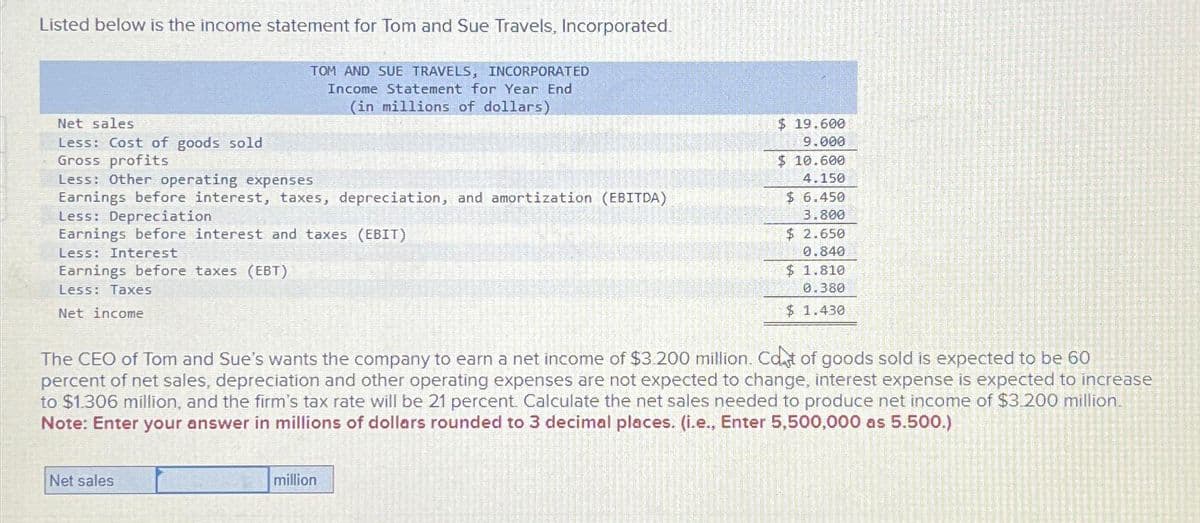

Listed below is the income statement for Tom and Sue Travels, Incorporated. TOM AND SUE TRAVELS, INCORPORATED Income Statement for Year End (in millions of dollars) Net sales Less: Cost of goods sold Gross profits Less: Other operating expenses Earnings before interest, taxes, depreciation, and amortization (EBITDA) Less: Depreciation Earnings before interest and taxes (EBIT) Less: Interest Earnings before taxes (EBT) Less: Taxes Net income The CEO of Tom and Sue's wants the company to earn a net income of $3.200 million. Cot of goods sold is expected to be 60 percent of net sales, depreciation and other operating expenses are not expected to change, interest expense is expected to increase to $1.306 million, and the firm's tax rate will be 21 percent. Calculate the net sales needed to produce net income of $3.200 million. Note: Enter your answer in millions of dollars rounded to 3 decimal places. (i.e., Enter 5,500,000 as 5.500.) Net sales $19.600 9.000 $ 10.600 4.150 $6.450 3.800 $ 2.650 0.840 $ 1.810 0.380 $ 1.430 million

Listed below is the income statement for Tom and Sue Travels, Incorporated. TOM AND SUE TRAVELS, INCORPORATED Income Statement for Year End (in millions of dollars) Net sales Less: Cost of goods sold Gross profits Less: Other operating expenses Earnings before interest, taxes, depreciation, and amortization (EBITDA) Less: Depreciation Earnings before interest and taxes (EBIT) Less: Interest Earnings before taxes (EBT) Less: Taxes Net income The CEO of Tom and Sue's wants the company to earn a net income of $3.200 million. Cot of goods sold is expected to be 60 percent of net sales, depreciation and other operating expenses are not expected to change, interest expense is expected to increase to $1.306 million, and the firm's tax rate will be 21 percent. Calculate the net sales needed to produce net income of $3.200 million. Note: Enter your answer in millions of dollars rounded to 3 decimal places. (i.e., Enter 5,500,000 as 5.500.) Net sales $19.600 9.000 $ 10.600 4.150 $6.450 3.800 $ 2.650 0.840 $ 1.810 0.380 $ 1.430 million

Chapter2: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:Listed below is the income statement for Tom and Sue Travels, Incorporated.

TOM AND SUE TRAVELS, INCORPORATED

Income Statement for Year End

(in millions of dollars)

Net sales.

Less: Cost of goods sold

Gross profits

Less: Other operating expenses

Earnings before interest, taxes, depreciation, and amortization (EBITDA)

Less: Depreciation

Earnings before interest and taxes (EBIT)

Less: Interest

Earnings before taxes (EBT)

Less: Taxes

Net income

The CEO of Tom and Sue's wants the company to earn a net income of $3.200 million. Cot of goods sold is expected to be 60

percent of net sales, depreciation and other operating expenses are not expected to change, interest expense is expected to increase

to $1.306 million, and the firm's tax rate will be 21 percent. Calculate the net sales needed to produce net income of $3.200 million.

Note: Enter your answer in millions of dollars rounded to 3 decimal places. (i.e., Enter 5,500,000 as 5.500.)

Net sales

$19.600

9.000

$ 10.600

4.150

$6.450

3.800

$ 2.650

0.840

$ 1.810

0.380

$ 1.430

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning