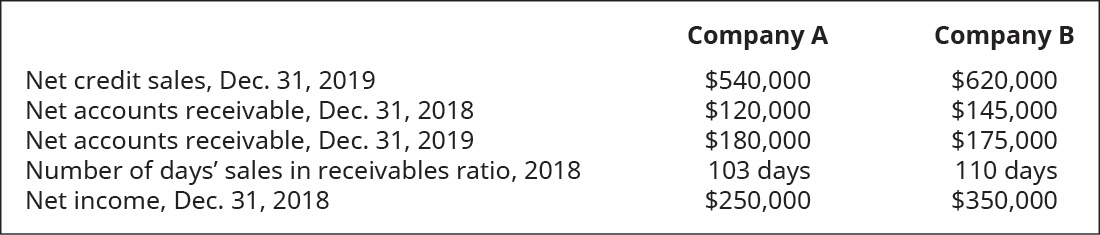

You are considering two possible companies for investment purposes. The following data is available for each company.

Additional Information: Company A:

A. Compute the number of days’ sales in receivables ratio for each company for 2019 and interpret the results (round answers to nearest whole number).

B. If Company A changed from the income statement method to the balance sheet method for recognizing bad debt estimation, how would that change net income in 2019? Explain (show calculations).

C. If Company B changed from the balance sheet method to the income statement method for recognizing bad debt estimation, how would that change net income in 2019? Explain (show calculations).

D. What benefits do each company gain by changing their method of bad debt estimation?

E. Which company would you invest in and why? Provide supporting details.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Principles of Accounting Volume 1

Additional Business Textbook Solutions

Principles of Management

Horngren's Accounting (11th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Construction Accounting And Financial Management (4th Edition)

Horngren's Accounting (12th Edition)

Cost Accounting (15th Edition)

- Brower Co. is considering the following alternative financing plans: Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming that income before bond interest and income tax is 2,000,000.arrow_forwardThe Moore Corporation has operating income (EBIT) of 750,000. The companys depreciation expense is 200,000. Moore is 100% equity financed, and it faces a 40% tax rate. What is the companys net income? What is its net cash flow?arrow_forwardMacon Mills is a division of Bolin Products. Inc. During the most recent year, Macon had a net income of $40 million. Included in the income was interest expense of $2,800,000. The companys tax rate was 40%. Total assets were $470 million, current liabilities were $104,000,000, and $72,000,000 of the current liabilities are noninterest bearing. What are the invested capital and ROI for Macon?arrow_forward

- Last year Vaughn Corp. had sales of $310,000 and a net income of $17,574, and its year-end assets were $217,000. The firm's total-debt-to-total-assets ratio was 45.8%. Based on the Du Pont equation, what was Vaughn's ROE? Note: Do not round intermediate calculations. Group of answer choices 18.12% 16.45% 15.68% 14.94% 17.27%arrow_forwardDuffert Industries has total assets of $970,000 and total current liabilities (consisting only of accounts payable and accruals) of $115,000. Duffert finances using only long-term debt and common equity. The interest rate on its debt is 9% and its tax rate is 25%. The firm's basic earning power ratio is 17% and its debt-to capital rate is 40%. What are Duffert's ROE and ROIC? Do not round your intermediate calculations. Group of answer choices 10.90%; 12.44% 13.63%; 14.46% 15.54%; 16.06% 8.86%; 12.73% 12.68%; 14.03%. Stepwise pls correct.arrow_forwardAurora Lighting Ltd has the following income statement items: sales of $12 000 000; cost of goods sold of $4 000 000; other operating expenses of $1 500 000; and interest expense of $50 000. Calculate gross profit margin of the company? Calculate earnings before interest and tax (EBIT) of the company? Calculate net income of the company given the company’s marginal tax rate of 25%? What are the three important questions of corporate finance? Briefly describe and relate them to the balance sheet of a company.arrow_forward

- he most recent financial statements for Kerch, Inc., are shown here (assuming no income taxes): Income Statement Balance Sheet Sales $4,500 Assets $14,900 Debt $10,300 Costs 3,450 Equity 4,600 Net income $1,050 Total $14,900 Total $14,900 Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $5,967. What is the external financing needed?arrow_forwardYou are given the following information for Smashville, Inc. Cost of goods sold: $ 224,000 Investment income: $ 2,400 Net sales: $ 389,000 Operating expense: $ 90,000 Interest expense: $ 7,400 Dividends: $ 15,000 Tax rate: 35 % Current liabilities: $ 24,000 Cash: $ 21,000 Long-term debt: $ 24,000 Other assets: $ 40,000 Fixed assets: $ 136,000 Other liabilities: $ 5,000 Investments: $ 44,000 Operating assets: $ 38,000 Calculate the gross margin, the operating margin, return on assets, and return on equity.arrow_forwardUse the following scenario to solve A-C. H2X Incorporated has accounts payable of $400,000 (a typical amount for the company, non-interest bearing), a bank loan of $700,000 at 9% interest rate, a bank loan of $1,000,000 at 6.5% interest rate, and equity of $2,800,000. Its income tax rate is 32%. Management estimates the company’s cost of equity is 14%. A. What is the company’s weighted average cost of capital on non-interest-bearing debt, interest bearing debt, and equity (or total invest capital)? a. 11% b. 10% c. 9% d. 12% B. Company managers are considering selling more stock to raise $500,000 of new equity to purchase $500,000 of new manufacturing equipment. What would the new weighted average cost of capital be if this plan were implemented? a. 10% b. 12% c. 9% d. 11% C. Company managers are projecting that the new manufacturing equipment from question 15 will produce a return on assets of 11%. Should the company proceed with this plan? a. No, because…arrow_forward

- Red Snail Satellite Company has a total asset turnover ratio of 3.50x, net annual sales of $25 million, and operating expenses of $11 million (including depreciation and amortization). On its balance sheet and income statement, respectively, it reported total debt of $2.50 million on which it pays a 11% interest rate. To analyze a company’s financial leverage situation, you need to measure the firm’s debt management ratios. Based on the preceding information, what are the values for Red Snail Satellite’s debt management ratios? Ratio Value Debt ratio Times-interest-earned ratio The US tax structure influences a firm’s willingness to finance with debt. The tax structure more debt.arrow_forwardSwirlpool, Inc. has a WACC of 11%, cost of debt of 8%, and a cost of equity of 12%. What must the debt-to-equity ratio be if the firm pays no tax? Need typed answer only.Please give answer within 45 minutesarrow_forwardPackaging's ROE last year was only 4%, but its management has developed a new operating plan that calls for a debt-to-capital ratio of 60%, which will result in annual interest charges of $185,000. The firm has no plans to use preferred stock and total assets equal total invested capital. Management projects an EBIT of $540,000 on sales of $5,000,000, and it expects to have a total assets turnover ratio of 1.9. Under these conditions, the tax rate will be 25%. If the changes are made, what will be the company's return on equity? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT - Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning