning 22600 Sub total 82600 Total Liabilities and Owners’ Equity 180600 The following are expected in the next 3 months January…is: Dec. 31, 20Y9 Dec. 31, 20Y8 Assets Cash $70,720 $47,940 Accounts receivable (net) 207,230 188,190 Inventories 298,520 289,850 Investments 0 102,000 Land 295,800 0 Equipment 438,600 358,020 Accumulated depreciation—equipment (99,110) (84,320) Total assets $1,211,760 $901,680 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $205,700 $194,140 Accrued expenses payable (operating expenses) 30,600 26,860 Dividends payable 25,500 20,400 Common stock, $1 par 202,000 102,000 Paid-in capital: Excess of issue price over par—common stock 354,000 204,000 Retained earnings 393,960 354,280 Total liabilities and stockholders' equity $1,211,760 $901,680 The income statement for the year ended December 31, 20Y9, is as follows: Sales $2,023,898 Cost of goods sold 1,245,476 Gross profit $778,422 Operating…hw6 q1 Consider the following balance sheet and income statement for Mmm Good Foods Incorporated (the company that operates Tasty Fried Chicken and Pizza Party), in condensed form, including some information from the cash flow statement: (amounts are in millions) Mmm Good Foods Incorporated Balance Sheet 2019 Cash and short-term Investments $ 719 Accounts receivable 385 Inventory 51 Other current assets 447 Long-lived assets 4,086 Total assets $ 5,688 Current liabilities $ 1,444 Total liabilities 11,164 Noncontrolling interest Shareholders’ equity (5,476) Total liabilities and equity $ 5,688 Income Statement Sales $ 6,516 Cost of sales 3,573 Gross margin $ 2,943 Earnings before interest and taxes $ 1,640 Interest 322 Taxes 339 Income from discontinued operations 610 Net income $ 1,589 Share price $ 78 Earnings per share 5.61 Number of outstanding shares (millions) 356.5 Cash Flows Cash flow from operations $ 1,219…

- SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…