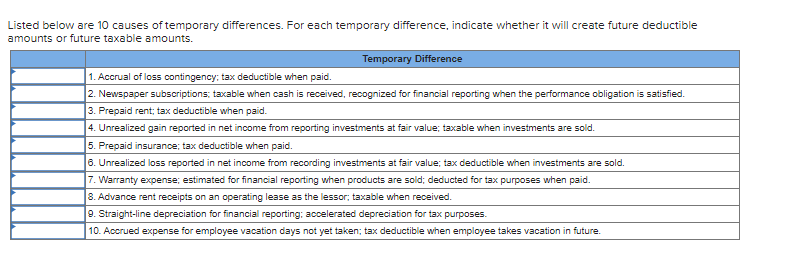

Listed below are 10 causes of temporary differences. For each temporary difference, indicate whether it will create future deductible amounts or future taxable amounts. Temporary Difference 1. Accrual of loss contingency; tax deductible when paid. 2. Newspaper subscriptions; taxable when cash is received, recognized for financial reporting when the performance obligation is satisfied. 3. Prepaid rent; tax deductible when paid. 4. Unrealized gain reported in net income from reporting investments at fair value; taxable when investments are sold. 5. Prepaid insurance; tax deductible when paid. 6. Unrealized loss reported in net income from recording investments at fair value; tax deductible when investments are sold. 7. Warranty expense; estimated for financial reporting when products are sold; deducted for tax purposes when paid. 8. Advance rent receipts on an operating lease as the lessor; taxable when received. 9. Straight-line depreciation for financial reporting: accelerated depreciation for tax purposes. 10. Accrued expense for employee vacation days not yet taken; tax deductible when employee takes vacation in future.

Listed below are 10 causes of temporary differences. For each temporary difference, indicate whether it will create future deductible amounts or future taxable amounts. Temporary Difference 1. Accrual of loss contingency; tax deductible when paid. 2. Newspaper subscriptions; taxable when cash is received, recognized for financial reporting when the performance obligation is satisfied. 3. Prepaid rent; tax deductible when paid. 4. Unrealized gain reported in net income from reporting investments at fair value; taxable when investments are sold. 5. Prepaid insurance; tax deductible when paid. 6. Unrealized loss reported in net income from recording investments at fair value; tax deductible when investments are sold. 7. Warranty expense; estimated for financial reporting when products are sold; deducted for tax purposes when paid. 8. Advance rent receipts on an operating lease as the lessor; taxable when received. 9. Straight-line depreciation for financial reporting: accelerated depreciation for tax purposes. 10. Accrued expense for employee vacation days not yet taken; tax deductible when employee takes vacation in future.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 1P: Definitions The FASB has defined several terms in regard to accounting for income taxes. Below are...

Related questions

Question

Hi there,

Need help with attached question, thanks kindly!

Transcribed Image Text:Listed below are 10 causes of temporary differences. For each temporary difference, indicate whether it will create future deductible

amounts or future taxable amounts.

Temporary Difference

1. Accrual of loss contingency; tax deductible when paid.

2. Newspaper subscriptions; taxable when cash is received, recognized for financial reporting when the performance obligation is satisfied.

3. Prepaid rent; tax deductible when paid.

4. Unrealized gain reported in net income from reporting investments at fair value; taxable when investments are sold.

5. Prepaid insurance; tax deductible when paid.

6. Unrealized loss reported in net income from recording investments at fair value; tax deductible when investments are sold.

7. Warranty expense; estimated for financial reporting when products are sold; deducted for tax purposes when paid.

8. Advance rent receipts on an operating lease as the lessor; taxable when received.

9. Straight-line depreciation for financial reporting: accelerated depreciation for tax purposes.

10. Accrued expense for employee vacation days not yet taken; tax deductible when employee takes vacation in future.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning