Required information (The following information applies to the questions displayed below,) The following events occur for Morris Engneering during 2021 and 2022, its first two years of operations. rebruary , 2011 PrOvide nervices to cuntonera on eccount for 30,800. July 13, 2011 Receive 021,000 from custoners on aceount. Decenber 11, 2021 Eetimate that 30N of uncellected sccounta will not be received, Apil 12, 2012 Provide service te eustomere en aceount for 143,000. June 18, 2012 keceive , 000 tron oust.omere for services provided in 2021. Beptember 13, 2012 Weite oft the renainiag amounte oved tro services provided in 20a1. Oetober , 2012 eeeive 3,000 trom euntomar for sarviees provided in 2022, Decenter 1, 2022 Katimate that 30 of uncellected sccsunta viil not be received. equired: Record transactions for each date (If no entry is required for a particular transactionievent, select "No Journal Entry Required" in

Required information (The following information applies to the questions displayed below,) The following events occur for Morris Engneering during 2021 and 2022, its first two years of operations. rebruary , 2011 PrOvide nervices to cuntonera on eccount for 30,800. July 13, 2011 Receive 021,000 from custoners on aceount. Decenber 11, 2021 Eetimate that 30N of uncellected sccounta will not be received, Apil 12, 2012 Provide service te eustomere en aceount for 143,000. June 18, 2012 keceive , 000 tron oust.omere for services provided in 2021. Beptember 13, 2012 Weite oft the renainiag amounte oved tro services provided in 20a1. Oetober , 2012 eeeive 3,000 trom euntomar for sarviees provided in 2022, Decenter 1, 2022 Katimate that 30 of uncellected sccsunta viil not be received. equired: Record transactions for each date (If no entry is required for a particular transactionievent, select "No Journal Entry Required" in

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter4: Completing The Accounting Cycle

Section: Chapter Questions

Problem 4PB: The unadjusted trial balance of Recessive Interiors at January 31, 2019, the end of the year,...

Related questions

Question

Transcribed Image Text:Required information

(The following information applies to the questions displayed below.)

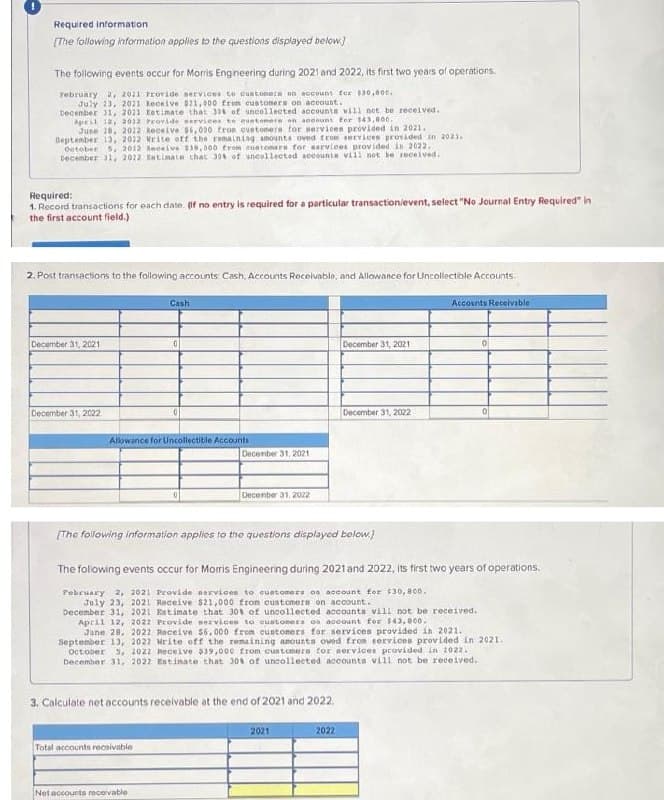

The following events occur for Morris Engineering during 2021 and 2022, its first two years of operations,

February 2, 2021 PEovide nervices to custonere on account for s30,000.

July 23, 2021 Receive 21, 00 from custoners on accaunt.

Decenber 1, 2021 tetimate that 30 of uncollected accounta will not be received.

April 12, 2012 Provide service to euntomere on aceount Eor 143,800.

June 20, 2022 keceive 6, 000 tron oustomera tor services provided in 2021.

Beptember 13, 2012 Write off the remaining amounts oved trom ervices provided in 2021.

Oateber s, 2012 Reeeive 39,000 trom euntomera for sarviees provided in 2022.

Decenber 1, 2022 katimate that 30 of uncellected sccounta vill not be received.

Required:

1. Record transactions for each date. (f no entry is required for a particular transactionievent, select "No Journal Entry Required" in

the first account field.)

2. Post transactions to the following accounts Cash, Accounts Receivable, and Allowance for Uncollectible Accounts.

Cash

Accounts Recelvable

December 31, 2021

December 31, 2021

December 31, 2022

December 31, 2022

Allowance for Uncollectitle Accounts

Decenber 31, 2021

Decenber 31, 2022

(The following information applios to the questions displayed below.)

The folowing events occur for Moris Engineering during 2021 and 2022, Its first two years of operations.

Pebruary 2, 2021 Provide nervices to cuatomers os account for 530, B00.

July 23, 2021 Receive $21,000 fron customers on account.

December 31, 2021 Estimate that 301 of uncollected accounts vill not be received.

April 12, 2022 Provide services to cuatoners on account for $43,800.

June 28, 2022 Receive $6,000 from customers for services provided in 2021.

Septenber 13, 2022 Mrite off the remaining anounta oved from services provided in 2021.

October 5, 2022 Receive $39,000 from customera for services provided in 2022.

December 31, 2022 Entinate that 30 of uncolleeted accounts vill not be received.

3. Calculate net accounts receivable at the end of 2021 and 2022.

2021

2022

Total accounts recaivable

Netaccounts recevable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning