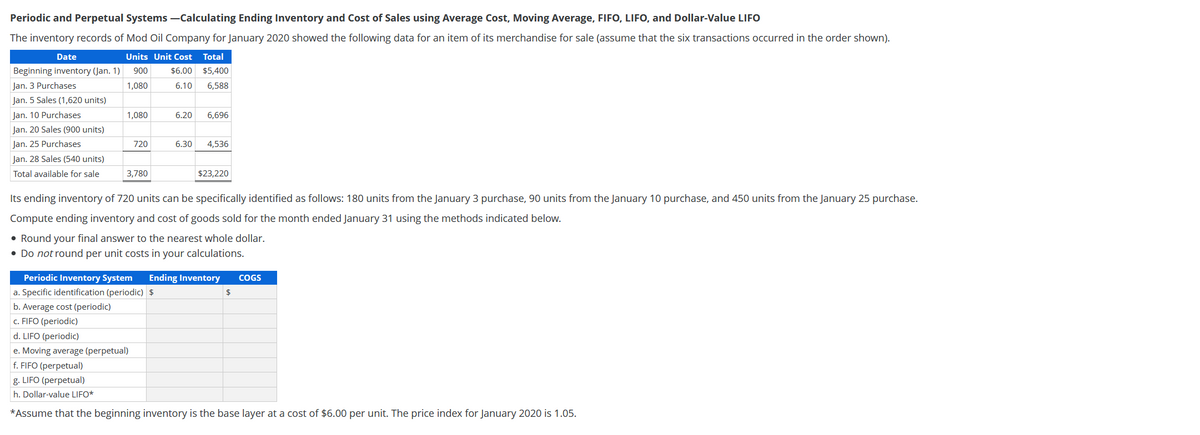

Periodic and Perpetual Systems -Calculating Ending Inventory and Cost of Sales using Average Cost, Moving Average, FIFO, LIFO, and Dollar-Value LIFO The inventory records of Mod Oil Company for January 2020 showed the following data for an item of its merchandise for sale (assume that the six transactions occurred in the order shown). Date Units Unit Cost Total Beginning inventory (Jan. 1) 900 $6.00 $5,400 Jan. 3 Purchases 1,080 6.10 6,588 Jan. 5 Sales (1,620 units) Jan. 10 Purchases 1,080 6.20 6,696 Jan. 20 Sales (900 units) Jan. 25 Purchases 720 6.30 4.536 Jan. 28 Sales (540 units) Total available for sale 3,780 $23,220 Its ending inventory of 720 units can be specifically identified as follows: 180 units from the January 3 purchase, 90 units from the January 10 purchase, and 450 units from the January 25 purchase. Compute ending inventory and cost of goods sold for the month ended January 31 using the methods indicated below. • Round your final answer to the nearest whole dollar. • Do not round per unit costs in your calculations. Periodic Inventory System Ending Inventory a. Specific identification (periodic)S b. Average cost (periodic) c. FIFO (periodic) d. LIFO (periodic) e. Moving average (perpetual) f. FIFO (perpetual) g. LIFO (perpetual) COGS h. Dollar value LIFO* *Assume that the beginning inventory is the base layer at a cost of $6.00 per unit. The price index for January 2020 is 1.05.

Periodic and Perpetual Systems -Calculating Ending Inventory and Cost of Sales using Average Cost, Moving Average, FIFO, LIFO, and Dollar-Value LIFO The inventory records of Mod Oil Company for January 2020 showed the following data for an item of its merchandise for sale (assume that the six transactions occurred in the order shown). Date Units Unit Cost Total Beginning inventory (Jan. 1) 900 $6.00 $5,400 Jan. 3 Purchases 1,080 6.10 6,588 Jan. 5 Sales (1,620 units) Jan. 10 Purchases 1,080 6.20 6,696 Jan. 20 Sales (900 units) Jan. 25 Purchases 720 6.30 4.536 Jan. 28 Sales (540 units) Total available for sale 3,780 $23,220 Its ending inventory of 720 units can be specifically identified as follows: 180 units from the January 3 purchase, 90 units from the January 10 purchase, and 450 units from the January 25 purchase. Compute ending inventory and cost of goods sold for the month ended January 31 using the methods indicated below. • Round your final answer to the nearest whole dollar. • Do not round per unit costs in your calculations. Periodic Inventory System Ending Inventory a. Specific identification (periodic)S b. Average cost (periodic) c. FIFO (periodic) d. LIFO (periodic) e. Moving average (perpetual) f. FIFO (perpetual) g. LIFO (perpetual) COGS h. Dollar value LIFO* *Assume that the beginning inventory is the base layer at a cost of $6.00 per unit. The price index for January 2020 is 1.05.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 50E: Inventory Costing Methods Crandall Distributors uses a perpetual inventory system and has the...

Related questions

Topic Video

Question

Transcribed Image Text:Periodic and Perpetual Systems -Calculating Ending Inventory and Cost of Sales using Average Cost, Moving Average, FIFO, LIFO, and Dollar-Value LIFO

The inventory records of Mod Oil Company for January 2020 showed the following data for an item of its merchandise for sale (assume that the six transactions occurred in the order shown).

Date

Units Unit Cost

Total

Beginning inventory (Jan. 1)

900

$6.00

$5,400

Jan. 3 Purchases

1,080

6.10

6,588

Jan. 5 Sales (1,620 units)

Jan. 10 Purchases

1,080

6.20

6,696

Jan. 20 Sales (900 units)

Jan. 25 Purchases

720

6.30

4,536

Jan. 28 Sales (540 units)

Total available for sale

3,780

$23,220

Its ending inventory of 720 units can be specifically identified as follows: 180 units from the January 3 purchase, 90 units from the January 10 purchase, and 450 units from the January 25 purchase.

Compute ending inventory and cost of goods sold for the month ended January 31 using the methods indicated below.

• Round your final answer to the nearest whole dollar.

• Do not round per unit costs in your calculations.

Periodic Inventory System

Ending Inventory

COGS

a. Specific identification (periodic) $

2$

b. Average cost (periodic)

c. FIFO (periodic)

d. LIFO (periodic)

e. Moving average (perpetual)

f. FIFO (perpetual)

g. LIFO (perpetual)

h. Dollar-value LIFO*

*Assume that the beginning inventory is the base layer at a cost of $6.00 per unit. The price index for January 2020 is 1.05.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning