Forecast Forecast Forecast Forecast Forecast year 1 year 2 year 3 year 4 year 5

Chapter4A: Nopat Breakeven: Revenues Needed To Cover Total Operating Costs

Section: Chapter Questions

Problem 1EP

Related questions

Question

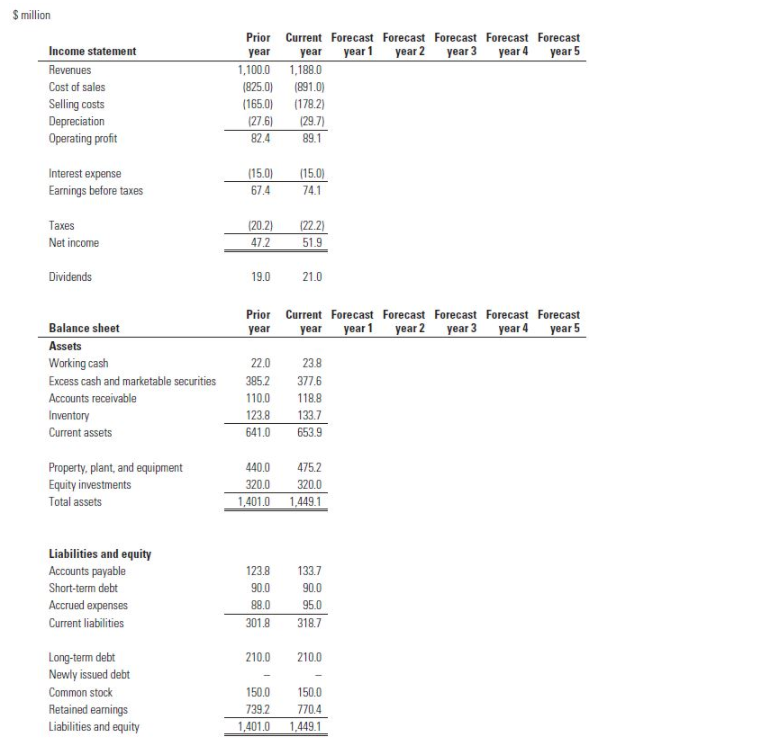

Presented is the income statement and

Transcribed Image Text:$ million

Prior Current Forecast Forecast Forecast Forecast Forecast

year

1,100.0 1,188.0

Income statement

year

year 1

year 2 year 3 year 4 year 5

Revenues

Cost of sales

(825.0)

(891.0)

Selling costs

Depreciation

Operating profit

(165.0)

(178.2)

(27.6)

(29.7)

82.4

89.1

(15.0)

Interest expense

Earnings before taxes

(15.0)

67.4

74.1

Тахes

(20.2)

(22.2)

51.9

Net income

47.2

Dividends

19.0

21.0

Prior Current Forecast Forecast Forecast Forecast Forecast

Balance sheet

year

year

year 1 year 2 year 3 year 4 year 5

Assets

Working cash

22.0

23.8

Excess cash and marketable securities

385.2

377.6

Accounts receivable

110,0

118.8

Inventory

123.8

133.7

Current assets

641.0

653.9

Property, plant, and equipment

440.0

475.2

Equity investments

320.0

320.0

Total assets

1,401.0 1,449.1

Liabilities and equity

Accounts payable

123.8

133.7

Short-term debt

90.0

90.0

Accrued expenses

88.0

95.0

Current liabilities

301.8

318.7

210.0

210.0

Long-term debt

Newly issued debt

Common stock

150.0

150.0

Retained earnings

Liabilities and equity

739,2

770.4

1,401.0

1,449.1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning