Concept explainers

Temporary and Permanent Differences In the current year, you are calculating a diversified company’s

Required:

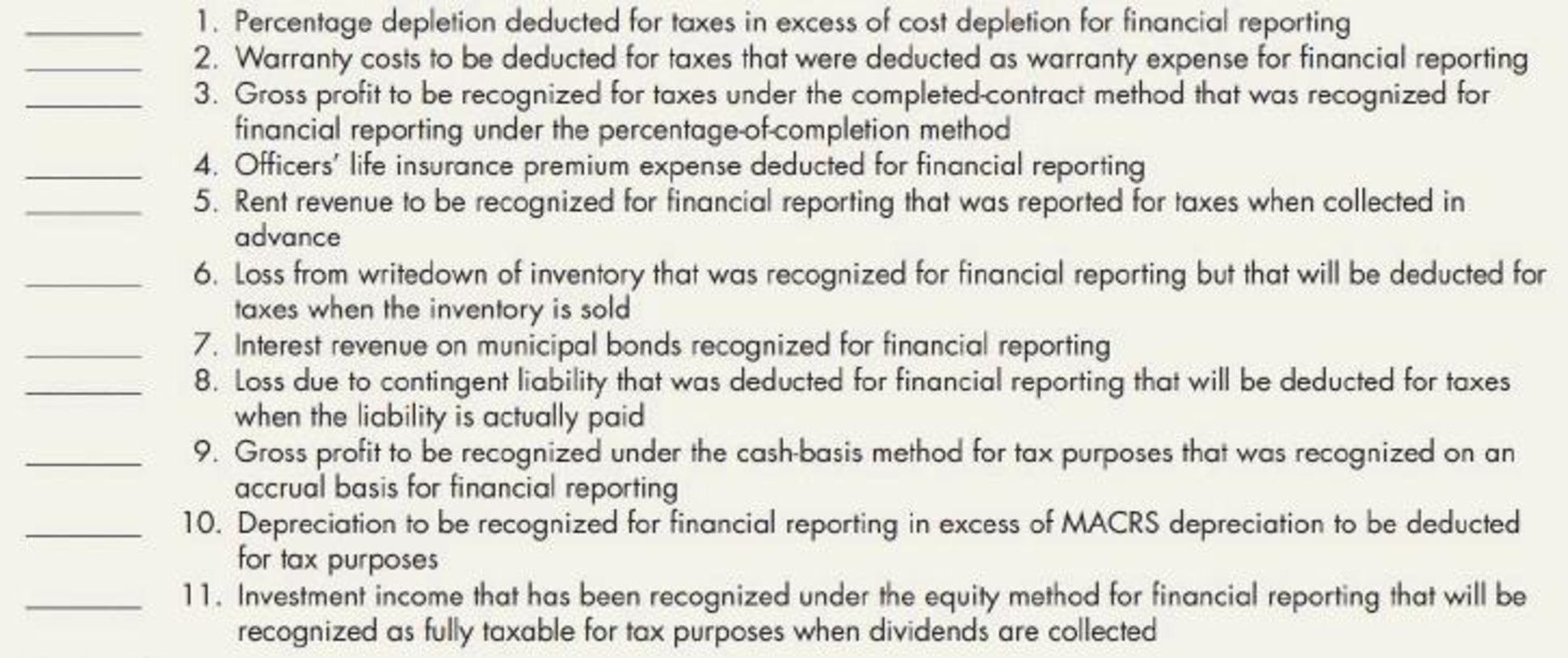

For each difference, indicate whether it is a temporary difference (T) or a permanent difference (P) by placing the appropriate letter on the line provided. If the difference is a temporary difference, also indicate for the current year whether it will result in a future taxable amount (FT) or a future deductible amount (FD).

Trending nowThis is a popular solution!

Chapter 18 Solutions

Intermediate Accounting: Reporting And Analysis

Additional Business Textbook Solutions

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Cost Accounting (15th Edition)

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Managerial Accounting: Tools for Business Decision Making

- Definitions The FASB has defined several terms in regard to accounting for income taxes. Below are various code letters (for terms) followed by definitions. 1. The deferred tax consequences of future deductible amounts and operating loss carryforwards 2. A difference between the tax basis of an asset or liability and its reported amount in the financial statements that will result in taxable or deductible amounts in future years when the reported amount of the asset or liability is recovered or settled, respectively 3. Temporary difference that results in taxable amounts in future years when the related asset or liability is recovered or settled, respectively 4. The future effects on income taxes, as measured by the applicable enacted tax rate and provisions of the enacted tax low, resulting from temporary differences and operating loss carryforwards at the end of the current year 5. The change during the year in a corporations deferred tax liabilities and assets 6. The deferred tax consequences of future taxable amounts 7. The portion of o deferred tax asset for which it is more likely than not that a tax benefit will not be realized 8. Temporary difference that results in deductible amounts in future years when the related asset or liability is recovered or settled, respectively 9. The sum of income tax payable and deferred tax expense (or benefit) 10. The amount of income taxes paid or payable (or refundable) for the current year 11. An excess of tax deductible expenses over taxable revenues in a year that may be carried forward to reduce taxable income in a future year 12. The excess of taxable revenues over tax deductible expenses and exemptions for the year 13. Income tax expense divided by income before income taxesarrow_forwardMultiple Temporary Differences Vickers Company reports taxable income of 4,500 for 2019. Vickers has two temporary differences between pretax financial income and taxable income at the end of 2019. The first difference is expected to result in taxable amounts totaling 2,470 in future years. The second difference is expected to result in deductible amounts totaling 1,360 in future years. Vickers has a deferred tax asset of 372 and a deferred tax liability of 690 at the beginning of 2019. The current tax rate is 30%, and no change in the tax rate has been enacted for future years. Vickers has positive, verifiable evidence of future taxable income. Required: Prepare Vickerss income tax journal entry at the end of 2019.arrow_forwardUncertain Tax Position At the end of the current year, Boyd Company claims a 200,000 tax credit on its income tax return. Boyd is uncertain whether the IRS will accept this credit. It studies the IRS regulations and determines that it is more likely than not that the IRS will accept all or some of this tax credit. Based on this research, Boyd estimates the following probability distribution of possible outcomes: Required: For the current year, determine (1) the amount that Boyd will recognize as a current tax benefit and (2) the amount that it will record as the unrecognized tax benefit.arrow_forward

- Interperiod Tax Allocation Klerk Company had four temporary differences between its pretax financial income and its taxable income during 2019 as follows: At the beginning of 2019, Klerk had a deferred tax liability of 84,300 related to Temporary Difference #2 and a deferred tax asset of 21,090 related to Temporary Difference #4. Based on its tax records, Klerk earned taxable income of 270,000 for 2019. Kerks accountant has prepared the following schedule showing the total future taxable and deductible amounts at the end of 2019 for its four temporary differences: The company has a history of earning income and expects to be profitable in the future. The income tax rate for 2019 is 40%, but in 2018 Congress enacted a 30% tax rate for 2020 and future years. During 2019, for financial accounting purposes, Klerk reported revenues of 750,000 and expenses of 447,100. The deferred taxes related to Temporary Differences #1, #2, and #4 are considered to be noncurrent by the company; the deferred tax related to Temporary Difference #3 is considered to be current. Required: 1. Prepare Klerks income tax journal entry for 2019. 2. Prepare a condensed 2019 income statement for Klerk. 3. Show how the income tax items are reported on Klerks December 31, 2019, balance sheet.arrow_forwardIncomc Taxes Then Company has been in operation for several years. It has both a deductible and a taxable temporary difference. At the beginning of 2019, its deferred tax asset was 690, and its deferred tax liability was 750. The company expects its lutine deductible amount to be deductible in 2020 and its Inline taxable amount to 1 taxable in 2021. In 2018, Congress enacted income tax rates for future years as follows: 2019, 30%; 2020, 34%; and 2021, 35%. At the end of 2019, Then reported income taxes payable of 25,800, an increase in its deferred tax liability of 300, and an ending balance in its deferred tax asset of 860. Thun has prepared the following schedule of items related to its income taxes for 2019. Required: Fill in the blanks in the preceding schedule. Show your calculations.arrow_forwardMultiple Temporary Differences Wilcox Company has prepared the following reconciliation of its pretax financial income with its taxable income for 2019: At the beginning of 2019, Wilcox had a deferred tax liability of 495. The current tax rate is 30%, and no change in the tax rate has been enacted for future years. At the end of 2019, Wilcox anticipates that actual warranty costs will exceed estimated warranty expense by 100 next year and that financial depreciation will exceed tax depreciation by 1,800 in future years. Wilcox has earned income in all past years and expects to earn income in the future. Required: 1. Prepare Wilcoxs income tax journal entry at the end of 2019. 2. Prepare the lower portion of Wilcoxs 2019 income statement. 3. Show how the income tax items are reported on Wilcoxs December 31, 2019, balance sheet.arrow_forward

- Which of the following is not a cause of a difference between pretax financial income and taxable income in a given period? a. operating loss carryforwards b. permanent differences c. applicable tax rates d. temporary differencesarrow_forwardDeferred Tax Assets. Components of the deferred tax asset of Biosante Pharmaceuticals, Inc., are shown in Exhibit 2.14. The company had no deferred tax liabilities. REQUIRED a. At the end of 2008, the largest deferred tax asset is for net operating loss carryforwards. (Net operating loss carryforwards [also referred to as tax loss carryforwards] are amounts reported as taxable losses on tax filings. Because the tax authorities generally do not pay corporations for incurring losses, companies are allowed to carry forward taxable losses to future years to offset taxable income. These future tax benefits give rise to deferred tax assets.) As of the end of 2008, what is the dollar amount of the companys net operating loss carryforwards? What is the dollar amount of the deferred tax asset for the net operating loss carryforwards? Describe how these two amounts are related. b. Biosante has gross deferred tax assets of 28,946,363. However, the net deferred tax assets balance is zero. Explain. c. The valuation allowance for the deferred tax asset increased from 21,818,084 to 28,946,363 between 2007 and 2008. How did this change affect the company's net income?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning