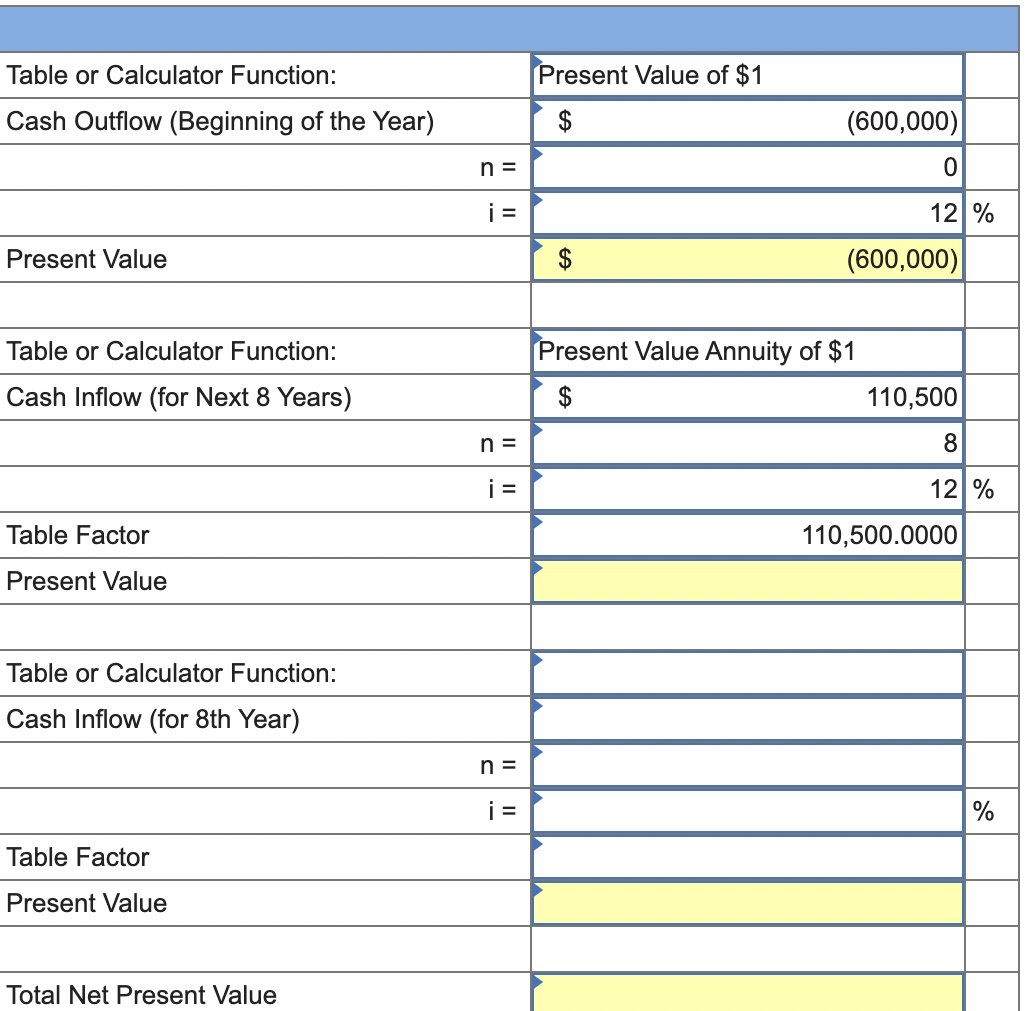

Linda’s Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investment follows: Initial investment (2 limos) $600,000 Useful life 8years Salvage value $100,000 Annual net income generated 48,000 LLT’s cost of capital 12% Help LLT evaluate this project by calculating each of the following: 1. Accounting rate of return. 2. Payback period. 3. Net present value. (photo answer chart) 4. Without making any calculations, determine whether the IRR is more or less than 12%.

Linda’s Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investment follows: Initial investment (2 limos) $600,000 Useful life 8years Salvage value $100,000 Annual net income generated 48,000 LLT’s cost of capital 12% Help LLT evaluate this project by calculating each of the following: 1. Accounting rate of return. 2. Payback period. 3. Net present value. (photo answer chart) 4. Without making any calculations, determine whether the IRR is more or less than 12%.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 19E

Related questions

Question

Linda’s Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investment follows:

Initial investment (2 limos) $600,000

Useful life 8years

Salvage value $100,000

Annual net income generated 48,000

LLT’s cost of capital 12%

Help LLT evaluate this project by calculating each of the following:

1. Accounting

2. Payback period.

3.

4. Without making any calculations, determine whether the IRR is more or less than 12%.

Transcribed Image Text:Table or Calculator Function:

Present Value of $1

Cash Outflow (Beginning of the Year)

(600,000)

n =

i =

12 %

Present Value

$

(600,000)

Table or Calculator Function:

Present Value Annuity of $1

Cash Inflow (for Next 8 Years)

2$

110,500

n =

8

i =

12 %

Table Factor

110,500.0000

Present Value

Table or Calculator Function:

Cash Inflow (for 8th Year)

n =

i =

%

Table Factor

Present Value

Total Net Present Value

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning