LO 5.10 Income Statement Sales (net) Less: Cost of goods sold Operating expenses Interest expense Income taxes Total expenses Net income $ 267,000 $160,000 62,000 11,000 10,000 SHOW ME HOW (243,000) 24,000 Coprige Cmpugs Laming A Rign Roval. May se cogkol. samed. er dplicanda k er ia part Due to dedseik gte tt pary c ay be mpred tre de ak ndir Chuari 64 Chapter 5 The Income Statement and the Statement of Cash Flows Balance Sheet $ 10,000 Current liabilities Bonds payable, 10% Common stock, $10 par Additional paidin capital Retained earnings Total Liabilities and Shareholders' Equity Cash $ 40,000 Receivables (nel) Inventory Long-term investments Property and equipment (net) Total Assets 22,000 56,000 30,000 282,000 $400,000 110,000 100,000 95,000 55,000 $400,000 Additional information: 1. The company's common 2. Dividends of S1.50 per share on the common stock were declared in 2019. 3. On December 31, 2019, common stock is selling for $20 per share. 4. On January 1, 2019, the accounts receivable (net) balance was $24,000, total assets amounted to S380,000, and total sharcholders' equity was S241,000. 5. Of the company's net sales, 78% are on credit. 6. The company operates on a 365-day business year. ock was outstanding the entire year.

LO 5.10 Income Statement Sales (net) Less: Cost of goods sold Operating expenses Interest expense Income taxes Total expenses Net income $ 267,000 $160,000 62,000 11,000 10,000 SHOW ME HOW (243,000) 24,000 Coprige Cmpugs Laming A Rign Roval. May se cogkol. samed. er dplicanda k er ia part Due to dedseik gte tt pary c ay be mpred tre de ak ndir Chuari 64 Chapter 5 The Income Statement and the Statement of Cash Flows Balance Sheet $ 10,000 Current liabilities Bonds payable, 10% Common stock, $10 par Additional paidin capital Retained earnings Total Liabilities and Shareholders' Equity Cash $ 40,000 Receivables (nel) Inventory Long-term investments Property and equipment (net) Total Assets 22,000 56,000 30,000 282,000 $400,000 110,000 100,000 95,000 55,000 $400,000 Additional information: 1. The company's common 2. Dividends of S1.50 per share on the common stock were declared in 2019. 3. On December 31, 2019, common stock is selling for $20 per share. 4. On January 1, 2019, the accounts receivable (net) balance was $24,000, total assets amounted to S380,000, and total sharcholders' equity was S241,000. 5. Of the company's net sales, 78% are on credit. 6. The company operates on a 365-day business year. ock was outstanding the entire year.

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

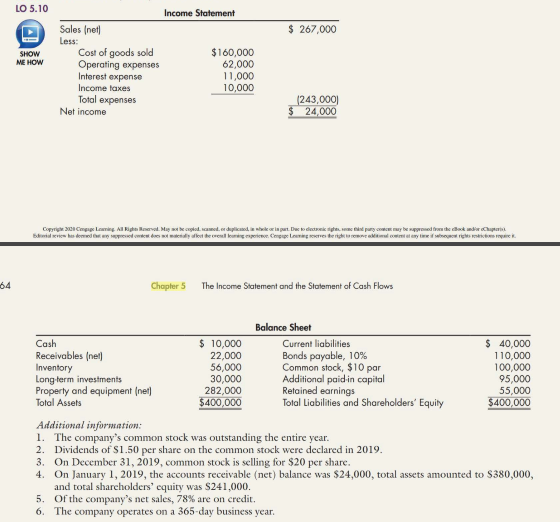

Byers Company presents the following condensed income statement for 2019 and condensed December 31, 2019, balance sheet: Compute the following ratios for Byers ( round all computations to two decimals): ( 1) earnings per share, ( 2) gross profit margin, ( 3) operating profit margin, ( 4) net profit margin, ( 5) total asset turnover, ( 6) return on assets, (7) return on common equity, (8) receivables turnover (in days), and (9 ) interest coverage.

Transcribed Image Text:LO 5.10

Income Statement

Sales (net)

Less:

Cost of goods sold

Operating expenses

Interest expense

Income taxes

Total expenses

Net income

$ 267,000

$160,000

62,000

11,000

10,000

SHOW

ME HOW

(243,000)

24,000

Coprige Cmpugs Laming A Rign Roval. May se cogkol. samed. er dplicanda k er ia part Due to dedseik gte tt pary c ay be mpred tre de ak ndir Chuari

64

Chapter 5

The Income Statement and the Statement of Cash Flows

Balance Sheet

$ 10,000

Current liabilities

Bonds payable, 10%

Common stock, $10 par

Additional paidin capital

Retained earnings

Total Liabilities and Shareholders' Equity

Cash

$ 40,000

Receivables (nel)

Inventory

Long-term investments

Property and equipment (net)

Total Assets

22,000

56,000

30,000

282,000

$400,000

110,000

100,000

95,000

55,000

$400,000

Additional information:

1. The company's common

2. Dividends of S1.50 per share on the common stock were declared in 2019.

3. On December 31, 2019, common stock is selling for $20 per share.

4. On January 1, 2019, the accounts receivable (net) balance was $24,000, total assets amounted to S380,000,

and total sharcholders' equity was S241,000.

5. Of the company's net sales, 78% are on credit.

6. The company operates on a 365-day business year.

ock was outstanding the entire year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,