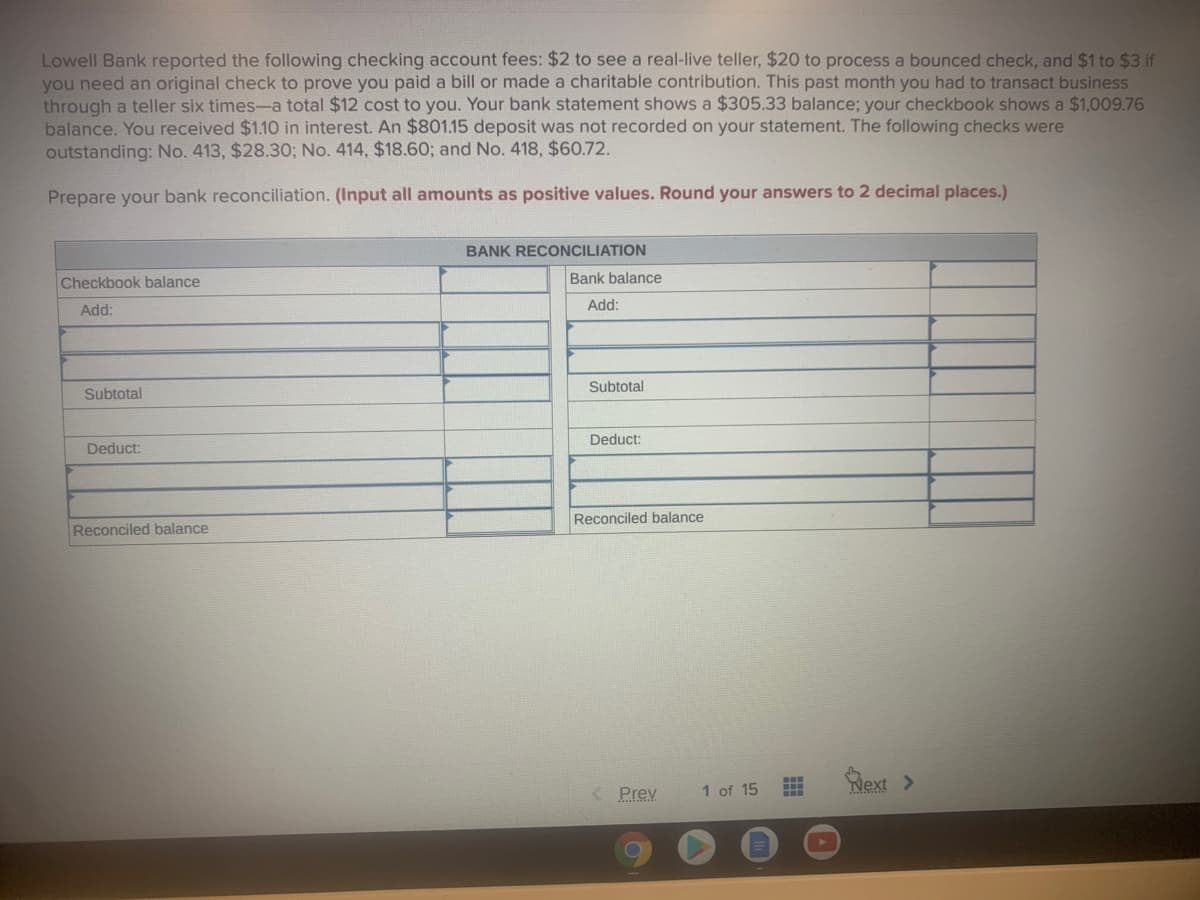

Lowell Bank reported the following checking account fees: $2 to see a real-live teller, $20 to process a bounced check, and $1 to $3 if you need an original check to prove you paid a bill or made a charitable contribution. This past month you had to transact business through a teller six times-a total $12 cost to you. Your bank statement shows a $305.33 balance; your checkbook shows a $1,009.76 balance. You received $1.10 in interest. An $801.15 deposit was not recorded on your statement. The following checks were outstanding: No. 413, $28.30; No. 414, $18.60; and No. 418, $60.72. Prepare your bank reconciliation. (Input all amounts as positive values. Round your answers to 2 decimal places.) BANK RECONCILIATION Checkbook balance Bank balance Add: Add: Subtotal Subtotal Deduct: Deduct: Reconciled balance Reconciled balance

Lowell Bank reported the following checking account fees: $2 to see a real-live teller, $20 to process a bounced check, and $1 to $3 if you need an original check to prove you paid a bill or made a charitable contribution. This past month you had to transact business through a teller six times-a total $12 cost to you. Your bank statement shows a $305.33 balance; your checkbook shows a $1,009.76 balance. You received $1.10 in interest. An $801.15 deposit was not recorded on your statement. The following checks were outstanding: No. 413, $28.30; No. 414, $18.60; and No. 418, $60.72. Prepare your bank reconciliation. (Input all amounts as positive values. Round your answers to 2 decimal places.) BANK RECONCILIATION Checkbook balance Bank balance Add: Add: Subtotal Subtotal Deduct: Deduct: Reconciled balance Reconciled balance

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter5: Bank Reconciliation (bankrec)

Section: Chapter Questions

Problem 2R

Related questions

Question

100%

Transcribed Image Text:Lowell Bank reported the following checking account fees: $2 to see a real-live teller, $20 to process a bounced check, and $1 to $3 if

you need an original check to prove you paid a bill or made a charitable contribution. This past month you had to transact business

through a teller six times-a total $12 cost to you. Your bank statement shows a $305.33 balance; your checkbook shows a $1,009.76

balance. You received $1.10 in interest. An $801.15 deposit was not recorded on your statement. The following checks were

outstanding: No. 413, $28.30; No. 414, $18.60; and No. 418, $60.72.

Prepare your bank reconciliation. (Input all amounts as positive values. Round your answers to 2 decimal places.)

BANK RECONCILIATION

Checkbook balance

Bank balance

Add:

Add:

Subtotal

Subtotal

Deduct:

Deduct:

Reconciled balance

Reconciled balance

Rext >

< Prev

1 of 15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning