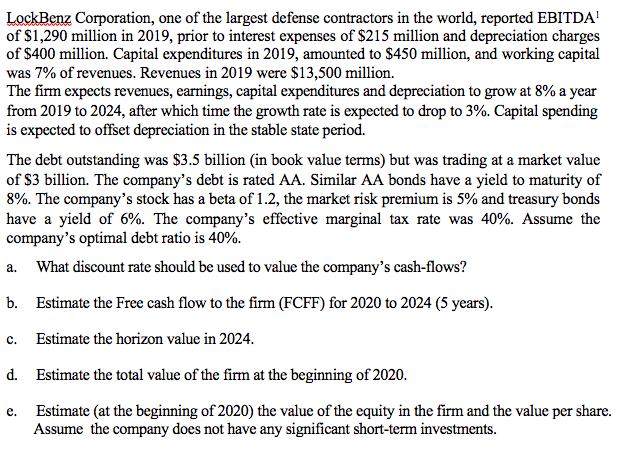

LockBenz Corporation, one of the largest defense contractors in the world, reported EBITDA' of $1,290 million in 2019, prior to interest expenses of $215 million and depreciation charges of $400 million. Capital expenditures in 2019, amounted to $450 million, and working capital was 7% of revenues. Revenues in 2019 were $13,500 million. The firm expects revenues, earnings, capital expenditures and depreciation to grow at 8% a year from 2019 to 2024, after which time the growth rate is expected to drop to 3%. Capital spending is expected to offset depreciation in the stable state period. The debt outstanding was $3.5 billion (in book value terms) but was trading at a market value of $3 billion. The company's debt is rated AA. Similar AA bonds have a yield to maturity of 8%. The company's stock has a beta of 1.2, the market risk premium is 5% and treasury bonds have a yield of 6%. The company's effective marginal tax rate was 40%. Assume the company's optimal debt ratio is 40%. a. What discount rate should be used to value the company's cash-flows? b. Estimate the Free cash flow to the firm (FCFF) for 2020 to 2024 (5 years). c. Estimate the horizon value in 2024. d. Estimate the total value of the firm at the beginning of 2020. Estimate (at the beginning of 2020) the value of the equity in the firm and the value per share. Assume the company does not have any significant short-term investments. e.

LockBenz Corporation, one of the largest defense contractors in the world, reported EBITDA' of $1,290 million in 2019, prior to interest expenses of $215 million and depreciation charges of $400 million. Capital expenditures in 2019, amounted to $450 million, and working capital was 7% of revenues. Revenues in 2019 were $13,500 million. The firm expects revenues, earnings, capital expenditures and depreciation to grow at 8% a year from 2019 to 2024, after which time the growth rate is expected to drop to 3%. Capital spending is expected to offset depreciation in the stable state period. The debt outstanding was $3.5 billion (in book value terms) but was trading at a market value of $3 billion. The company's debt is rated AA. Similar AA bonds have a yield to maturity of 8%. The company's stock has a beta of 1.2, the market risk premium is 5% and treasury bonds have a yield of 6%. The company's effective marginal tax rate was 40%. Assume the company's optimal debt ratio is 40%. a. What discount rate should be used to value the company's cash-flows? b. Estimate the Free cash flow to the firm (FCFF) for 2020 to 2024 (5 years). c. Estimate the horizon value in 2024. d. Estimate the total value of the firm at the beginning of 2020. Estimate (at the beginning of 2020) the value of the equity in the firm and the value per share. Assume the company does not have any significant short-term investments. e.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 20P

Related questions

Question

100%

Transcribed Image Text:LockBenz Corporation, one of the largest defense contractors in the world, reported EBITDA'

of $1,290 million in 2019, prior to interest expenses of $215 million and depreciation charges

of $400 million. Capital expenditures in 2019, amounted to $450 million, and working capital

was 7% of revenues. Revenues in 2019 were $13,500 million.

The firm expects revenues, earnings, capital expenditures and depreciation to grow at 8% a year

from 2019 to 2024, after which time the growth rate is expected to drop to 3%. Capital spending

is expected to offset depreciation in the stable state period.

The debt outstanding was $3.5 billion (in book value terms) but was trading at a market value

of $3 billion. The company's debt is rated AA. Similar AA bonds have a yield to maturity of

8%. The company's stock has a beta of 1.2, the market risk premium is 5% and treasury bonds

have a yield of 6%. The company's effective marginal tax rate was 40%. Assume the

company's optimal debt ratio is 40%.

a.

What discount rate should be used to value the company's cash-flows?

b. Estimate the Free cash flow to the firm (FCFF) for 2020 to 2024 (5 years).

c.

Estimate the horizon value in 2024.

d. Estimate the total value of the firm at the beginning of 2020.

Estimate (at the beginning of 2020) the value of the equity in the firm and the value per share.

Assume the company does not have any significant short-term investments.

e.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning