Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 94PSB

Related questions

Question

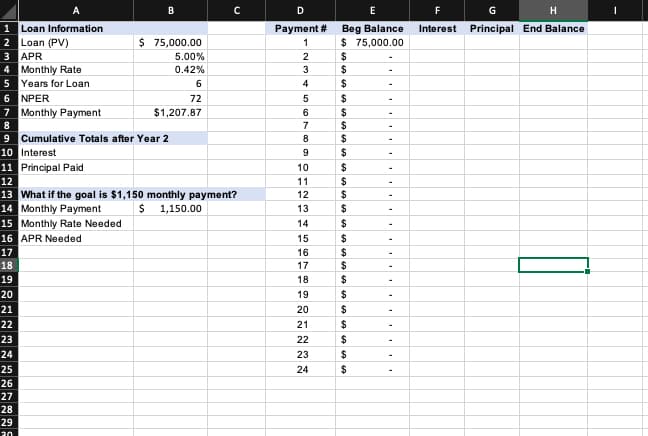

1) Use the Loan worksheet to complete the loan amortization table.

In cell F2, insert the IPMT function to calculate the interest for the first payment. Copy the function to the range F3:F25. (The results will update after you complete the other functions and formulas.)

2) In cell G2, insert the PPMT function to calculate the principal paid for the first payment. Copy the function to the range G3:G25.

3) In cell H2, insert a formula to calculate the ending principal balance. Copy the formula to the range H3:H25.

4) Now you want to determine how much interest was paid during the first two years.

In cell B10, insert the CUMIPMT function to calculate the cumulative interest after the first two years. Make sure the result is positive.

5) In cell B11, insert the CUMPRINC function to calculate the cumulative principal paid at the end of the first two years. Make sure the result is positive.

6) You want to perform a what-if analysis to determine the rate if the monthly payment is $1,150 instead of $1,207.87.

In cell B15, insert the RATE function to calculate the necessary monthly rate given the NPER, proposed monthly payment, and loan. Make sure the result is positive.

7) Finally, you want to convert the monthly rate to an APR.

In cell B16, insert a formula to calculate the APR for the monthly rate in cell B15.

Transcribed Image Text:B

G

Loan Information

Beg Balance

$ 75,000.00

1

Payment #

Interest

Principal End Balance

$ 75,000.00

2 Loan (PV)

3 APR

4 Monthly Rate

5 Years for Loan

6 NPER

7 Monthly Payment

5.00%

2

2$

0.42%

3

4

24

72

24

$1,207.87

6

2$

8

7

9 Cumulative Totals after Year 2

10 Interest

11 Principal Paid

8

10

$

12

11

13 What if the goal is $1,150 monthly payment?

14 Monthly Payment

15 Monthly Rate Needed

16 APR Needed

12

24

1,150.00

13

24

14

24

15

$

24

24

17

16

18

17

19

18

20

19

2$

21

20

$

22

21

24

23

22

24

23

2$

25

24

%24

26

27

28

29

20

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning