Lindsey Corporation had the following account balances: Sales revenue $200,000 Beginning inventory 40,000 Purchases 80,000 Purchase discounts 3,000 Freight-in 1,000 Ending inventory 30,000 Purchases returns and allowances 2,000 Given the information above, and assuming that Lindsay's total operating expenses (exclusive of the cost of goods sold) are $40,000, pretax income is a. $114,000 b. $110,000 c. $46,000 d. $74,000

Lindsey Corporation had the following account balances: Sales revenue $200,000 Beginning inventory 40,000 Purchases 80,000 Purchase discounts 3,000 Freight-in 1,000 Ending inventory 30,000 Purchases returns and allowances 2,000 Given the information above, and assuming that Lindsay's total operating expenses (exclusive of the cost of goods sold) are $40,000, pretax income is a. $114,000 b. $110,000 c. $46,000 d. $74,000

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 8EA: Record the journal entry for each of the following transactions. Glow Industries purchases 750...

Related questions

Question

Lindsey Corporation had the following account balances:

Sales revenue $200,000

Beginning inventory 40,000

Purchases 80,000

Purchase discounts 3,000

Freight-in 1,000

Ending inventory 30,000

Purchases returns and allowances 2,000

Given the information above, and assuming that Lindsay's total operating expenses (exclusive of the cost of goods sold) are $40,000, pretax income is

a. $114,000

b. $110,000

c. $46,000

d. $74,000

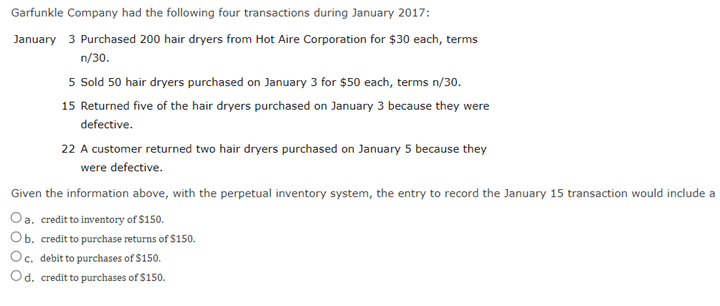

Transcribed Image Text:Garfunkle Company had the following four transactions during January 2017:

January 3 Purchased 200 hair dryers from Hot Aire Corporation for $30 each, terms

n/30.

5 Sold 50 hair dryers purchased on January 3 for $50 each, terms n/30.

15 Returned five of the hair dryers purchased on January 3 because they were

defective.

22 A customer returned two hair dryers purchased on January 5 because they

were defective.

Given the information above, with the perpetual inventory system, the entry to record the January 15 transaction would include a

Oa. credit to inventory of $150.

Ob. credit to purchase returns of $150.

Oc. debit to purchases of $150.

Od. credit to purchases of $150.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,