List and explain the substaintive tests of Cash & Inventory

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter11: Auditing Inventory, Goods And Services, And Accounts Payable: The Acquisition And Payment Cycle

Section: Chapter Questions

Problem 31CYBK

Related questions

Topic Video

Question

List and explain the substaintive tests of Cash & Inventory .

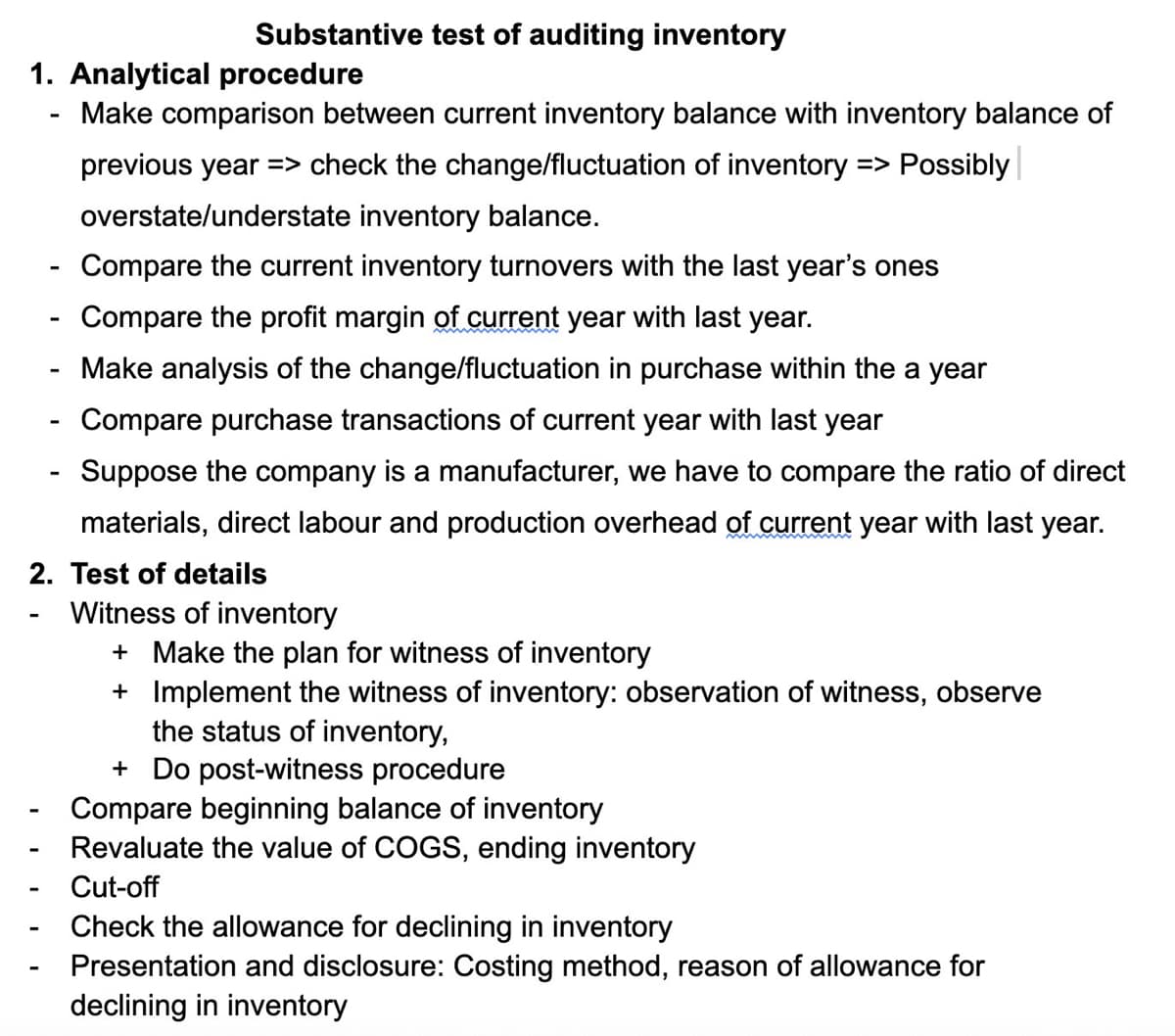

Transcribed Image Text:Substantive test of auditing inventory

1. Analytical procedure

Make comparison between current inventory balance with inventory balance of

previous year => check the change/fluctuation of inventory => Possibly

overstate/understate inventory balance.

Compare the current inventory turnovers with the last year's ones

Compare the profit margin of current year with last year.

Make analysis of the change/fluctuation in purchase within the a year

Compare purchase transactions of current year with last year

Suppose the company is a manufacturer, we have to compare the ratio of direct

materials, direct labour and production overhead of current year with last year.

2. Test of details

Witness of inventory

+ Make the plan for witness of inventory

+ Implement the witness of inventory: observation of witness, observe

the status of inventory,

+ Do post-witness procedure

Compare beginning balance of inventory

Revaluate the value of COGS, ending inventory

Cut-off

Check the allowance for declining in inventory

Presentation and disclosure: Costing method, reason of allowance for

declining in inventory

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,