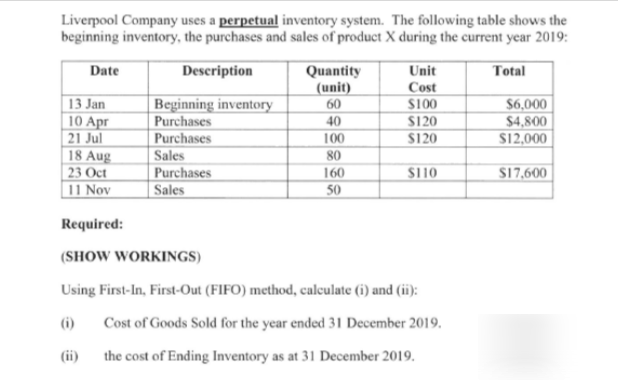

Liverpool Company uses a perpetual inventory system. The following table shows the beginning inventory, the purchases and sales of product X during the current year 2019: Date Description Unit Quantity (unit) Total Cost 13 Jan 10 Apr 21 Jul 18 Aug | 23 Oct 11 Nov Beginning inventory Purchases Purchases Sales Purchases Sales $6,000 $4,800 S12,000 60 S100 40 S120 100 S120 80 S110 S17,600 160 50 Required: (SHOW WORKINGS) Using First-In, First-Out (FIFO) method, calculate (i) and (ii): (i) Cost of Goods Sold for the year ended 31 December 2019. (ii) the cost of Ending Inventory as at 31 December 2019.

Liverpool Company uses a perpetual inventory system. The following table shows the beginning inventory, the purchases and sales of product X during the current year 2019: Date Description Unit Quantity (unit) Total Cost 13 Jan 10 Apr 21 Jul 18 Aug | 23 Oct 11 Nov Beginning inventory Purchases Purchases Sales Purchases Sales $6,000 $4,800 S12,000 60 S100 40 S120 100 S120 80 S110 S17,600 160 50 Required: (SHOW WORKINGS) Using First-In, First-Out (FIFO) method, calculate (i) and (ii): (i) Cost of Goods Sold for the year ended 31 December 2019. (ii) the cost of Ending Inventory as at 31 December 2019.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 2PEA: Beginning inventory, purchases, and sales for Item ProX2 are as follows: Assuming a perpetual...

Related questions

Question

Transcribed Image Text:Liverpool Company uses a perpetual inventory system. The following table shows the

beginning inventory, the purchases and sales of product X during the current year 2019:

Date

Description

Unit

Quantity

(unit)

Total

Cost

13 Jan

10 Apr

21 Jul

18 Aug

| 23 Oct

11 Nov

Beginning inventory

Purchases

Purchases

Sales

Purchases

Sales

$6,000

$4,800

S12,000

60

S100

40

S120

100

S120

80

S110

S17,600

160

50

Required:

(SHOW WORKINGS)

Using First-In, First-Out (FIFO) method, calculate (i) and (ii):

(i)

Cost of Goods Sold for the year ended 31 December 2019.

(ii)

the cost of Ending Inventory as at 31 December 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning