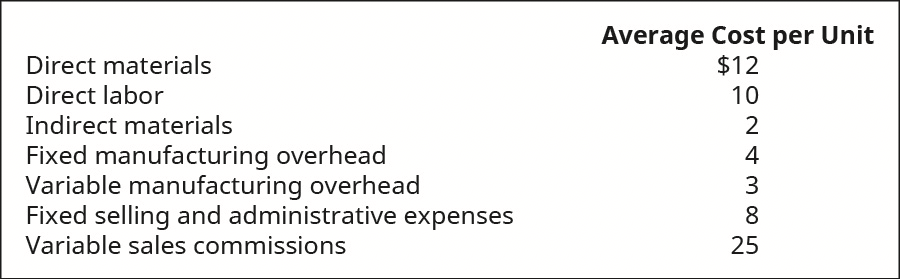

LO 2.2Rose Company has a relevant range of production between 10,000 and 25,000 units. The following cost data represents average cost per unit for 15,000 units of production. Using the cost data from Rose Company, answer the following questions: If 10,000 units are produced, what is the variable cost per unit? If 18,000 units are produced, what is the variable cost per unit? If 21,000 units are produced, what are the total variable costs?

EA5.

LO 2.2Rose Company has a relevant range of production between 10,000 and 25,000 units. The following cost data represents average cost per unit for 15,000 units of production.

Using the cost data from Rose Company, answer the following questions:

- If 10,000 units are produced, what is the variable cost per unit?

- If 18,000 units are produced, what is the variable cost per unit?

- If 21,000 units are produced, what are the total variable costs?

- If 11,000 units are produced, what are the total variable costs?

- If 19,000 units are produced, what are the total

manufacturing overhead costs incurred? - If 23,000 units are produced, what are the total manufacturing overhead costs incurred?

- If 19,000 units are produced, what are the per unit manufacturing overhead costs incurred?

- If 25,000 units are produced, what are the per unit manufacturing overhead costs incurred?

As per the honor code, we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and specify the other subparts (up to 3) you’d like an answer to.

Variable cost is the amount that is associated with the production of goods directly and is relevant for decision-making purposes in relation to special orders, makes or buy the product, etc. It does not change per unit however changes in whole with a change in production level.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps