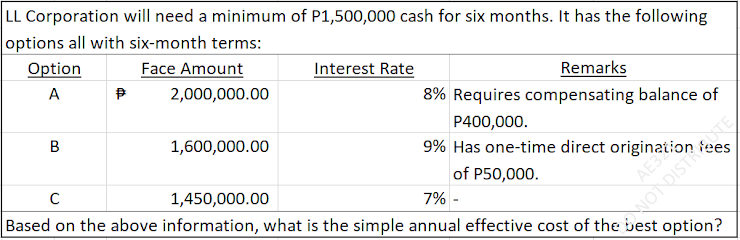

LL Corporation will need a minimum of P1,500,000 cash for six months. It has the following options all with six-month terms: Option Face Amount Interest Rate Remarks 8% Requires compensating balance of A 2,000,000.00 P400,000. 1,600,000.00 9% Has one-time direct origination of P50,000. 1,450,000.00 7% - Based on the above information, what is the simple annual effective cost of the best option? AE3

Q: Required information Skip to question [The following information applies to the questions display...

A: Calculation of the amount of service department cost allocated to P1 and P2 using step method: De...

Q: 1. How much is the cash balance after all transactions were taken into account? 2. How much is the a...

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: How does Merchandise Inventory impact Declan's Designs' 2022 Statement of Cash Flows?

A: Operating Activities - Under this activity all the company operation-related activities like sales, ...

Q: 1 of 1 GE1715 SAMPLE PROBLEMS ON FINANCIAL RATIOS 1. The management of International Heal Medical Co...

A: Return on assets is one of the profitability ratio which helps in analysing how much operating incom...

Q: Record adjusting journal entries for each separate case below for year ended December 31. Assume no ...

A: journal entry help in keeping record of transaction. Transactions may have Debit balance or credit b...

Q: Rich Goma Corporation failed to file its income tax return for the fiscal year ending August 31, 202...

A: In Philippines interest for late filing of income tax return is levy at 12% per year from the date t...

Q: How does Depreciation Expense impact Declan's Designs' 2022 Statement of Cash Flows?

A: The cash flow statement is prepared to record the cash flow from various activities during the perio...

Q: An auditor's engagement letter most likely would include a statement regardıng: 1. Conditions under ...

A: Auditing involves an independent examination of financial records of an entity with a view to provid...

Q: In May, assets with a carrying value of P170,000 were sold for P145,000, The statement of financial ...

A: Hi student Since there are multiple questions, we will answer only first question. If you want remai...

Q: In the base year Marley Enterprises of Vancouver had cash of $560, accounts receivable of $2650, inv...

A: Inventory forms a part of current assets and represents the value of raw material, work in process a...

Q: On January 1, 2021 Asset of Matalino Company was P2,500,000 and its liabilities was P800,000. By Dec...

A: As per accounting equation in accounting, total assets must be equal to total liabilities and equity...

Q: Explain: Understanding the intentions of accounting students to pursue career as a professional acco...

A: Answer: There are wide variety of scope for accounting field. Accounting field students have career...

Q: after tax of P2,700,000 in 20x1. What is the basic earnings per share in 20x1? *

A: Earnings per shares refers to the profit earned by each shareholder after paying all the expenses of...

Q: Whirly Corporation's contribution format income statement for the most recent month is shown below: ...

A: The question is based on the concept of Cost Accounting. Variable cost = Variable cost per unit rema...

Q: How do Dividends Paid impact Declan's Designs' Statement of Cash Flows? Question 30 options: ...

A: Financing Activities - All the issues and purchases of shares, Payment of Dividends, Issuance, and r...

Q: Which of the following is not added to net income as an adjustment to reconcile net income to cash f...

A: Cash flows from operating activities is one of the important section of cash flows statement which s...

Q: XYZ Corporation has annual cash demand of 3,000,000 for a fund set aside for operating expenses. The...

A: Optimum cash balance: It is the balance wherein the cost of depositing the fund is minimum if we com...

Q: The following information is departmental cost allocation with two service departments and two produ...

A: Lets understand the basics. In this method, cost of the service department is allocated to another s...

Q: SHOW WORKING PLEASE . NO HANDWRITING The School Book Shop sells T Shirts emblazoned with the school...

A: Economic order quantity (EOQ) is the inventory units that the company must produce or sell to avoid ...

Q: Sheffield Corporation agrees on January 1, 2020, to lease equipment from Packers, Inc. for 3 years. ...

A: The question is based on the concept of Operating Lease in Lease Accounting. Operating lease does n...

Q: What is Declan's Design's 2022 Cash Flows from Operating Activities? Question 23 options: Incr...

A: The cash flow statement is prepared to record the cash flow from various activities during the perio...

Q: If you receive your full bonus at the end of the year, what is your total (gross or before tax) pay ...

A: Taxable income refers to the amount to which tax is imposed. It is arrived at after allowing certain...

Q: For the year ended Dec. 31, 2019, Nando Company paid interest totaling P100,000. The prepaid intere...

A: Interest expense is an expense that is due on the amount borrowed from the lender. It is reported in...

Q: An analysis of the cash book and other records of Bye Corporation shows the following data: Accounts...

A: The income statement is one of the financial statements of the business which represents the profita...

Q: Assume at December 31, 2020, Kraft Heinz Foods Inc. reported the following amounts (in millions) in ...

A: Here in this question, we are required to calculate two ratios. Debt to asset ratio showing how much...

Q: Other accrued liabilities—real estate taxes Glennelle’s Boutique Inc. operates in a city in which r...

A: The real estate tax bills for 2019 are received only in May 2020. However, the firm has already incu...

Q: Give examples of differences in corporate governance in different countries ( Continental Europe &am...

A: A set of rules, policies, regulations, processes, and practices used to control, regulate, and direc...

Q: Choy, after recelving her degree in Hotel and Restaurant Management began her own business called Ch...

A: Acccounting equation is the basic principle of accounting which states that Asset = Liability + Capi...

Q: ABC COMPANY made the following cash expenditures during 2009 related to development of a new plastic...

A: The question is related to Accounting for Intangible Assets. As per the Standard the development of ...

Q: Menlo Company distributes a single product. The company's sales and expenses for last month follow: ...

A: Since you have posted a question with multiple sub-parts , we will do the first three sub-parts for ...

Q: For the year ended December 31, a company has revenues of $324,000 and expenses of $199,500. The own...

A: The closing entries are prepared to close the temporary accounts of the business including revenue, ...

Q: the acquisition, the two companies have the following account balances. Clay’s equipment (with a fiv...

A: Consolidated Statements: Consolidated statements are reports that can be utilized when the parent or...

Q: In preparing a statement of cash flows, the reconciliation of net income to cash from operating acti...

A: Cash flow statement includes: Cash flows from operating activities Cash flows from investing activi...

Q: The West Indies School Book Shop sells T Shirts emblazoned with the school's name and logo. The shir...

A: Introduction:- Job relationships are contractual in nature, consisting of an agreement between the p...

Q: The following items are reported on a company's balance sheet: Cash $550,800 Marketable securities 4...

A: Ratio analysis helps to analyze the financial statements of the company. The management can take dec...

Q: On November 1, 2012, management of Dianne Company committed to a plan to dispose of a major subsidia...

A: Concept Loss from discontinued operation shall be disclosed separately in the income statement The g...

Q: 1. How much is the total expense? 2. How much is the net income? 3. What is the balance of the endin...

A: Here to give the details of analysis of the transaction which are incurred into the business entity ...

Q: In 2018, SoundSmart Company started its production, specialising in manufacturing motorcycle helmets...

A:

Q: Question 14 Which of the following would be an example of vouching? 1. Making sure a sale is include...

A: Audit: It implies to the detailed investigation and analysis of company's financial records to make ...

Q: 6. How much is the total revenue from sales? Your answer 7. How much is the total expense? Your answ...

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: The following is the adjusted trial balance of Sierra Company. Sierra Company Adjusted Trial Balance...

A: The income statement, balance sheet and statement of shareholders equity are the important financial...

Q: Adams Corporation uses a periodic inventory system and the retail inventory method to estimate endin...

A: Net purchase at retail = Goods available at retail - markups + markdowns Goods available at retail ...

Q: There was an explosion at the plant on December 23, 2021 with damages estimated at $1,385,000. The c...

A: As investigated from the given details, the loss appears to have happened due to company's error.

Q: y created a standard cost system to help control costs and has established the following standards f...

A: Material price variance = (Standard price - Actual price)*Actual quantity purchased Material quantit...

Q: a. Calculate the unit cost for each product using the appropriate cost drivers for each product. Not...

A: Solution Note : As per the Q&A guideline we are required to answer the first three subparts only...

Q: Tara Westmont, the proprietor of Tiptoe Shoes, had annual revenues of $187,000, expenses of $104,700...

A: >Owner’s capital balance is the part of Equity.>It contains the amount of amount invested by t...

Q: c. Interest Payable. At its December 31 year-end, the company holds a mortgage payable that has incu...

A: adjusting entry is passed when transactions occurs at the end of accounting period to record any inc...

Q: Sunland Company specializes in leasing large storage units to other businesses. Sunland entered a co...

A: GIVEN te Lease Payment Interest (9%) onOutstanding Lease Receivable Reduction ofLease Rec...

Q: The Dividends account a) appears on the income statement along with the expenses of the business. b)...

A: Dividend is actually what is paid to share holder. it is is distribution of profit that company p...

Q: Euphoria Company had a balance of P820,000 in the professional fees expense account on December 31,...

A: Professional Charges is a money-making account. It is listed under revenues in the first segment of ...

Step by step

Solved in 2 steps with 2 images

- A contract is estimated to yield 48 quarterly net returns of $3000 beginning three months from now. To secure the contract, outlays of $40,000 now and $35, 000 two years from now are required. What is the contract's net present value to a business whose cost of capital is 12% compounded quarterly? Multiple Choice S 35,800.12 $10,444.80 $23, 200.17 $800.12 $8170.80A firm sells the same material with two separate payment plans.1. According to the 1st payment plan, the payment period is 12 months, each monthly payment is 10 837 000 dollars, and an interim payment of 12 million dollars is required at the end of the 6th month.2. In the 2nd payment plan, the payment period is 18 months, each monthly payment is 7 965 000 dollars and an interim payment of 36 million dollars is required at the end of the 12th month. Annual nominal interest rate for both options is 60%. Which payment plan would you recommend? In payments, discrete compound interest is applied.ABC Inc. has a total annual cash requirement of P9,075,000 which are to be paid uniformly. ABC has the opportunity to invest the money at 24% per annum. The company spends, on the average, P40 for every cash conversion to marketable securities. What is the optimal cash conversion size? A.P60,000B.P45,000C.P55,000D.P72,500

- Suppose that a party wanted to enter an FRA that expires in 121 days and is based on 55-day LIBOR. The dealer quotes a rate of 0.049 on the FRA. Assume that at expiration, the 55-day LIBOR is 0.029, and the notional amount is USD10,000,000. What is the payoff of the FRA short position?NewBank decides to invest $45 million in 30-day T-bills. The T-bills are currently trading at $4,986.70 (including commissions) for a $5,000 face value instrument. What does the balance sheet look like?Red Company desires to finance its P300,000 inventory. Funds are required for 4 months. Under consideration is a warehouse receipt loan at an annual interest rate of 17 percent, with an 85 percent advance against the inventory’s value. The warehousing cost is P5,000 for the 4-month period. Determine the financing cost.

- Suppose a party wanted to enter into an FRA that expires in 42 days and is based on 137-day LIBOR. The dealer quotes a 4.75 percent rate on this FRA. Assume that at expiration the 137-day LIBOR is 4 percent and the notional principal is $ 20,000,000. Calculate the FRA payout for a long position.Company is contemplating factoring its accounts receivable. The factor will acquire P250,000 of the company’s accounts receivable every 2 months. An advance of 75 percent is given by the factor on receivables at an annual charge of 18 percent. There is a 2 percent factor fee associated with receivables purchased. What is the cost of the factoring arrangement? choose the letter of the correct answera. P30,000.00b. P33,750.00c. P63,750.00d. P103,000.00e. P125,000.00The Xeor supply company needs to increase its working capital Tk. 5.4 million. The following three financing alternatives are available (assume a 365 day year).i) Forgo cash discount (granted on a basis of 5/10, net 30) and pay on the final due date.ii) Borrow Tk. 6 million from a bank at 15 percent interest. This alternative would necessitate maintaining a 12 percent compensating balance.iii) Issue Tk. 5.7 million of six-month commercial paper to net Tk. 5.4 million. Assume that new paper would be issued every six months (Note: commercial paper has no stipulated interest rate. It is sold at a discount, and the amount of the discount determines the interest cost to the issuer.) Requirement: Assuming that the firm would prefer the flexibility of bank financing, provided theadditional cost of this flexibility was no more than 3 percent per annum, whichalternative should Xeor select? Why?

- A firm sells the same material with two separate payment plans.1. According to the 1st payment plan, the payment period is 12 months, each monthly payment is 10.837.000 TL, and an interim payment of 12 million TL is required at the end of the 6th month.2. In the 2nd payment plan, the payment period is 18 months, each monthly payment is 7.965.000 TL and an interim payment of 36 million TL is required at the end of the 12th month. Annual nominal interest rate for both options is 60%. Which payment plan would you recommend? In payments, discrete compound interest is applied.A certain company sells engines worth P1,000,000 cash. If paid on installment basis, it requires a down payment with the balance payable quarterly in 2 years at an interest rate of 8% pa compounded quarterly. What must the required down payment be if the quarterly payment is P65,000.00?a. P 523,843.71 b. P 404,297.49 c. P 459,050.50 d. P 562,980.65A Firm buys an FRA on 90-day LIBOR expiring in 30 days with Notional principal of $20 million. The contract rate is 10%. If at expiration, LIBOR is 8%, how much will the long has to pay to the short i.e., seller of FRA. What happens if at expiration, LIBOR is 12%?